When you’re self-employed in the UK, understanding which expenses you can claim is crucial for staying tax-efficient and compliant with HMRC rules. Whether you’re a sole trader or in a business partnership, knowing what costs reduce your taxable profit can make a real difference to your financial bottom line.

Many self-employed professionals overpay tax simply because they aren’t aware of what’s deductible. From home office costs to travel, advertising, and even training, the range of allowable expenses is broad, but it’s important to follow specific rules.

In this guide, you’ll learn exactly what expenses you can claim as self employed, how to calculate them, and how to make sure you’re staying on the right side of HMRC. Whether you’re just starting out or optimising your next tax return, this guide is your complete reference.

What Are Allowable Business Expenses for the Self Employed?

As a self-employed individual, allowable business expenses are costs that you can deduct from your income to work out your taxable profit.

This means you only pay Income Tax on the profit left after deducting your eligible business-related costs. The goal is to reduce your tax bill fairly, based on what it actually costs you to run your business.

Allowable expenses cover a broad range of spending, including office supplies, rent, travel, marketing, and professional services. For example, if your turnover is £50,000 and you incur £12,000 in allowable expenses, you’ll only be taxed on £38,000.

It’s important to remember that only expenses that are “wholly and exclusively” for business purposes qualify. HMRC does not allow deductions for personal costs, even if they’re mixed with business activities.

Limited companies follow different rules, so this guide is specific to sole traders and individuals in partnerships. Understanding allowable expenses helps ensure you’re not overpaying tax and keeps your finances accurate and transparent in the eyes of HMRC.

Can I Claim Expenses If I Work From Home?

If you work from home, you’re entitled to claim a proportion of your home expenses as business costs. This can include rent or mortgage interest, council tax, electricity, heating, telephone and broadband. There are two main ways to calculate your work-from-home expenses.

Actual Cost Method

- Divide your annual costs by the number of rooms used for business.

- Further divide by how much time is spent working.

Example: If you have four rooms and one is used solely as an office, and your electricity bill is £1,200, you can claim £300. If you work from home 3 days a week, the claimable amount is £128.57.

Simplified Expenses Method

Use HMRC’s flat rate system based on monthly hours worked:

-

- 25–50 hours/month: £10

- 51–100 hours/month: £18

- 101+ hours/month: £26

Multiply the monthly flat rate by the number of months you worked from home.

Using the simplified method makes calculations easier but may offer a smaller claim. Whichever method you choose, keep records and apply the most consistent method throughout the tax year. This ensures your deductions are fair and justifiable if HMRC requests evidence.

What Travel and Vehicle Costs Can Be Claimed?

You can claim travel and vehicle costs, but only when they’re directly related to business activities. This includes visiting clients, suppliers, or travelling to work sites.

Eligible costs include:

- Fuel and oil

- Insurance

- Repairs and servicing

- Vehicle tax and MOT

- Parking fees (excluding fines)

- Breakdown cover

- Train, bus, air and taxi fares

- Hotel stays and meals on overnight trips

You can choose between claiming actual vehicle costs or using simplified mileage rates.

For cars and vans, HMRC allows:

- 45p per mile for the first 10,000 business miles

- 25p per mile thereafter

- 24p per mile for motorcycles

You cannot claim for travel between home and a regular place of work, nor for any private use. Fines and penalties are also excluded.

If you buy a vehicle outright, you may be able to claim it as a capital allowance if you use traditional accounting. For those using cash basis accounting, car purchases can still qualify for capital allowances if you don’t use mileage rates.

Which Office Costs and Equipment Are Deductible?

Office costs are a common category of allowable expenses and include both short-term consumables and long-term investments in tools or equipment.

Claimable items include:

- Stationery and postage

- Printer ink, paper, envelopes

- Telephone and mobile costs (business usage only)

- Internet services

- Rent for office space

- Light, heating and water bills (if working from home)

- Computer software subscriptions (if under two years or regularly renewed)

If you buy equipment like laptops or printers that are expected to last more than two years, the method of claiming depends on your accounting style.

Under traditional accounting, you’ll claim capital allowances. If using the cash basis, these can be claimed as standard expenses.

You cannot claim for personal use or any equipment used for non-business purposes. For example, a home printer used mostly for family purposes won’t qualify.

Ensure all software and tech tools are business-related and maintain digital or paper records of purchases. This clarity will help avoid issues in case of an HMRC audit.

Can I Claim Clothing or Uniforms?

When it comes to clothing, you can only claim items that are strictly necessary for your job and not suitable for everyday use.

This includes:

- Protective clothing like steel-toe boots or high-visibility jackets

- Uniforms that display a company logo or are required for work

- Costumes for performers, such as actors or entertainers

You cannot claim for regular clothes, even if you only wear them to work. For example, suits, business casual wear, or shoes are not allowable expenses under HMRC guidelines, even if they’re worn solely during business hours.

Your clothing must serve a specific functional or branding purpose to be deductible. If your work involves manual labour or specific safety requirements, clothing that protects you on the job will usually qualify.

Keep receipts and records of these purchases, along with a note explaining their role in your business. If there’s ever a question from HMRC, having this documentation in place supports your claim and helps avoid unnecessary disputes.

Are Staff Costs and Subcontractors Expenses I Can Claim?

You can claim a wide range of staff-related expenses if you hire employees or subcontractors as part of running your business.

