Morrisons’ refusal to offer a pay rise above the National Living Wage in 2026 has sparked major backlash from its employees, unions, and even customers. At the heart of the controversy is the supermarket’s claim that rising operational costs, largely driven by Labour’s tax changes, have made significant wage increases unaffordable.

Key Takeaways:

- Morrisons blames Rachel Reeves’ 2024 Budget and rising National Insurance for £200m in added costs.

- The company is offering only the legal minimum wage, triggering union outrage.

- Usdaw has initiated a strike ballot, and employees are calling out “tone-deaf” corporate messaging.

- Public backlash and customer boycotts are growing amid claims of unfair treatment.

What Triggered the Morrisons Pay Rise Dispute in 2026?

The pay dispute at Morrisons erupted following a company-wide announcement in early January 2026. In a formal email to employees, management declared that the supermarket would not offer a wage increase beyond the National Living Wage.

This decision coincided with news of the upcoming wage adjustment to £12.71 per hour for workers aged 21 and over, due in April.

The supermarket attributed its pay restraint to ongoing financial pressures, referencing a £200 million increase in operational costs. These include government-imposed tax changes, inflation, and competitive strain from budget rivals.

Morrisons’ management claimed the business had already invested heavily in staff pay in previous years, but further increases were no longer viable without jeopardising financial stability.

This announcement drew immediate criticism from the union Usdaw, representing over 45,000 employees, and set the stage for a conflict that could lead to strikes. For many, the issue went beyond numbers, it reflected a deeper disconnect between leadership and its workforce.

How Did Labour’s Budget and Tax Changes Affect Morrisons?

The financial pressure facing Morrisons in 2026 is closely linked to policy decisions made by the Labour government under Chancellor Rachel Reeves. These policies introduced a range of fiscal reforms aimed at funding public services, but they also had ripple effects on large employers like Morrisons.

Rachel Reeves’ October 2024 Budget highlights

Rachel Reeves’ first budget as Chancellor introduced measures that significantly impacted employers. The budget was framed as a step towards economic stability and social investment, but its consequences for businesses were immediate and substantial.

For Morrisons, the budget translated into a heavy financial burden, intensifying pressure on its already strained profit margins.

National Insurance Contributions (NICs) Hike and Lower Threshold

One of the most contentious elements was the rise in employers’ NICs, coupled with a reduction in the income threshold at which these contributions are paid.

This double hit forced companies to pay more for every employee, regardless of business size or revenue. According to internal estimates, this change alone contributed significantly to the £200 million in additional annual costs reported by Morrisons.

Plastic Packaging Tax and Operational Cost Pressures

Other operational expenses worsened the strain. The government’s continued enforcement of the plastic packaging tax led to rising costs across Morrisons’ supply chain.

When paired with inflation, cyberattack disruptions, and increased energy prices, the financial environment became highly volatile. The supermarket claimed it had no choice but to cut back on discretionary expenses, including staff pay increments.

Overall Cost Burden: £200 Million

By the end of 2025, the combined effects of tax changes and wage mandates had reportedly cost Morrisons an extra £200 million. Executives argued this wiped out any flexibility to offer pay increases beyond the statutory minimum, emphasising that profitability and long-term sustainability had to come first.

The budget’s impact was clear, but many argue that it became a convenient excuse for suppressing wages, especially when other retailers managed to do more.

Why Is Morrisons Only Offering the National Living Wage?

Morrisons insists its current pay policy is based on economic necessity, not corporate unwillingness. In internal communications, executives pointed out that the supermarket had already committed over £70 million to meet the National Living Wage increase to £12.71 in April 2026. The business is technically compliant with all legal wage obligations.

However, the retailer has made it clear that no further increase will be considered at this time. Management argued that offering pay above the legal minimum would be financially unsustainable given rising labour and operational costs.

They also highlighted the competitive pressures from discount supermarkets, noting that price-focused customers limit their ability to raise prices to offset wage hikes.

For employees and unions, this position is disappointing. Morrisons, once one of the highest-paying supermarkets in the UK, now aligns itself with the legal baseline, a stark contrast to its previous reputation for rewarding its workforce.

