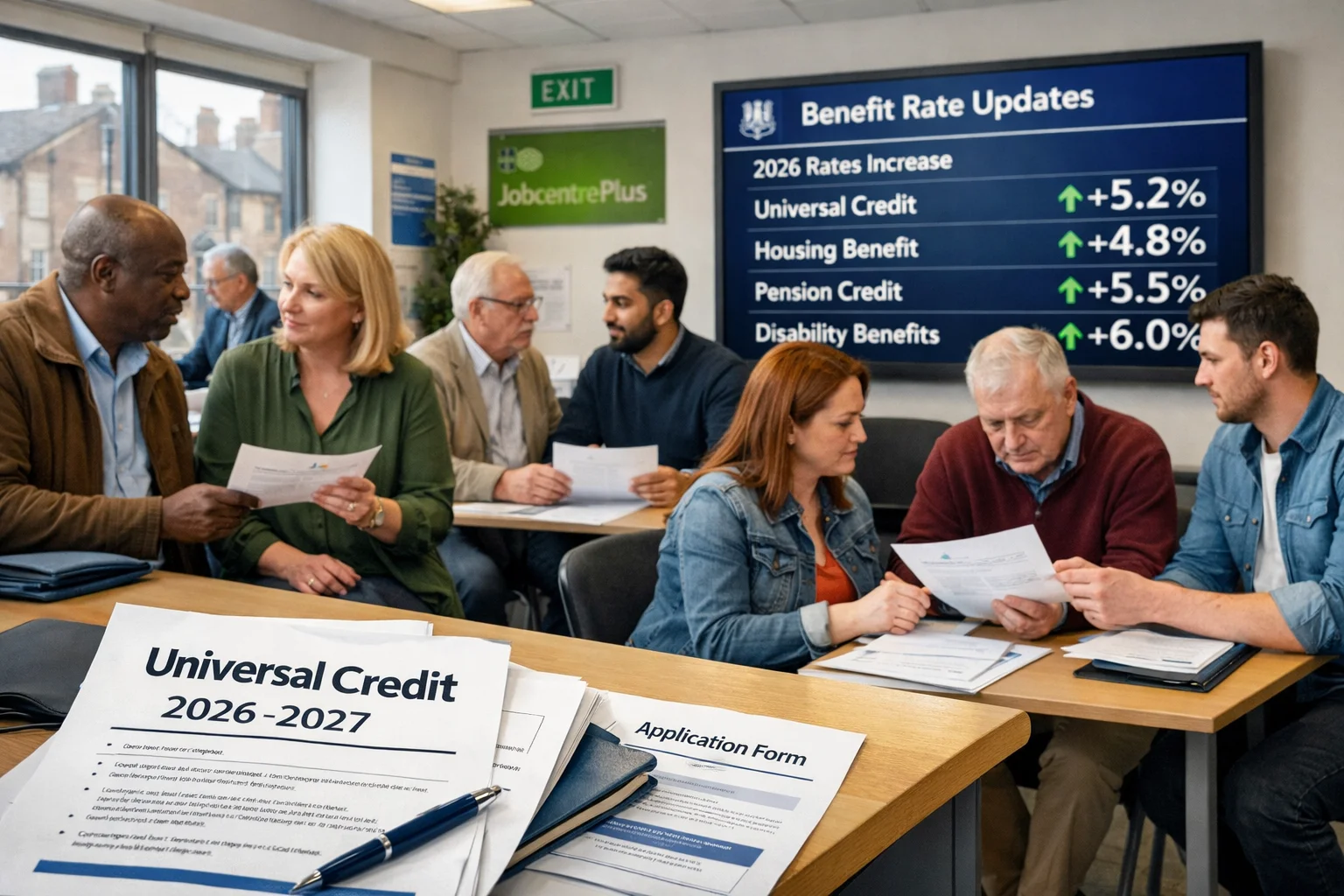

Are you wondering how the 2026 changes to Universal Credit will affect your monthly payments? With inflation on the rise and government policy shifting, the Department for Work and Pensions (DWP) has introduced some of the most significant updates to benefit payments in years.

From increases to the standard allowance to sweeping cuts to the health-related components, these changes could impact thousands of claimants across the UK. This guide breaks down exactly what you need to know about the Universal Credit benefit rates for 2026 to 2027.

