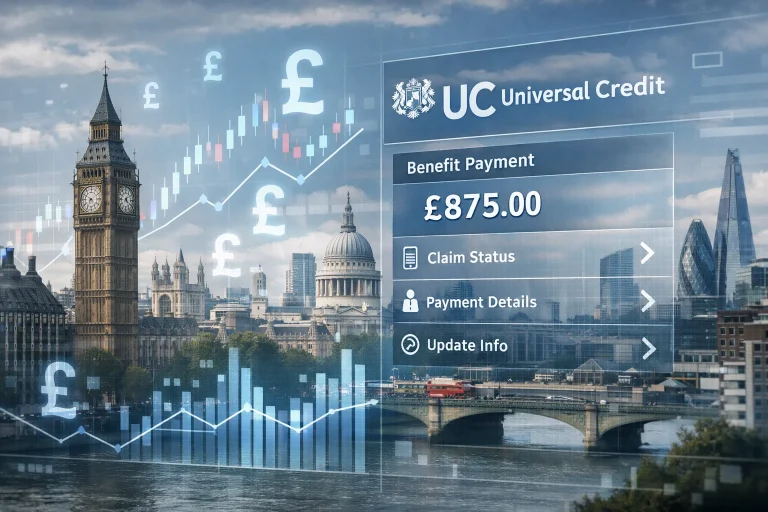

If you earn £1000 a month, your Universal Credit payment will likely be reduced, and in some cases, you may receive little to no support depending on your circumstances. The exact amount depends on several factors such as your standard allowance, housing support, children, disabilities, and whether you qualify for a work allowance.

Universal Credit is designed to support people on low incomes, but income over certain thresholds leads to deductions through the taper system.

Key Takeaways:

- For most, £1,000/month will significantly reduce or even nullify Universal Credit.

- A 55% taper rate applies to income above the work allowance.

- Those with housing costs, children or health issues may retain more support.

- Using a benefits calculator is essential to get your accurate figure.

- Housing, savings, and family status affect your Universal Credit entitlement.

What Is Universal Credit and Who Can Claim It in the UK?

Universal Credit is a financial support benefit provided by the UK government to individuals and families on a low income, those who are out of work, or people unable to work due to a disability or health condition.

It has replaced several legacy benefits including Housing Benefit, Income Support, and income-based Jobseeker’s Allowance (JSA).

To be eligible, you must be aged 18 or over (with some exceptions for 16 to 17-year-olds), live in the UK, and have savings under £16,000. You can apply whether you’re employed, unemployed, or self-employed.

If you live with a partner, you must apply jointly. Those over the State Pension age may not be eligible unless living with someone younger.

Students can claim Universal Credit in certain circumstances, such as if they have a child or a disability. EU, EEA or Swiss citizens may need settled status to claim. In short, Universal Credit is intended to be flexible and responsive, depending on each person’s situation.

How Do Your Monthly Earnings Affect Universal Credit Payments?

Your monthly earnings play a critical role in how much Universal Credit you receive. When you earn money, the Department for Work and Pensions (DWP) applies specific rules to determine how your income will reduce your payment.

Explanation of Taper Rate (55%)

The taper rate is a fixed percentage that determines how much of your Universal Credit is deducted when you earn over your Work Allowance.

As of 2025, for every £1 you earn above the Work Allowance threshold, 55p is deducted from your Universal Credit. This rule ensures a gradual reduction in benefits rather than a sudden stop.

For example, if your income exceeds the allowance by £500, then £275 (55% of £500) will be deducted from your overall payment. This system incentivises work, but can lead to significantly reduced payments for moderate earners.

How the Earnings Threshold Works?

Not everyone has a Work Allowance. You’ll only get it if:

- You’re responsible for a child, or

- You have a limited capability to work, and

- You either do or don’t get help with housing costs.

If you qualify, your monthly earnings threshold before deductions are:

- £393 if you get housing help

- £631 if you don’t get housing help

Income under these limits won’t reduce your UC. Anything above will be tapered at 55%.

Overview of What Happens at £1,000 Per Month Income

If you earn £1,000 a month, and you do not have a Work Allowance (for example, you’re a single adult with no children or health issues), then your full income is subject to the taper rate.

This means:

- 55% of £1,000 = £550 deduction

- If your standard allowance is £340.50, your entire Universal Credit may be cancelled out.

However, if you do qualify for Work Allowance, your deduction will be lower. For example, if your allowance is £393, only £607 of your income is tapered. That means your deduction would be £333.85 and you may still receive some support.

Your earnings affect UC on a month-by-month basis, making accurate reporting essential to avoid under or overpayments.

What Is the Work Allowance and Do You Qualify for It?

The Work Allowance is the amount you can earn before your Universal Credit is reduced. Whether you qualify depends on your household situation.

You may be eligible if:

- You have dependent children, or

- You are assessed as having limited capability for work, due to illness or disability.

If you’re eligible for Work Allowance, your Universal Credit won’t be affected until your earnings exceed the set threshold.