What Are Usdaw’s Claims in the Morrisons Pay Row?

Usdaw, the Union of Shop, Distributive and Allied Workers, has strongly criticised Morrisons’ decision, calling it a step backwards for workers’ rights in the retail sector. Representing around 45,000 Morrisons employees, the union argues that the retailer has failed to engage in meaningful negotiations regarding pay.

Union leaders say Morrisons’ flat offer is out of step with the economic realities faced by workers. With inflation still affecting household expenses, many employees feel that remaining at minimum wage erodes their quality of life.

Usdaw has accused the company of ignoring the efforts and dedication of its frontline staff, particularly those who remained committed through the pandemic and beyond.

The union has now launched a formal ballot, encouraging members to vote against the offer. If the ballot leads to strike action, Morrisons could become the first major UK supermarket to face coordinated industrial disruption over wages in years.

How Are Morrisons Employees Reacting to the Pay Dispute?

Employee reaction has been vocal, emotional, and highly critical of Morrisons’ stance. Internal emails leaked to Reddit sparked widespread commentary from workers who described the communications as out of touch.

One user mockingly quoted management’s defence of its pay freeze, saying, “Butttt please USDAW look at our costs,” followed by a laughing emoji.

Many employees feel the company’s explanation is disingenuous. One user wrote, “They are literally the worst paying retailer in the UK at this point.” Others pointed out the high turnover rate among new hires, with claims that over 90% of new starters quit before probation due to low pay and “toxic management.”

Some head office staff even expressed solidarity. “If I wouldn’t risk losing my job, I’d strike with you,” said one commenter. Another added, “They just squeeze every penny until they have no choice but to pay what the law demands.”

The general sentiment is that Morrisons’ leadership has lost touch with both its workforce and its responsibilities.

What Is the Public and Customer Sentiment?

Customer sentiment toward Morrisons has also taken a hit as news of the pay dispute spreads. Shoppers are voicing concerns about fairness, corporate responsibility, and how staff are treated.

- Many long-time customers have said they will no longer shop at Morrisons until fair wages are offered.

- Others have compared the store unfavourably to Aldi and Lidl, citing better prices and perceived ethical standards.

- Some believe industrial action will damage the brand, especially if store operations are disrupted.

A former loyal shopper wrote, “After 20 years as a Safeway and Morrisons customer, I now do my big shop at Lidl.” Another added, “They’re not even that cheap. People shop with their feet.”

These responses reflect growing frustration with large corporations that fail to support frontline workers, especially in sectors like retail where employees are essential to customer satisfaction.

Are Other Supermarkets Doing Better in Staff Pay?

As Morrisons aligns its base pay with the National Living Wage, questions have arisen about how it compares to other UK supermarkets. While specific figures vary depending on location and role, several competitors appear to be offering better compensation packages.

Contextual Comparison With Other UK Supermarket Wages (if Available)

Tesco and Sainsbury’s have both offered wages that slightly exceed the National Living Wage, especially in London and other high-cost areas. Aldi has often been praised for its generous pay rates and structured progression opportunities. Lidl, likewise, offers competitive starting pay and regular increases.

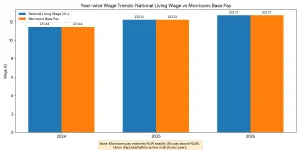

Year-wise Wage Trends vs National Wage

Year National Living Wage (21+) Morrisons Base Pay Pay Above NLW? Union Dispute?

2024 £11.44 £11.44 No Yes

2025 £12.21 £12.21 No Yes

2026 £12.71 £12.71 No Yes (Ballot)

This table shows a consistent pattern, Morrisons offers the bare minimum, while other retailers take proactive steps to remain competitive.

Competitive Strategies and Wage Positioning

Beyond base wages, competitors are also investing in employee wellbeing, training, and flexible working arrangements. These strategies not only improve retention but also enhance brand loyalty.

Morrisons, by contrast, has been accused of making unilateral changes to contracts and shifting staff across departments without consent, as evidenced by Reddit discussions.