Whether you’re currently claiming or planning to apply soon, understanding the new structure can help you make informed decisions. With updated figures straight from GOV.UK, Parliament, and expert reports, this article covers all the critical updates, so you don’t miss out on what you may be entitled to.

What Is Changing in Universal Credit Benefit Rates for 2026 to 2027?

From April 2026, Universal Credit will undergo major adjustments as outlined in the Universal Credit Act 2025. The most notable change is a 6.2% increase to the standard allowance, a combination of a 3.8% inflation-based rise and an additional 2.3% uplift mandated by the Act.

This aims to support households during ongoing economic pressures while aligning with the Consumer Prices Index (CPI) as measured in September 2025. Another key change is the restructuring of the health element, also known as the Limited Capability for Work and Work-Related Activity (LCWRA).

The government plans to drastically reduce this component for new claimants while freezing it for most existing ones. This creates a two-tier system, where new applicants after April 2026 will receive a significantly lower health-related addition than those already receiving it.

In addition, work allowances, carer amounts, childcare support, and certain disability additions will see moderate increases. These updates are aimed at both simplifying the system and encouraging more people with health conditions to re-enter employment where possible.

For most households, the changes mean higher base payments but potentially reduced entitlements if you’re applying for health-related support. Reviewing your eligibility early could ensure you receive the higher rates before the policy fully takes effect.

How Much Will the Standard Allowance Increase in April 2026?

Universal Credit claimants across the UK will see noticeable increases in their monthly standard allowances starting in April 2026. These rises are part of the government’s response to inflation and are outlined under the Universal Credit Act 2025, designed to deliver a total uplift of around 6.2%.

The standard allowance is the core part of any Universal Credit award and varies depending on your age and household type. Let’s take a detailed look at how much your standard allowance will change, based on your circumstances.

Breakdown of New Standard Allowance by Age and Household Type

For single claimants under the age of 25, the monthly payment will increase from £316.98 to £338.58. For those aged 25 or older, the standard allowance will rise from £400.14 to £424.90.

Joint claimants will also see significant increases. If both partners are under 25, their combined standard allowance goes up from £497.55 to £528.34. If one or both partners are aged 25 or over, the increase will take their allowance from £628.10 to £666.97. These figures reflect a substantial support boost, aimed at offsetting the rising cost of living across the UK.

Monthly Rate Comparison: 2025/26 vs 2026/27

The comparison below shows the changes in Universal Credit standard allowances between the current and upcoming financial years. This increase applies across all eligible claimants and is designed to provide more consistent financial relief.

| Household Type | 2025/26 Monthly Rate | 2026/27 Monthly Rate | Increase |

|---|---|---|---|

| Single claimant under 25 | £316.98 | £338.58 | £21.60 |

| Single claimant aged 25 or over | £400.14 | £424.90 | £24.76 |

| Couple both under 25 | £497.55 | £528.34 | £30.79 |

| Couple, one or both 25 or over | £628.10 | £666.97 | £38.87 |

These updated figures are among the largest increases in recent years and are intended to help claimants maintain their purchasing power during periods of high inflation.

Standard Allowance Increases by Category

The following table gives you a detailed look at how different groups will benefit from the standard allowance increase starting April 2026.

| Claimant Category | Previous Monthly Rate (2025/26) | New Monthly Rate (2026/27) |

|---|---|---|

| Single under 25 | £316.98 | £338.58 |

| Single 25 or over | £400.14 | £424.90 |

| Couple both under 25 | £497.55 | £528.34 |

| Couple, one or both 25 or over | £628.10 | £666.97 |

These increases will automatically apply to all qualifying claimants, without the need for any additional application. Make sure your Universal Credit records are up to date to benefit from the new rates as soon as they come into effect.

What’s Happening to the Health Element (LCWRA) in 2026?

The health element of Universal Credit, officially known as the Limited Capability for Work and Work-Related Activity (LCWRA), is undergoing one of the most significant reforms in the 2026–2027 benefits update.

The government has introduced a two-tier system, with stark differences between new claimants and existing recipients. This is a crucial change, especially for those with long-term health conditions or disabilities planning to claim Universal Credit after April 2026.

The aim of these reforms is to narrow the financial gap between those who receive LCWRA and those on the standard allowance.

This aligns with the government’s intent to reduce dependency on health-related benefits and encourage individuals with manageable conditions to return to work. However, for many potential claimants, this could mean a substantial reduction in support.

