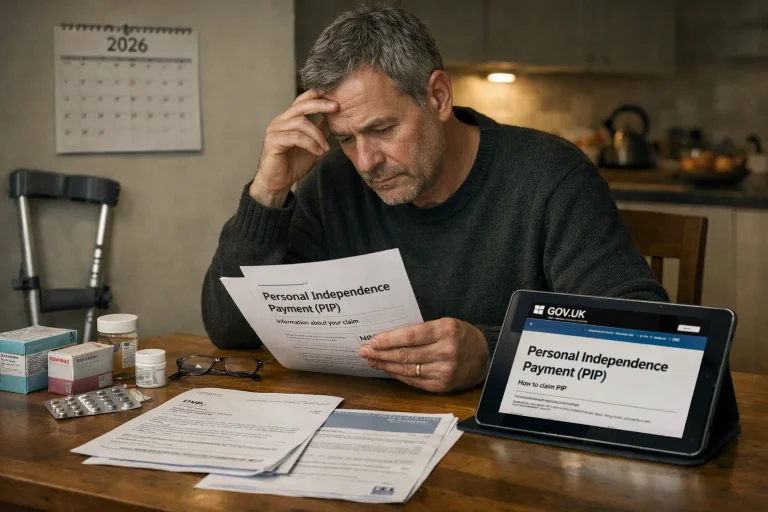

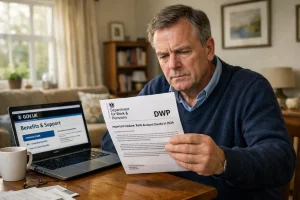

Are you concerned about how upcoming changes to your benefits might impact your bank details? From 2026, the UK’s Department for Work and Pensions (DWP) will begin proactive bank account checks under new legislation aimed at reducing benefit fraud.

This initiative, introduced through the Public Authorities (Fraud, Error and Accountability) Act, marks a significant shift in how eligibility for Universal Credit, ESA, and Pension Credit will be verified.

These checks are designed to ensure that claimants meet financial criteria such as savings thresholds without directly monitoring daily transactions.

While the DWP claims this will improve accuracy in benefit delivery, many people are questioning the privacy implications and what exactly the DWP can access.

If you’re receiving benefits or even if you’re not, it’s important to understand how these changes may affect you. This article explores everything you need to know about DWP bank account checks in 2026 and how you can prepare for them.

What Are DWP Bank Account Checks in 2026?

From 2026, the DWP will begin a new process of checking the bank accounts of benefit claimants as part of its wider strategy to combat fraud and error in the welfare system.

This will be made possible through powers granted by the Public Authorities (Fraud, Error and Accountability) Act. The purpose of these checks is to determine whether claimants meet financial eligibility rules, such as savings limits and income thresholds.

Rather than monitoring purchases or everyday transactions, the DWP will rely on a specific type of data request called an Eligibility Verification Notice. These notices are sent to banks and financial institutions, which are then required to check their customer records against criteria provided by the DWP.

These checks form part of a “test and learn” strategy, where the process will be gradually rolled out and refined. The goal is to reduce incorrect payments and make sure public funds are directed only to those who are genuinely eligible, while ensuring transparency and fairness in the process.

Which Benefits Will Be Affected First?

The initial rollout of the DWP’s bank account checks will focus on three major means-tested benefits that have historically seen the highest levels of overpayment and fraud.

These include:

- Universal Credit (UC)

- Employment and Support Allowance (ESA)

- Pension Credit

These benefits were selected due to the financial eligibility requirements involved and their susceptibility to fraud based on undeclared income or savings. The DWP aims to reduce the frequency of errors and fraud by verifying information that claimants may otherwise self-report inaccurately.

While these three are the starting point, the government has indicated that additional benefits could be added to this policy at a later date.

Potential future additions might include:

- Carer’s Allowance

- Disability Living Allowance

- Child Benefit

- Personal Independence Payment (PIP)

However, the State Pension is excluded from this initiative and cannot be included under the current legislation, even with parliamentary approval. This phased approach allows time to evaluate effectiveness before expanding the scope further.

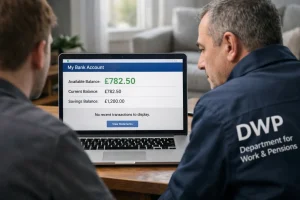

What Can the DWP Actually See in Your Bank Account?

