In 2025, the UK Government is modernising how pension benefits are managed by introducing new DWP pension update banking rules.

These changes aim to reduce fraud, overpayments, and eligibility errors, particularly affecting pensioners receiving means-tested benefits like Pension Credit. Banks will now share account data with the DWP to verify eligibility more accurately.

This article explains what these rules mean for pensioners, who will be affected, and how retirees can prepare for these important welfare updates.

Why Has the DWP Introduced New Banking Rules for Pensioners?

The DWP has introduced new banking rules as part of a broader effort to reduce fraud, improve accuracy, and modernise the UK’s welfare system. With billions lost yearly due to errors and fraudulent claims, these changes are crucial for protecting public funds.

Key Reasons Behind the Change:

- To reduce the £10 billion lost annually to fraud and error

- To ensure only eligible pensioners receive financial support

- To implement digital, data-driven verification processes

- To align with larger welfare reform legislation

- To make the benefits system more accountable and efficient

These reforms are designed to support genuine claimants while safeguarding the sustainability of pension and social welfare resources.

What Are the Key Changes Under the DWP Pension Banking Update?

As part of the DWP’s efforts to tighten oversight and reduce benefit-related fraud, the 2025 banking updates introduce critical changes to how pensioners’ bank accounts are monitored.

These updates are not designed to intrude on privacy but rather to ensure that pension-related benefits are accurately assessed and fairly distributed.

Below, we explore how the new system of monitoring will function and what specific information banks will be permitted to share with the DWP.

How Bank Account Monitoring Will Work?

From September 2025, banks are required to monitor benefit-receiving accounts for specific “red flag” indicators.

These indicators include unusual banking patterns or evidence of financial conditions that may contradict benefit eligibility, such as having savings above the acceptable threshold for Pension Credit.

Banks will not monitor every transaction or pry into spending habits. Instead, automated systems will scan accounts for anomalies that suggest a need for further review.

These include patterns like a sudden increase in deposits or a mismatch between the declared income and bank records.

What Specific Data Will Be Shared with the DWP?

The data banks shared with the DWP will be limited and focused. Contrary to public concern, banks will not provide full transaction histories. Instead, they will share:

| Data Type | Shared with DWP |

|---|---|

| Account balance | No |

| Full transaction history | No |

| Confirmation of account ownership | Yes |

| Personal identity verification | Yes |

| Alerts on suspicious financial flags | Yes |

The DWP will use this information as a basis for investigation, not for automatic enforcement. A triggered alert may lead to a manual review, but it won’t result in immediate action unless additional evidence is found.

Who Will Be Affected by the New DWP Pension Monitoring Rules?

The updated banking rules predominantly affect pensioners who receive means-tested benefits, rather than those who receive only the State Pension. This includes:

- Pension Credit recipients

- Individuals receiving Housing Benefit or Council Tax reduction

- Retirees with savings over £10,000

- Low-income pensioners relying on additional DWP assistance

If a retiree receives only the State Pension, they are unlikely to be impacted unless there is a change in their personal or banking information. The monitoring focuses primarily on verifying the ongoing eligibility of pensioners whose benefit levels depend on income and savings thresholds.

Will the DWP Have Access to Pensioners’ Spending or Full Bank Details?

There has been widespread concern about privacy under these new rules, but the reality is more restrained. The DWP will not have access to how pensioners spend their money or their detailed bank statements.

Banks are only permitted to share filtered data that relates to eligibility markers. They are legally restricted from over-sharing and must follow a Code of Practice. Institutions breaching these limitations may face penalties.

This limited approach ensures that pensioners’ privacy is preserved while enabling the DWP to detect inconsistencies. The focus remains on fair administration rather than surveillance.

How Will These Rules Help Detect and Prevent Benefit Fraud?

The rules are designed to provide early warning signals of potential fraud or mistakes, allowing the DWP to act proactively. Rather than investigating every pensioner, the system works by identifying anomalies that suggest further investigation is warranted.

Key Benefits:

- Real-time alerts: Allowing for quicker identification of overpayments or suspicious changes.

- Improved coordination: Banks and the DWP working together enhances response times.

- Reduced fraud and error: Eliminates outdated records and reliance on unverified claims.