The Major Cut for New Claimants

- From 6 April 2026, new claimants approved for LCWRA will receive a reduced rate of £217.26 per month.

- This is nearly half of the current LCWRA rate of £423.27, a major change that will impact financial planning for thousands of new applicants.

- Only claimants who meet the severe conditions criteria or are terminally ill will receive the higher rate after this date.

Freeze for Existing Claimants

- Existing LCWRA claimants before April 2026 will continue to receive the higher payment, which is increasing slightly from £423.27 to £429.80.

- This rate will be frozen for most claimants until 2029, except those undergoing reassessment who still meet the eligibility criteria.

- The government has confirmed that no current claimants will see their payments decrease because of this change.

Who Qualifies for the Higher LCWRA Rate?

- You must apply and be approved for LCWRA before 6 April 2026.

- There is typically a 3-month qualifying period, so your condition must be reported by early January 2026 at the latest.

- Those who already receive LCWRA and remain eligible under reassessment will continue on the higher rate.

Why the Government Is Making These Changes?

- The government believes the current LCWRA rate creates a financial incentive not to work.

- By reducing the payment for new claimants, they hope to encourage those with less severe health issues to re-enter employment.

- This policy shift reflects a broader change in approach from welfare support to employment-focused support.

LCWRA Comparison Pre- and Post-April 2026

| Claimant Group | 2025/26 Rate | 2026/27 Rate | Change |

|---|---|---|---|

| Existing LCWRA Claimants (standard) | £423.27 | £429.80 | +£6.53 |

| Existing LCWRA Claimants (severe/terminal condition) | £423.27 | £429.80 | +£6.53 |

| New LCWRA Claimants (from April 2026) | £423.27 | £217.26 | -£206.01 |

It’s important to understand these changes in advance. If you believe you qualify for LCWRA, report your condition to the DWP immediately to avoid the lower rate and secure the support you’re entitled to.

What Are the Updates to Child and Disability Elements?

From April 2026, several components of Universal Credit related to children and disability support will be adjusted in line with inflation and the additional uprating set by the government. These updates will help families cope with rising living costs and provide modest improvements in financial assistance.

The first child element, for children born before 6 April 2017, will increase from £339.00 to £351.88 per month. For children born on or after that date, or for any subsequent children, the amount will rise from £292.81 to £303.94 per month.

Disabled child additions have also been uprated. The lower rate addition will increase from £158.76 to £164.79, and the higher rate will go from £495.87 to £514.71. These changes provide additional help to families with disabled children who face higher daily costs.

- First child (before 6 April 2017): £339.00 → £351.88

- First child (after 6 April 2017) or subsequent children: £292.81 → £303.94

- Disabled child addition (lower rate): £158.76 → £164.79

- Disabled child addition (higher rate): £495.87 → £514.71

Although these are small increases, they ensure that child and disability elements of Universal Credit remain linked to inflation and provide a baseline of support for vulnerable families.

Will There Be Any Changes to Deductions and Overpayments?

Yes, several categories of deductions and overpayments under Universal Credit will see changes from April 2026. These updates mostly reflect adjustments in line with the uprated standard allowances.

Deductions are applied to recover debts or overpayments or in cases of benefit fraud. These can include rent arrears, third-party deductions, and penalties.

In 2026, the overall maximum deduction rate remains capped at 15% of the standard allowance, reduced from previous limits of 25%.

The table below outlines some of the key deductions and how they’re changing:

| Deduction Category | 2025/26 Rate | 2026/27 Rate |

|---|---|---|

| Single under 25 – 100% reduction rate | £10.40 | £11.10 |

| Single 25 or over – 100% reduction rate | £13.10 | £13.90 |

| Couple both under 25 – 100% per claimant | £8.10 | £8.60 |

| Couple one/both over 25 – 100% per claimant | £10.30 | £10.90 |

| Third-party deduction (single over 25) | £20.01 | £21.25 |

| Rent/service charges (max 15% of allowance) – single 25+ | £60.02 | £63.74 |

| Civil penalties (single over 25) | £60.02 | £63.74 |

The intention behind these updates is to maintain fair repayment while adjusting for inflation. Claimants are encouraged to review their deduction breakdowns through their online UC account to avoid unexpected reductions in their monthly payments.

How Will Carers and People on Childcare Support Be Affected?