One of the most common concerns is how much access the DWP will have to personal banking information. It’s important to understand exactly what data is shared and what remains private under this new system.

What Information Will DWP Get?

When an Eligibility Verification Notice is issued, banks are instructed to share only specific and limited details, including:

- Full name and date of birth of the account holder

- Sort code and account number of the relevant account

- The balance held in the account, if it meets certain thresholds

- Whether the account matches the eligibility indicators set out in the DWP’s notice

- Details of linked accounts that may be associated with the claimant

The goal is to identify capital or savings that exceed eligibility limits, such as the £16,000 savings threshold for Universal Credit claimants.

What Information is Off-limits?

Despite public fears, the DWP will not have unrestricted access to your finances.

Banks are forbidden by law from sharing the following:

- Transaction history or spending details (e.g., Amazon purchases or grocery receipts)

- Information about political views, health data or other special category data

- Full bank statements or loan information

- Personal details not relevant to benefit eligibility

Banks that share this kind of data could face penalties, and the law enforces strict compliance with UK GDPR regulations.

DWP Can vs Cannot See

| DWP Can See | DWP Cannot See |

|---|---|

| Account holder's name and date of birth | Itemised spending or transaction history |

| Sort code and account number | Shopping, subscriptions, or purchases |

| Account balance above eligibility limit | Data on loans or overdrafts |

| Linked accounts if flagged | Special category data (e.g., medical) |

| Eligibility indicator match | Personal notes or memos |

In summary, DWP can only access what is strictly relevant for assessing benefit eligibility.

How Will These Bank Account Checks Work?

Understanding the process behind the new checks can help you prepare and avoid surprises. The entire system is structured to identify issues early, reduce human error, and protect public money while ensuring privacy safeguards remain in place.

What is an Eligibility Verification Notice?

An Eligibility Verification Notice (EVN) is a formal request from the DWP to banks and financial institutions.

It outlines specific indicators the DWP is looking for, such as:

- Accounts receiving benefit payments

- Accounts holding savings over a specified limit

- Linked accounts with shared addresses or personal details

Banks are required to search their records and report only accounts that meet these indicators.

What’s the Bank’s Role?

Once they receive an EVN, the bank must:

- Search for accounts that match the criteria in the notice

- Verify details such as balances and account ownership

- Return only the necessary information (name, date of birth, account number, and indicators)

- Avoid sharing any transaction history or non-relevant personal data

They are not permitted to conduct investigations themselves and cannot access data beyond what the DWP has requested.

Will Your Benefits Stop Immediately if Flagged?

No. If your account is flagged, this does not automatically affect your benefits. The DWP uses this data to open a further inquiry where necessary, but a human decision-maker is always involved.

This ensures:

- Fairness and due process

- The opportunity to respond or clarify before any action

- Protection from wrongful suspensions or errors

The system is not designed to be punitive, but corrective in nature.

What Triggers a DWP Investigation?

DWP investigations are not random or universal. An inquiry is only launched when specific criteria are triggered. These are known as eligibility indicators, and they highlight potential discrepancies between a person’s declared financial circumstances and actual bank data.

Common triggers for investigation include:

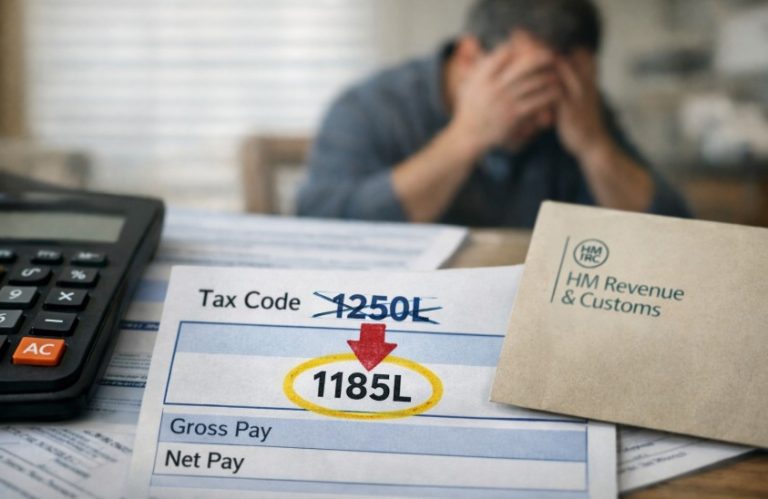

- Savings above £6,000 or £16,000 depending on benefit type

- Unexplained large deposits into your account

- Regular income that hasn’t been declared to DWP

- Linked accounts under the same address holding excess capital

- Signs of international transactions suggesting a claimant may not be residing in the UK

These indicators are based on legal benefit rules, and once detected, they prompt the DWP to manually review the case.

