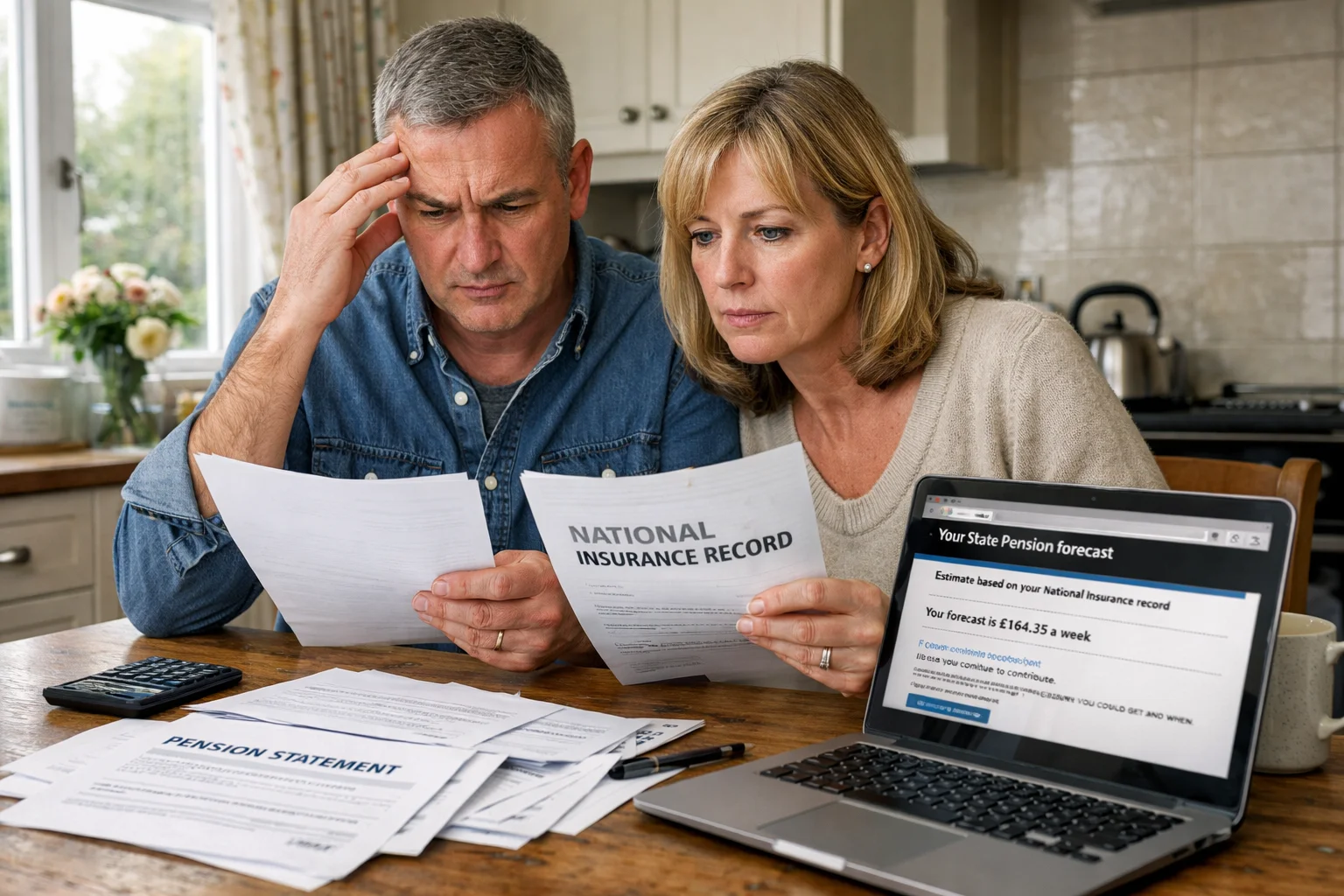

The HMRC state pension error matters because up to 800,000 people may have seen state pension forecasts that were too high, mainly due to contracted-out National Insurance periods not being properly reflected in the online forecast tool for years.