- Targeted action: Ensures those abusing the system are investigated without burdening compliant recipients.

These measures help close gaps previously exploited through third-party accounts or outdated personal information. By improving traceability, the government can ensure benefits are distributed correctly and reduce administrative errors that lead to under- or over-payments.

What Are the Risks for Pensioners Who Don’t Comply with the New Rules?

Non-compliance with the new DWP banking rules can lead to serious financial and legal consequences for pensioners. From delayed payments to potential legal actions, it’s essential to understand the risks and take timely steps to remain eligible and protected.

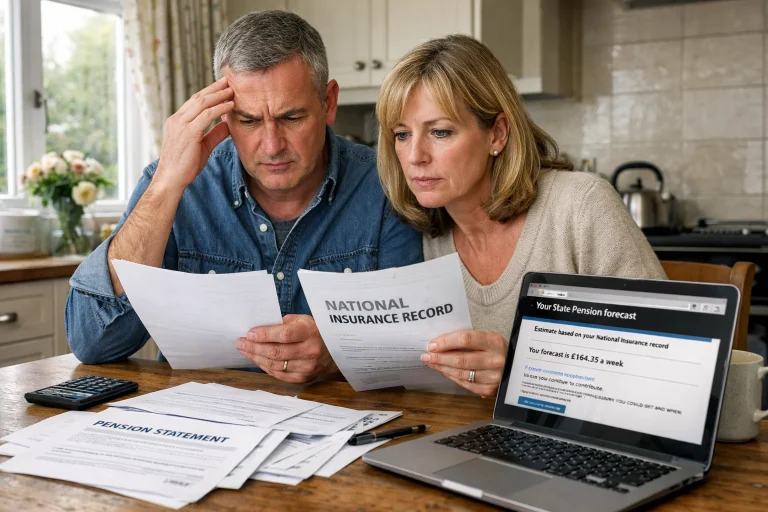

Payment Delays and Benefit Suspensions

One of the most immediate risks is a disruption in pension payments. If a pensioner fails to update their bank details, does not confirm account ownership, or provides mismatched identity information, payments may be temporarily suspended pending verification.

Real-world example:

Margaret, an 81-year-old pensioner in Kent, had her Pension Credit temporarily paused because her bank account, set up years ago with a family member as joint holder, no longer matched her DWP records. After visiting her bank and updating her documentation, her payments resumed, but only after several weeks of delay.

Debt Recovery and Legal Actions

If the DWP determines that someone has been overpaid or received benefits fraudulently, even unintentionally, it may demand repayment. In some cases, legal enforcement could follow, including deductions from future payments or direct recovery from the recipient’s account.

Pensioners using third-party bank accounts or neglecting to report life changes like moving home, receiving additional income, or a change in marital status are most at risk. This underlines the importance of keeping the DWP informed of any updates that could affect eligibility.

How Can Pensioners Prepare for the Banking Rule Changes?

To ensure uninterrupted pension payments under the new DWP banking rules, pensioners should take proactive steps to stay compliant.

The first priority is to ensure that the bank account receiving pension payments is in the pensioner’s own name. This is a key requirement under the updated verification system.

Pensioners should also double-check that their personal identification records, such as a passport or driver’s licence, are up to date. This helps when banks share data with the DWP for eligibility checks. Another essential step is registering a valid mobile number for two-factor authentication, which strengthens account security.

Finally, it’s crucial to notify the DWP promptly about any changes in income, savings, or household circumstances. Staying transparent and accurate can help avoid payment delays or unnecessary investigations.

What Support Will Be Available to Pensioners During This Transition?

The DWP acknowledges that not all pensioners are digitally fluent or comfortable navigating online systems. To accommodate this, several support measures are being introduced:

- DWP helplines will be expanded to address questions regarding the new rules

- In-person banking support will be available at many local branches for those needing help with ID updates or account changes

- Community-led workshops will provide educational sessions for pensioners

- Support for vulnerable individuals will be prioritised through targeted outreach and social services collaboration

These initiatives aim to make the transition smoother, particularly for older adults who may struggle with digital banking or lack nearby family support.

How Do These Banking Changes Affect the Future of Pension Payments in the UK?