The 2026–2027 Universal Credit updates bring positive changes for carers and those receiving support for childcare costs, helping to ease financial pressure for families and those with caring responsibilities. While the overall structure remains intact, key elements are being uprated to reflect inflation and evolving family needs.

The carer element of Universal Credit will increase from £201.68 to £209.34 per month. This additional amount is provided to those who care for a severely disabled person for at least 35 hours a week. The increase helps ensure that carers receive better recognition for their vital unpaid work.

Childcare support also gets an uplift. The maximum monthly childcare cost support will rise from £1,031.88 to £1,071.09 for one child, and from £1,768.94 to £1,836.16 for two or more children. These payments assist working parents in covering the often high cost of childcare, enabling them to remain in employment.

- Carer element: £201.68 → £209.34

- Childcare cost for one child: £1,031.88 → £1,071.09

- Childcare cost for two or more children: £1,768.94 → £1,836.16

These increases aim to support work-life balance and reduce the burden of childcare expenses. Claimants should ensure all childcare costs are accurately reported to DWP to receive the full support they’re entitled to.

What Other Benefits Are Increasing in 2026?

In addition to Universal Credit, several other benefits are set to increase from April 2026. These updates are based on inflation (3.8% for most) or earnings growth (4.8% for pensions) and are part of the government’s statutory annual uprating process.

These changes aim to provide ongoing support for the UK’s most vulnerable individuals and families. Let’s explore the specific benefit increases you can expect.

Quick Overview of PIP, ESA, Attendance Allowance, State Pension

For those receiving Personal Independence Payment (PIP), all components are increasing:

- Daily living component, standard: £73.90 → £76.70

- Daily living component, enhanced: £110.40 → £114.60

- Mobility component, standard: £29.20 → £30.30

- Mobility component, enhanced: £77.05 → £80.00

Employment and Support Allowance (ESA) also increases:

- Work-related activity group: £92.05 → £95.55

- Support group component: £48.50 → £50.35

Attendance Allowance, usually for individuals over state pension age with care needs, is increasing as well:

- Lower rate: £73.90 → £76.70

- Higher rate: £110.40 → £114.60

State Pension Increases: Basic and New

The State Pension is being uprated by 4.8%, in line with average earnings growth:

- New State Pension: £230.25 → £241.30 per week

- Basic State Pension: £176.45 → £184.90 per week

These changes help pensioners maintain their spending power in the face of inflation and living cost increases. The triple-lock guarantee remains a key policy, ensuring pensioners do not fall behind economically.

Pension Credit Updates

For older claimants with limited income, Pension Credit is also increasing:

- Single claimant: £227.10 → £238.00 per week

- Couple: £346.60 → £363.25 per week

This means more older adults will be lifted above the poverty line, especially important for those not qualifying for the full State Pension.

Housing Benefit Considerations

Although most people are now transitioned to Universal Credit’s housing element, around 1.8 million people still claim Housing Benefit. While it will increase in line with rents for social tenants, the Local Housing Allowance (LHA) for private renters remains frozen, which has drawn criticism from housing campaigners.

The government is maintaining this freeze despite rising rents, meaning many private renters may struggle to cover their actual housing costs through benefits alone.

The increases across these benefits demonstrate the government’s broader approach to uprating welfare support while targeting certain areas for reform, like housing and disability payments.

What Is Happening to the Benefit Cap in 2026?

Despite multiple benefit increases across Universal Credit and other welfare systems, the Benefit Cap will remain frozen for 2026–2027. This marks the fourth consecutive year that the cap has not risen in line with inflation, which is causing concern among anti-poverty campaigners.

The Benefit Cap is the maximum amount a household can receive in total welfare payments. It applies unless the claimant is exempt (for example, receiving PIP or working enough hours). Here’s how the cap remains structured.

Greater London:

- Single adults (no children): £1,413.92 per month

- Couples or single parents: £2,110.25 per month

Rest of Great Britain:

- Single adults (no children): £1,229.42 per month

- Couples or single parents: £1,835.00 per month

- The cap includes Universal Credit, Housing Benefit, and Child Benefit

- It does not include PIP, Attendance Allowance, or Carer’s Allowance

Although the cap levels haven’t changed, the rising value of benefit entitlements means more families may now be affected, especially in high-rent areas. Claimants are advised to review their benefit mix and consult an adviser if they believe they might be capped.

When Should You Report a Health Condition to Secure the Higher Rate?

If you have a long-term health condition or disability and are planning to claim Universal Credit, the timing of your application is critical.