That can leave some workers at risk of retiring with a lower state pension than expected and without enough time to top up missing years.

Key takeaways:

- HMRC confirmed a planned update to improve forecast accuracy for people reaching state pension age after April 2029

- The issue links to contracted-out periods tied to the old SERPS system

- Some people may need to recheck their forecast and National Insurance record, and consider voluntary contributions where appropriate

- HMRC said sorry for the problems users experienced and confirmed the tool now accounts for contracted-out years for the affected group

What Is the HMRC State Pension Error and How Did It Go Unnoticed for Nine Years?

The HMRC state pension error refers to a long-running flaw in the online Check your State Pension forecast tool that could show overly optimistic results for certain users.

Reporting indicated the issue persisted for around nine years, with many people potentially receiving forecasts that did not properly account for contracted-out National Insurance history.

This matters because the tool is widely used to help people understand whether they are on track for the full new state pension and whether they should make extra National Insurance payments to fill gaps.

A key detail is that the tool could fail to reflect manual adjustments applied to records for workers who had previously contracted out.

That meant a person could be told they were due the full state pension and did not need to make additional contributions, even though a deduction could apply later. Over time, that gap between forecast and reality could become a serious planning problem for households.

How Were Up to 800,000 UK Workers Affected by the HMRC State Pension Error?

Up to 800,000 UK workers were reported as being at risk of misleading forecasts, particularly those who had contracted out and who are due to reach state pension age after April 2029.

The concern is not only about the final payment amount, but also about decision-making along the way. If someone believes they will receive the maximum state pension, they may stop checking their record, stop making contributions, or retire earlier than planned.

The articles also underline the missed opportunity angle. If forecasts are inflated, people can be deprived of the chance to increase their weekly payments by addressing gaps sooner.

That can be particularly important because the new state pension depends on qualifying years, and the tool was designed to help users identify missing or incomplete years and top up where needed. In human terms, the risk is simple. People plan around a number they trust, then discover later that the number was wrong.

When Did HMRC First Become Aware of the State Pension Error and Why Was the Fix Delayed?

The story of the HMRC state pension error is as much about timing as it is about technology. The online forecast tool was launched in February 2016, just two months before the new state pension was introduced, and it quickly became the obvious place for workers to check their position.

Yet the reporting describes a problem that lingered for years, despite internal awareness and previous changes.

At a high level, the issue was linked to how the tool handled contracted-out records. The tool could not always register manual adjustments tied to contracted out history, which meant that some forecasts could be too high.

Ministers were first made aware of the error in 2017, but the fixes did not arrive in a way that fully resolved the problem for everyone straight away, especially for those reaching state pension age after April 2029.

Timeline overview

- February 2016: The online state pension forecast tool launches, intended to help users check progress towards the maximum payment and identify missing years

- 2017: Ministers are first made aware of the error, according to the reporting

- 2019: It is reported that around 360,000 incorrect estimates had already been issued in the three years since launch

- 2021: The coverage notes that it took a further four years after 2017 for any fixes to be implemented, indicating a slow response

- February 2024: HMRC advises some users to wait until 14 February to check, following a system update on 13 February aimed at improving accuracy

- After the update, HMRC confirms the update ensures customers who reach state pension age after April 2029 will receive a forecast taking into account the years they were contracted out

The delay matters because the tool was positioned as a practical planning aid. If the forecasts were wrong for a group of users, then every year without a reliable correction increased the chance that people would make financial decisions on incomplete information.

Sir Steve Webb, a former pensions minister now at consultancy LCP, captured the risk in a vivid phrase when he warned the error put people at risk of retirements “built on sand”. He also said, “It is good to see that HMRC are making further updates to improve the accuracy of state pension forecasts.”

Those comments reflect both the seriousness of the risk and the value of making the system accurate going forward.

Why Was the Contracted-Out Deduction Not Included in State Pension Forecasts?

To understand why the HMRC state pension error happened, it helps to unpack what contracting out meant and why it creates complexity for forecasting.

The coverage explains that contracting out, now abolished, allowed millions of employees to opt out of paying into the additional state pension, commonly linked to SERPS, if they were instead building pension benefits through a private or workplace scheme.