What Happens If Your Account Is Flagged?

If your account is flagged during the bank verification process, it does not mean you are automatically guilty of fraud or that your benefits will be stopped immediately. Instead, the DWP opens a manual investigation led by a human officer.

You will likely be contacted by the DWP to explain the flagged indicator. This may involve providing evidence, such as account statements or proof of exemptions (like inheritance, compensation, or one-off payments). The DWP will not take action based solely on the data received from the bank. If no error or fraud is found, your benefits will continue as normal.

In the case of a genuine mistake or discrepancy, you may be asked to update your records or repay any overpayment without penalties. An appeal process is also available if you disagree with the DWP’s conclusion.

Will These Checks Affect People Not Claiming Benefits?

Yes, in certain cases, these checks may extend to individuals who are not currently receiving benefits. If someone is suspected of fraudulently accessing benefits, such as by using another person’s account or not declaring capital, the DWP may investigate accounts not directly tied to benefit claims.

Under the new law, financial institutions are allowed to flag accounts linked to existing benefit claims if they meet the eligibility indicators. For example, if a claimant’s partner or child has an account that shares the same address and exceeds savings thresholds, this account might be reviewed.

However, mass surveillance is not part of the policy. Only accounts linked to known eligibility indicators will be reviewed. State Pension-only recipients are excluded from these checks under current legislation.

Is This Surveillance or Justified Anti-Fraud?

The introduction of these checks has sparked a national debate. While many people agree that reducing fraud is necessary, others are concerned about overreach and the erosion of privacy.

Critics argue that even limited data sharing could lead to more invasive practices in future. The DWP has stressed that these powers are not about surveillance, but about improving benefit accuracy.

Strict legal safeguards are in place, including:

- Independent oversight and annual reviews

- GDPR compliance and data encryption

- Penalties for banks that overshare information

- Mandatory human intervention in decisions

The government believes that with proper controls, the system will maintain public trust while strengthening benefit integrity.

How Should You Prepare for the DWP Bank Account Checks?

If you’re a benefit claimant, there are simple steps you can take to avoid issues once the new checks are in place. Being proactive and transparent is key to ensuring your payments are unaffected.

Here are ways you can prepare:

- Review your current savings and ensure they are below the legal thresholds

- Update the DWP about any changes in income, savings, or circumstances

- Avoid using linked accounts to hide savings, even unintentionally

- Keep all benefit declarations honest and accurate

- Be ready to provide evidence if contacted

If you’re not claiming benefits but live with someone who is, be aware that your account might be flagged if linked indicators are present. The more accurate and honest your information, the less likely you are to face problems when the policy is rolled out.

Conclusion

The DWP bank account checks launching in 2026 represent a major shift in how benefit eligibility will be verified across the UK.

These checks aim to reduce fraud and error by enabling the DWP to access limited bank information under strict legal guidelines. While many fear this is an invasion of privacy, the data being shared is minimal and solely focused on eligibility criteria.

By introducing the system with a phased, test-and-learn approach, the government aims to ensure fairness, transparency and accuracy.

Benefit claimants are encouraged to stay informed, keep their records updated, and engage with the process if contacted. The key to avoiding issues is honesty and awareness of eligibility rules.

With strong oversight and a focus on human-led decisions, the DWP hopes this policy will protect public money while supporting those who genuinely need financial help.

FAQs

When will the DWP start checking bank accounts?

The pilot phase begins in 2025 with full national rollout expected in 2026.

Who will the DWP check first?

Initial checks will focus on claimants of Universal Credit, Pension Credit, and Employment and Support Allowance.

Will the DWP see all my bank transactions?

No. Only summary details like account balances and eligibility indicators are shared, not individual purchases.

Can I refuse DWP access to my bank details?

No. Under the new law, DWP can request relevant data from banks without your consent to detect fraud.

How can I protect my privacy under the new system?

Ensure your benefit records are accurate and declare savings or income honestly to avoid incorrect flags.

Are State Pension claimants included in these checks?

No. State Pension recipients are excluded and cannot be added to the scheme by law.

What if my account is flagged incorrectly?

You’ll be contacted with a chance to explain, and you can appeal any decision with supporting evidence.