This is because, from 6 April 2026, new claimants will receive a much lower LCWRA (health element) amount compared to those who qualify beforehand. The government has set a clear cut-off to determine who gets the higher rate and who doesn’t.

To ensure you receive the higher LCWRA rate, you must report your health condition and begin the assessment process before 6 January 2026, allowing for the standard 3-month qualifying period. This means you must act quickly to avoid being placed into the lower payment category of £217.26 per month instead of £423.27.

You can report your condition through your Universal Credit online account or by contacting the DWP helpline.

If you’re unsure, it’s recommended to speak to a welfare adviser. Failing to report by the deadline could result in a significant loss of monthly income, so don’t delay taking action.

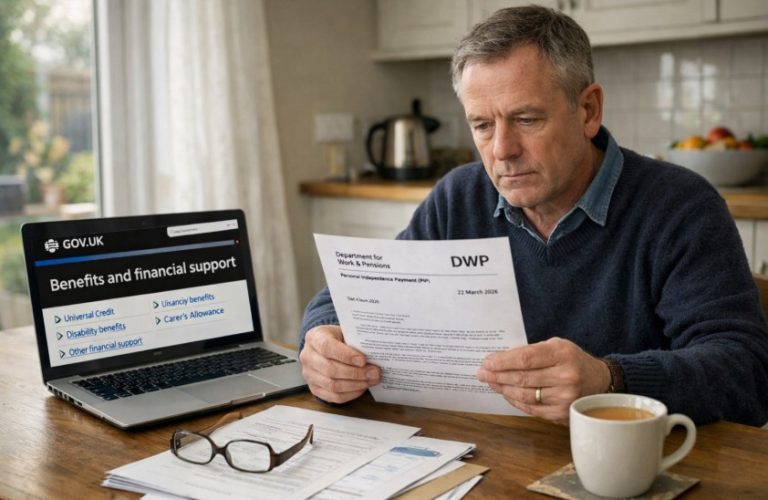

What Should You Do If You’re Already Claiming Universal Credit?

If you’re currently receiving Universal Credit, the changes coming in April 2026 may or may not affect you, depending on your circumstances. Understanding your current benefit structure and what is changing can help you make the right decisions and protect your income.

- If you already receive LCWRA, your amount will not decrease, and you’ll be protected by transitional arrangements.

- If you are being reassessed, as long as your condition qualifies, you’ll retain the higher rate.

- If you’re on legacy benefits like income-based JSA or ESA, and have received a migration notice, you must apply for Universal Credit within the stated period to avoid payment delays or loss.

- If you haven’t reported a health condition yet, consider doing so before January 2026 to be eligible for the higher LCWRA amount.

Overall, the best approach is to review your claim regularly, keep all information up to date, and seek support if you’re unsure how these changes apply to you.

Conclusion

Universal Credit is set for major updates in 2026, with both increases and reductions that could significantly affect how much you receive. While the standard allowance is increasing across all age groups and household types, the health element (LCWRA) will be cut for most new claimants.

Child and disability elements, carer support, and childcare costs are seeing small but meaningful increases, offering additional help to families and carers.

However, the benefit cap freeze and the LCWRA two-tier system raise important questions about fairness and support for vulnerable groups.

The good news is that existing claimants are protected from reductions, and those who act before the cut-off may still access higher rates. Understanding these updates now, and acting quickly if you’re affected, is the best way to protect your income in 2026 and beyond.

FAQs

How much will Universal Credit increase in April 2026?

The standard allowance will increase by about 6.2%, with single over-25s getting £424.90 per month.

Who will be affected by the LCWRA reduction?

Only new claimants applying on or after 6 April 2026 will receive the lower LCWRA rate of £217.26.

How do I qualify for the higher LCWRA rate before 2026?

You must report your health condition to the DWP before 6 January 2026 to allow for the 3-month qualifying period.

Will housing benefit or PIP be impacted by these changes?

No, housing benefit and PIP are not affected by the Universal Credit Act changes in 2026.

What happens if I miss the deadline to report my health condition?

You’ll likely receive the lower LCWRA rate, unless you meet severe or terminal illness criteria.

Is the benefit cap changing in 2026?

No, the benefit cap remains frozen, which may impact households receiving multiple benefits.

How will these changes affect people on legacy benefits?

If you receive a migration notice, you must move to Universal Credit. You may qualify for transitional protection.