In practice, that meant paying lower National Insurance for a period, then facing an adjustment later when state pension amounts were finally calculated.

Explanation of SERPSand Contracted-out National Insurance

Contracting out was part of an older pension landscape. Under this arrangement, people could redirect some of what would have gone towards the additional state pension into a workplace or private pension.

The articles describe the additional state pension as SERPS. The result is that contracted out periods are not a simple footnote, they are part of how entitlements are ultimately worked out.

How Deductions Work at Retirement?

The key mechanism is the deduction. When someone retires, a deduction can be made from their final state pension for any periods when they were contracted out.

That is the central detail that the forecast tool needed to represent accurately. If a tool does not show that deduction, then the forecast can look better than the amount a person later receives, because the deduction reduces the final outcome.

Why Millions of Workers Were at Risk of Inflated Forecasts?

Millions of people used contracting out historically, which is why the potential impact number is large.

If a forecast tool fails to reflect contracted out deductions, then large numbers of users could be told they will receive the full new state pension and do not need further National Insurance contributions, even though the deduction might mean they do.

The reporting notes that up to 800,000 people could have been told incorrectly that they did not need to make more National Insurance contributions to reach the qualifying number of years.

This is also why the issue is framed as a shortfall risk rather than a simple technical glitch. A forecast that is too high can reduce urgency.

People may not top up missing years, or they may believe they are already at the maximum, which weakens their ability to remedy a shortfall before state pension age.

The Tool’s Technical Limitation

The core limitation described is that the tool was unable to register manual adjustments applied to records of workers who had contracted out.

That is why the error persisted for certain users, especially those reaching state pension age after April 2029, even after earlier corrections were made for people reaching state pension age before that date.

Put simply, the system was not reflecting a known quirk of the rules, so the forecast could be out of step with the eventual calculation.

What Did HMRC’s February 2024 Update Change for State Pension Forecast Accuracy?

HMRC’s February 2024 update was presented as a planned change aimed at improving forecast accuracy, specifically for people who will reach state pension age after April 2029.

Following coverage of the issue, HMRC published a message aimed at users checking their state pension forecast via Government Gateway.

It advised anyone wanting to use the tool who will reach state pension age after April 2029 to wait until 14 February to do so, following a system update on 13 February that would “improve the accuracy of forecasts”.

HMRC also put the change in clear terms through a spokesperson statement. “We have made a planned update to our online

Check your State Pension tool to ensure customers who reach state pension age after April 2029 will receive a forecast which takes into account the years they were contracted out.”

The spokesperson added, “We’re sorry for the problems that some people have experienced with the tool in the past, but are pleased to confirm this update will ensure customers who reach state pension age after April 2029 will now receive a forecast which takes into account the years they were contracted out.”

What Should Affected Individuals Do Now to Check Their State Pension Forecast?

For anyone worried about the HMRC state pension error, the most important step is practical. Check again, and check the right details.

The reporting highlights that the affected group includes those with contracted out history who reach state pension age after April 2029, and that HMRC advised waiting until after the update date to get a more accurate forecast.

With that in mind, people can take structured actions to reduce the risk of unpleasant surprises later.

Steps for checking NI record

A careful check starts with the basics.

- Log in via Government Gateway and use the official state pension forecast tool to view the latest forecast after the update date referenced in the coverage

- Review the National Insurance record section to see whether years are marked as full, partial, or missing

- Note any years that appear incomplete, since the tool was designed to highlight missing or incomplete years so users can consider topping up

The aim is to create a simple list. What does the forecast say, and what does the record show about qualifying years.

How to Verify Contracted Out Periods?

Contracted out history is the detail at the heart of this issue, so it deserves focused attention.

- Look for indicators in the account information that reflect contracted-out periods, since the reported issue was that the tool did not always reflect the deduction linked to those years

- Compare the latest forecast after the system update with any older saved forecasts, if available, to see whether the estimate has changed materially

- If there is confusion about why the figure differs, make a note of the years that might relate to contracting out, so the question is specific when raised with support teams

This is not about memorising pension rules. It is about confirming whether contracted-out years were properly accounted for in the updated forecast.