These practices have created a perception that Morrisons prioritises profits over people, a reputation that may be hard to shake without structural changes.

Will This Dispute Lead to Industrial Action?

With Usdaw already initiating a ballot and staff frustration at boiling point, there is a strong possibility of industrial action. Employees and union leaders have made it clear that if Morrisons continues to resist offering an above-minimum pay rise, strikes will follow.

This would mark a historic moment in UK retail. While industrial action has been more common in sectors like transport and healthcare, it’s rare in supermarkets. A successful strike could have knock-on effects across the industry, pushing other employers to reconsider their own pay strategies.

Ultimately, how Morrisons responds to the ballot will determine whether the company can resolve this conflict through dialogue or face prolonged unrest.

Could Morrisons’ Ownership Structure Be Fueling the Crisis?

One significant factor in this pay dispute is the change in Morrisons’ ownership. Once a family-run business, Morrisons is now under private equity control. According to union officials and employees alike, this shift has led to a focus on short-term profitability at the expense of long-term workforce investment.

Usdaw’s national officer Darren Matthews questioned whether this ownership model is responsible for the supermarket’s reluctance to improve wages. He argued that corporate goals now prioritise returns for investors over staff wellbeing.

Employees on Reddit echoed this view, suggesting that the private equity owners are “squeezing every penny” and treating staff as disposable. This sentiment, coupled with flat pay and rigid management practices, is creating a volatile environment that could further damage company morale and public perception.

What’s Next for Morrisons and Its Workers?

As the pay row intensifies, several outcomes are possible depending on Morrisons’ next steps and the union ballot results.

- If the company reopens negotiations with Usdaw and offers even a modest raise above NLW, tensions may ease.

- Should the ballot pass, Morrisons will likely face a series of strikes that disrupt operations and drive away customers.

- The company might also face long-term reputational damage, especially if customer boycotts continue.

To rebuild trust, Morrisons would need to offer transparent communication, fair pay reviews, and better internal policies. The ball is firmly in management’s court, and their next move will set the tone for employee relations moving forward.

Conclusion

The Morrisons pay rise controversy is more than just a debate over numbers , it’s a test of corporate responsibility, government policy, and labour solidarity. The company’s reliance on Labour’s budget as justification for stagnant wages may be financially sound, but it has alienated both employees and customers.

Usdaw’s demands for fair treatment and meaningful dialogue reflect a broader trend in the retail industry, where frontline workers are increasingly unwilling to settle for the minimum. As the strike ballot approaches, Morrisons faces a choice: evolve its wage policy or risk a crisis of trust that could redefine its position in UK retail.

The coming weeks will reveal whether the supermarket chooses compromise or confrontation. Either way, the outcome will be closely watched by employers and workers alike.

FAQs About Morrisons Pay Rise Controversy

What prompted the Morrisons pay rise controversy in early 2026?

Morrisons’ refusal to offer a wage increase beyond the National Living Wage triggered backlash from employees and unions. The company cited government tax changes and rising costs as reasons.

How much has Morrisons’ costs increased due to government policies?

According to Morrisons, Labour’s budget changes, including increased employer National Insurance and wage hikes, added £200 million in extra annual costs.

What is Usdaw’s role in the Morrisons pay dispute?

Usdaw represents 45,000 staff and is advocating for better pay. They launched a ballot after failed negotiations and may proceed with strike action.

Why are staff calling Morrisons “tone-deaf”?

Employees criticised internal emails as dismissive of their concerns. Many feel management is out of touch with frontline realities and staff welfare.

How does Morrisons’ pay compare with other UK supermarkets?

Morrisons offers the legal minimum wage, while some competitors pay slightly above it. Others also provide better conditions and growth opportunities.

Are customers reacting to Morrisons’ pay policies?

Yes, some long-time customers are boycotting the supermarket. There’s growing concern about ethics, especially with industrial action on the horizon.

What happens next if the strike vote passes?

If the majority support a strike, Morrisons could face its first widespread industrial action in years. This may lead to store disruptions and reputational damage.