Work Allowance Thresholds (2025)

Condition Monthly Work Allowance

With housing costs £393

Without housing costs £631

If your earnings are below these thresholds, your UC isn’t reduced. If they’re above, only the amount over is subject to the 55% taper rate. The Work Allowance is crucial in determining how much Universal Credit you can keep while working. Make sure to check your eligibility based on your household setup.

How Does the Taper Rate Reduce Your Universal Credit?

Once your income exceeds the Work Allowance (or if you don’t qualify for one), the taper rate kicks in. This mechanism slowly reduces your Universal Credit as you earn more. Let’s break it down with a calculation. Suppose you’re a single adult over 25 with no children and no Work Allowance.

Example Deduction Table

Monthly Earnings Work Allowance Earnings Tapered UC Deduction (55%)

£1,000 £0 £1,000 £550

In this scenario, if your Standard Allowance is £400.14, your Universal Credit would be entirely cancelled out.

However, if you qualify for a £393 Work Allowance:

Monthly Earnings Work Allowance Earnings Tapered UC Deduction (55%)

£1,000 £393 £607 £333.85

That means you may still receive some payment if other components (like housing) apply. The taper ensures work always pays, but its impact is substantial at moderate incomes like £1,000.

What Are the Key Components of a Universal Credit Payment?

Universal Credit is made up of several parts, depending on your personal situation. These components are combined to create your total monthly payment.

Standard Allowance (age-based)

Everyone receives a base amount depending on age and whether they live alone or with a partner. As of April 2025:

- Single under 25: £316.98

- Single 25 and over: £400.14

- Couple under 25: £497.55 (joint)

- Couple over 25: £628.10 (joint)

This is the starting point of your entitlement.

Housing Element

This covers rent and eligible housing costs. The amount depends on:

- Where you live

- Your actual rent

- Local housing allowance limits

Homeowners may qualify for a loan for mortgage interest instead of a direct housing element.

Child Element

If you have children, you can receive extra amounts:

- First child (born before April 2017): £339

- First child (born after): £292.81

- Second child: £292.81 per child

Only the first two children are usually included unless exceptions apply.

Disability and Carer’s Element

If you or your child has a disability, or if you’re a carer, you may receive:

- Limited capability for work and work-related activity: £423.27

- Lower disability payment (older ESA claims): £158.76

- Carer element: £201.68 (if you care 35+ hours/week for a qualifying person)

These elements are stacked on top of the standard allowance to reflect the extra costs faced by households in complex situations.

Understanding what makes up your Universal Credit helps you calculate what you could get and how earnings affect it.

How Much Universal Credit Can You Expect if You Earn £1000 a Month?

If you earn £1000 per month, the amount of Universal Credit you receive will depend heavily on whether you qualify for a work allowance and what additional elements apply to your claim. Universal Credit is designed to reduce as your earnings increase, rather than stop completely, unless your income exceeds what would be payable.

Calculation Breakdown: Single Claimant, No Kids, With/without Housing Help

For a single claimant over 25 with no children and no housing support, the standard allowance is £400.14. Since this person doesn’t qualify for a work allowance, the full £1000 monthly income is subject to the 55% taper rate. That results in a deduction of £550 from their Universal Credit. In this case:

- Standard Allowance: £400.14

- Tapered Deduction: £550

- Universal Credit Received: £0

If you do qualify for a work allowance of £393 (for those with children or limited work capability), only the income above that is tapered.

For example:

- £1000 – £393 = £607 (subject to taper)

- 55% of £607 = £333.85

- Standard Allowance: £400.14

- Final UC: £400.14 – £333.85 = £66.29

Example Scenarios Based on Common Claimant Profiles

Scenario Income Work Allowance Taper Deduction Estimated UC

Single, 25+, no kids, no housing £1000 £0 £550 £0

Single, 25+, with child, no housing £1000 £631 £202.85 £197.29

Single, 25+, with housing support £1000 £393 £333.85 £66.29 + housing element

These figures are illustrative. To get your specific figure, use an official Universal Credit calculator based on your full circumstances.

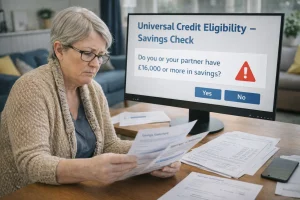

Will Savings or Capital Affect Your Universal Credit Eligibility?

Savings and capital significantly influence how much Universal Credit you can receive. If you have more than £6,000, your payment is reduced. Every £250 above this limit results in a £4.35 reduction from your Universal Credit each month. If your total savings or investments exceed £16,000, you will not be eligible to claim Universal Credit at all.

Savings considered include money in your bank accounts, premium bonds, shares, and even rental income from properties (excluding your main home). If you jointly claim with a partner, your combined capital is assessed. The DWP uses these figures to determine if you still qualify, and failing to report accurate savings can result in overpayments or penalties.

If you receive a large lump sum from redundancy, inheritance, or savings growth, you should immediately report this to avoid issues with your payments. The Universal Credit system is very strict about the savings threshold.

What If Your Circumstances Change While Claiming UC?

Your Universal Credit entitlement can shift dramatically if your circumstances change. You must report any changes as soon as they happen. This includes changes to your job, income, rent, household composition, savings, health, or whether you become a carer.