When Voluntary NI Contributions Are Beneficial?

The coverage points to voluntary top ups as a key remedy route for some people, with figures and limits mentioned in the reporting.

- Voluntary contributions may be useful if the record shows missing or incomplete years and the forecast indicates that adding qualifying years could raise the weekly amount

- They may be particularly relevant if a person was previously told they did not need extra contributions, but the updated forecast suggests a gap

- The reporting states that HMRC previously said it would allow those affected to top up by making lump sum payments of up to £907 per missing year, which highlights both the potential cost and the option

This is where individual circumstances matter. People may need to weigh cost versus benefit, and consider how many years they can and should fill.

Guidance on Contacting HMRC or DWP

If the forecast changes sharply or looks inconsistent with expectations, a direct query may be needed.

- Contact HMRC support channels linked to the online tool to ask how contracted-out years are reflected in the forecast after the update

- Keep the query focused on facts, including the forecast value, the years in question, and any contracted-out history indicators

- If the question relates to state pension entitlement and final calculation at retirement, it may involve DWP processes, since state pension payments are ultimately calculated at state pension age as the coverage notes

A good rule is to ask one clear question at a time. For example, whether the updated forecast now includes the contracted-out deduction for the specific retirement date bracket.

Actions to Avoid Further Pension Shortfalls

Even with an improved tool, people can reduce risk by building a repeatable routine.

- Recheck the forecast periodically rather than assuming one view is final

- Avoid making irreversible retirement decisions based solely on a single forecast number

- Keep records of any advice received and any forecast screenshots, so changes over time are easy to track

- If considering voluntary payments, document how many years are missing and the estimated impact on the weekly amount

The aim is not to panic. It is to replace assumptions with evidence, so retirement planning is based on an accurate picture.

How Much Could Someone Lose Because of the HMRC State Pension Error?

The money impact of the HMRC state pension error can range from modest confusion to a serious long-term reduction, depending on the person’s contracted-out history and whether they have gaps in qualifying years.

The reporting includes a case where a retiree was originally promised £185.15 a week, but later told she would receive £148.25 a week instead. That gap is significant.

It was described as nearly £2,000 a year over the course of retirement. The same coverage also notes the retiree paid nearly £5,000 in top-up contributions under protest, and later HMRC offered a refund of the difference plus £850 in compensation.

For context, the articles state that the full new state pension pays £230.25 a week at today’s rates, and that an individual needs 35 full years of qualifying National Insurance contributions to receive the full amount.

If a forecast wrongly suggests someone is already on course for the maximum, they may miss the chance to fill missing years.

Scenario What the forecast suggests What may happen at retirement Likely outcome

Contracted-out years are not reflected Full state pension without extra contributions Deduction applied for contracted out periods Lower weekly payment than expected

Updated forecast reflects the deduction Shortfall or lower estimate appears The user can consider topping up missing years Better ability to plan and act

Can Workers Top Up National Insurance Contributions to Fix the Shortfall?

Top ups are repeatedly highlighted as the main practical lever for people who discover gaps after rechecking their position. The forecast tool was created partly for this purpose, helping users see whether they are on course for the maximum payment and whether missing or incomplete years could be filled by making additional payments.

In the context of the HMRC state pension error, the concern is that some people may have been wrongly told they did not need to do this, which could leave them with fewer qualifying years than they expected.

Explanation of voluntary NI contributions

Voluntary National Insurance contributions are additional payments that can be made to fill missing or incomplete qualifying years on a person’s record. The basic idea is that by adding qualifying years, a person may increase their state pension entitlement, depending on their individual record and forecast.

The reporting focuses on voluntary payments as a remedy path for those who may have been affected by incorrect forecasts.

Cost Per Missing Year (Up to £907)

The articles cite a clear figure for the potential cost of filling a year. HMRC previously said it would allow those affected by the error to top up their National Insurance contributions by making lump sum payments of up to £907 per missing year.

That number is important because it frames the decision. A person is not only deciding whether to top up, but they are also deciding whether the long term increase in weekly pension is worth the upfront payment.