The DWP banking update marks a turning point in how the UK manages benefit delivery. As digital tools become more integrated into public administration, the government is positioning itself to offer a more transparent and fraud-resistant welfare system.

Key Future Impacts:

| Aspect | Impact on Pension System |

|---|---|

| Digital verification | Reduces manual errors and boosts efficiency |

| Real-time eligibility checking | Prevents overpayments before they occur |

| Stronger data privacy regulation | Ensures trust in government-bank data sharing |

| Financial inclusion | Encourages updating banking habits among retirees |

As technology evolves, pensioners may see more streamlined services, quicker dispute resolution, and greater assurance that benefits are fairly distributed.

Conclusion

The DWP pension update banking rules represent a significant evolution in the UK’s approach to welfare administration. By leveraging digital verification and working collaboratively with banks, the DWP aims to ensure fairness, reduce fraud, and improve the accuracy of benefit distribution.

While the changes may seem complex, they are designed with safeguards and support mechanisms to help pensioners navigate them with ease.

Those who stay informed, keep their records updated, and seek assistance when needed will benefit from a more secure and reliable pension system.

Frequently Asked Questions

Does this change impact all pensioners or only those on certain benefits?

These changes mainly impact those on means-tested benefits, such as Pension Credit. Those receiving only the State Pension are typically unaffected unless there is a change in their personal or financial details.

Are banks legally required to report to the DWP under the new rules?

Yes, under the new legislation, banks are legally obligated to share specific, non-transactional data when red flag indicators are detected. This includes account ownership and identity confirmation.

What types of changes should pensioners report to the DWP?

Pensioners should report changes including income, savings, living arrangements, name or address updates, job status, or medical condition shifts, anything that could influence benefit eligibility.

Can pensioners challenge or appeal a DWP investigation?

Yes, if a pensioner disagrees with a DWP decision or investigation outcome, there is an appeals process. They can request a mandatory reconsideration and, if needed, escalate to an independent tribunal.

Will the banking updates affect joint accounts or third-party accounts?

Yes, accounts that do not match the pensioner’s official name on record may be flagged. It’s advisable to ensure the pension is paid into an account solely or primarily registered to the pensioner.

Is it safe to give consent to banks for DWP data sharing?

Banks are only allowed to share limited data under strict guidelines and must comply with a Code of Practice that ensures privacy and data protection.

What if a pensioner doesn’t have digital banking or ID documents?

Support is available at local branches, via the DWP helpline, and through community services. Paper ID and offline assistance will be accepted to ensure no pensioner is excluded.

{

“@context”: “http://schema.org/”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Does this change impact all pensioners or only those on certain benefits?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “These changes mainly impact those on means-tested benefits such as Pension Credit Those receiving only the State Pension are typically unaffected unless there is a change in their personal or financial details.”

}

},

{

“@type”: “Question”,

“name”: “Are banks legally required to report to the DWP under the new rules?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, under the new legislation banks are legally obligated to share specific non-transactional data when red flag indicators are detected. This includes account ownership and identity confirmation.”

}

},

{

“@type”: “Question”,

“name”: “What types of changes should pensioners report to the DWP?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Pensioners should report changes including income savings living arrangements name or address updates job status or medical condition shifts anything that could influence benefit eligibility.”

}

},

{

“@type”: “Question”,

“name”: “Can pensioners challenge or appeal a DWP investigation?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes if a pensioner disagrees with a DWP decision or investigation outcome there is an appeals process. They can request a mandatory reconsideration and, if needed, escalate to an independent tribunal.

”

}

},

{

“@type”: “Question”,

“name”: “Will the banking updates affect joint accounts or third-party accounts?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, accounts that do not match the pensioner’s official name on record may be flagged. It’s advisable to ensure the pension is paid into an account solely or primarily registered to the pensioner.”

}

},

{

“@type”: “Question”,

“name”: “Is it safe to give consent to banks for DWP data sharing?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Banks are only allowed to share limited data under strict guidelines and must comply with a Code of Practice that ensures privacy and data protection.”

}

},

{

“@type”: “Question”,

“name”: “What if a pensioner doesn’t have digital banking or ID documents?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Support is available at local branches via the DWP helpline and through community services. Paper ID and offline assistance will be accepted to ensure no pensioner is excluded.

”

}

}

]

}