Failing to report changes can lead to overpayments, which you will need to repay, or underpayments that leave you short. Even if your circumstances change just after your assessment period ends, it can still affect your next payment.

If your income rises, for example, your Universal Credit may reduce or stop. If you lose a job or have increased childcare costs, your payment might go up. Keeping your claim updated ensures you get the right amount and avoid sanctions. Reporting changes is easily done through your Universal Credit online account.

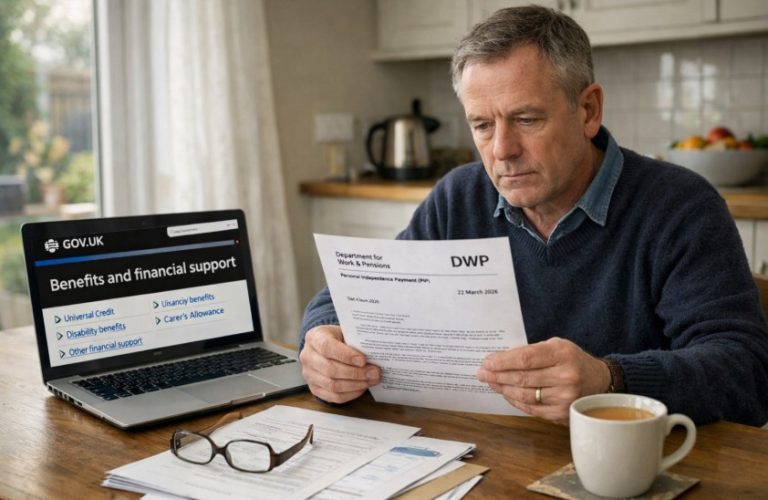

Where Can You Check Your Exact Universal Credit Amount?

Since Universal Credit depends on so many personal factors, the most accurate way to check how much you’ll receive if you earn £1000 a month is by using an online benefits calculator. These tools are approved and recommended by the UK government.

Overview of recommended benefit calculators:

- Citizens Advice – Offers detailed questions to guide you based on current UC rules.

These calculators assess your earnings, housing costs, savings, family size, health, and more. They can also help you plan for future changes in your circumstances.

Using these tools ensures your figures are accurate without needing to wait for a DWP response. They’re also confidential and updated regularly with the latest policy rules.

How Do You Apply for Universal Credit in the UK?

Applying for Universal Credit is straightforward and done online. Your claim begins the day you submit it. If you live with a partner, you must apply together and link your accounts. The process also includes identity checks and a claimant commitment agreement.

You’ll need the following information:

- Your National Insurance number

- Income and savings details

- Rent amount and housing situation

- Details of dependents or caring responsibilities

Application Process Overview

Step Action

1 Create an online UC account

2 Submit claim and provide evidence

3 Attend initial interview or phone meeting

4 Sign claimant commitment

5 Wait up to 5 weeks for your first payment

If you can’t apply online, phone support and the Help to Claim service from Citizens Advice are available.

What Other Support Can You Access Alongside Universal Credit?

Universal Credit is just one form of financial support. You may be eligible for other assistance based on your circumstances, helping you reduce financial stress.

Advance Payments

If you’re waiting for your first UC payment, you can apply for an advance. This is a loan deducted from future payments.

Help With Childcare Costs

UC covers up to 85% of childcare costs.

You can claim:

- £1,031.88 per month for one child

- £1,768.94 per month for two or more children

Council Tax Reduction

You may qualify for reduced council tax through your local authority. It’s separate from UC but often based on similar criteria.

Local Authority Hardship Funds

Councils offer discretionary hardship payments for rent arrears, emergency needs, or unexpected costs. These can supplement your UC. Taking advantage of additional support systems can significantly ease financial burdens while on Universal Credit.

Conclusion

If you earn £1000 a month, your Universal Credit could range from nothing to a partial payment, depending on your situation. Without a Work Allowance, most of your benefit may be reduced due to the taper rate.

However, families, those with disabilities, or housing needs may still receive meaningful support. The best way to find out exactly what you qualify for is by using an official benefit calculator and ensuring your personal details are up to date.

Universal Credit is tailored to your circumstances and changes monthly with your income. Always stay informed and proactive to make sure you’re getting the right help.

FAQs

Can I still receive Universal Credit if I work full-time and earn £1000?

Yes, but your payment will be reduced by the taper rate unless you qualify for a Work Allowance.

How often is Universal Credit paid in the UK?

Universal Credit is paid monthly, though people in Scotland can choose to receive it twice monthly.

Will my housing costs be covered if I earn £1000 a month?

Possibly. Your earnings reduce your housing element, but you may still receive partial help depending on your rent.

What happens if my earnings change each month?

Universal Credit is adjusted monthly during your assessment period to reflect your latest income.

How does Universal Credit work for self-employed people?

Self-employed earnings are assessed monthly. A minimum income floor may apply after a year in business.

What deductions can reduce my Universal Credit payment?

Repayments, previous benefit overpayments, council tax debts, and income all reduce your UC.

Can students claim Universal Credit if they earn £1000 a month?

Only if they meet special criteria like having a child or disability, and income will still affect the payment.