Eligibility Rules

The reporting does not provide a full rulebook, but it does make two practical points clear.

- People need a certain number of qualifying years, with 35 full years mentioned as the benchmark for the full new state pension

- The decision to top up is linked to what the record shows, meaning eligibility in practice starts with confirming whether years are missing or incomplete

Where the record shows a shortfall, the user can explore whether voluntary contributions are an available option in their circumstances.

When Top Ups Are Advisable?

Top-ups can be more relevant in a few situations highlighted by the coverage.

- If a person’s forecast changes after the system update and now shows they are not on course for the full amount

- If the record shows missing or incomplete years, and the user has time to take action before reaching state pension age

- If a person previously relied on an inflated forecast and now needs a route to increase weekly payments to remedy the shortfall

The key is timing. A person who discovers the issue earlier has more options than someone who discovers it right at retirement.

How to Calculate Potential Gains?

The simplest approach is to use the updated forecast tool and treat it as a before-and-after exercise.

- Note the current forecast weekly amount and whether it states the person is on course for the full new state pension

- Identify how many years are missing or incomplete on the record

- Consider how the forecast changes when additional qualifying years are added, where the tool provides that guidance

- Compare the potential increase over retirement against the stated cost per missing year, which the reporting puts at up to £907

This is also where people may wish to seek clarity from HMRC if the contracted-out history makes the numbers feel counterintuitive.

What Lessons Does the HMRC State Pension Error Offer About Retirement Planning?

The clearest lesson is that automated forecasts are helpful, but they are not a substitute for verification when a record contains complexity. Contracted-out history is a prime example. The reporting shows how a missing deduction in a tool can create years of false reassurance, even for people who actively check their forecasts.

Retirement planning is often built around a few anchor numbers, and if one of those numbers is wrong, the whole plan can drift off course.

Practical lessons include:

- Treat a state pension forecast as a planning aid, not a guarantee of final payment

- Recheck forecasts, especially after official system updates

- Focus on the National Insurance record, since qualifying years and gaps are the building blocks of entitlement

- Avoid life-changing decisions like retiring early based on a single forecast snapshot

The news coverage also highlights a human cost. A long dispute can damage confidence and peace of mind, even when corrections and refunds eventually arrive.

Conclusion

The HMRC state pension error shows how a widely used digital service can shape financial decisions on a national scale. When forecasts are inaccurate, the harm is not only the lower payment that may come later.

It is the lost time to act, the missed chance to top up missing years, and the retirement choices made on numbers that were too high. HMRC’s February 2024 update is designed to address this by ensuring that customers who reach state pension age after April 2029 receive a forecast that takes into account the years they were contracted out.

HMRC also acknowledged the user impact, saying, “We’re sorry for the problems that some people have experienced with the tool in the past.” For UK workers, the path forward is clear. Recheck forecasts, review records, and use the corrected information to plan with confidence.

FAQs

Who is most likely to be affected by the HMRC state pension error?

People who were contracted out and reach state pension age after April 2029 are highlighted as the key group. They may have previously seen forecasts that were too high.

Does the HMRC state pension error change how much state pension someone is already receiving?

The coverage focuses on forecast accuracy rather than recalculating all payments automatically. Actual pension payments are calculated when someone reaches retirement age.

Why did contracting out cause problems for the online forecast tool?

Contracting out can lead to a deduction at retirement for certain periods. The tool did not always reflect that deduction, which could inflate forecasts.

What should someone do if their forecast drops after the system update?

They should review their National Insurance record for missing or incomplete years. They can also contact HMRC for clarification on contracted-out years and deductions.

Can voluntary National Insurance payments help fix a shortfall linked to the error?

Yes, voluntary contributions can help fill missing years for some people. The reporting states HMRC referenced lump sum payments of up to £907 per missing year.

Why did it take so long to fix the issue after ministers were aware?

The reporting says ministers were first made aware in 2017, and fixes took years to implement. The tool required updates so contracted-out years were properly taken into account.

What is the full new state pension amount mentioned in the reports?

The articles cite £230.25 a week at today’s rates. They also state that 35 qualifying years are needed for the full amount.