These include:

- Wages or salaries

- Bonuses and commission payments

- Employer National Insurance contributions

- Pension contributions

- Agency fees

- Costs of hiring freelancers or subcontractors

- Relevant staff training and development

It’s essential that all staff-related expenses are directly connected to your business operations. For example, hiring a virtual assistant, website developer or part-time bookkeeper would count as allowable costs if they’re supporting your commercial activity.

However, you cannot claim for carers, domestic staff like nannies, or anyone providing personal services. Additionally, training must support your current business role rather than prepare you for a new business venture.

Ensure you maintain clear contracts, invoices, and payment records for all staff and subcontractor expenses.

HMRC may ask for proof to verify that these services were delivered and were necessary for your business. Proper documentation ensures smooth claims and reduces the risk of audit issues.

What Marketing and Advertising Costs Are Allowable?

Marketing and advertising play a crucial role in business growth, and many of these costs are considered allowable for self-employed individuals.

Eligible expenses include:

- Advertising in newspapers, magazines, or directories

- Website development and hosting

- Pay-per-click advertising

- Social media promotions

- Printed materials like flyers or business cards

- Free samples to customers

Subscriptions to trade publications and membership fees for professional organisations can also be claimed if they relate directly to your industry.

However, costs associated with entertaining clients, customers, or suppliers are not deductible. This includes meals, hospitality events, or gifting beyond small promotional items.

Always ensure your marketing activity is directly linked to generating business income. For example, a website showcasing your services or a paid campaign to attract leads would qualify.

Keep a record of marketing invoices and payments, especially for long-term contracts with advertising firms. These expenses can significantly reduce your taxable profit and support your business’s visibility simultaneously.

Can I Claim Financial and Legal Expenses?

Financial and legal expenses are often overlooked, but many are fully deductible if they are for business purposes.

You can claim:

- Accountant or bookkeeper fees

- Business-related solicitor, architect, or surveyor charges

- Bank, credit card, or overdraft fees

- Leasing or hire purchase interest

- Interest on business loans

- Professional indemnity and public liability insurance

- Alternative finance arrangements like Islamic Finance

However, legal fees connected to buying property or equipment must be claimed as capital allowances under traditional accounting. Likewise, fines, penalties, or legal costs related to breaking the law are not allowable.

Also excluded is the cost of filing your Self Assessment tax return, though you can claim the accounting support if it relates to business calculations.

Keep detailed invoices and receipts for all professional services and financial fees. Being able to prove the business nature of these expenses is key if you’re ever queried by HMRC.

Correct categorisation of these costs in your records helps ensure accurate claims and avoids any penalties.

What Counts as Reselling, Stock and Raw Materials?

If your business involves selling physical products, you can claim the costs of goods you buy to resell or that are used in producing those goods.

These include:

- Stock for resale

- Raw materials or components

- Packaging directly linked to products

- Direct production costs (like outsourced assembly)

These expenses must be wholly for business use. For example, if you’re an online retailer buying inventory to sell on platforms like Etsy or Amazon, the purchase cost of those items qualifies as an allowable expense. Likewise, if you’re a manufacturer, raw materials used in production count too.

However, you cannot claim for goods or materials used for personal reasons. Additionally, you cannot deduct depreciation of equipment or stock used beyond its expected business purpose.

Tracking these costs throughout the year is essential. Maintaining clear purchase receipts, invoices, and supplier details ensures accuracy when completing your Self Assessment. Claiming these properly reduces your taxable profit and gives you a clearer picture of your business profitability.

Can I Claim Training and Courses as a Business Expense?

Training courses are a valuable way to maintain and improve your business skills, and many of them qualify as allowable expenses.

HMRC allows deductions for courses that help you:

- Improve skills currently used in your business

- Stay up to date with industry practices or legal changes

- Learn relevant administrative or technology-related skills

For example, if you’re a freelance marketer taking a course on SEO updates or a dog trainer attending a behaviour workshop, you can claim the cost of that training.

However, you cannot claim for training intended to help you start a new business or change career direction. For instance, a virtual assistant who takes a wedding photography course cannot deduct the cost if it’s unrelated to their current trade.

To support your claim, keep course enrolment receipts and documentation showing how the training supports your existing business. If you’re ever unsure whether a course is claimable, refer to HMRC’s guidance or speak to a qualified accountant for clarity.

What Is the Difference Between Allowable Expenses and Capital Allowances?

Understanding the difference between allowable expenses and capital allowances is essential for proper expense claims.

Allowable expenses are day-to-day costs you incur while running your business, like utilities, phone bills, stationery, and travel. These are claimed in full during the tax year they occur.

Capital allowances, on the other hand, apply to assets that provide long-term value. These include business vehicles, equipment, and machinery expected to be used over several years. Instead of deducting the full cost immediately, capital allowances let you spread the deduction over time.

The accounting method you use affects how you claim:

| Accounting Method | Allowable Expenses | Capital Allowances |

| Traditional (Accrual) | Consumables, rent, utilities | Equipment, vehicles, machinery |

| Cash Basis | Most expenses claimed as-is | Vehicles only (if not using mileage rate) |

Remember, you cannot claim both capital allowance and an allowable expense on the same item. Accurate record-keeping and selecting the right method ensures your tax return is compliant and you receive the correct tax relief.

How Do I Calculate and Claim My Self Employed Expenses?

Calculating and claiming self-employed expenses requires careful record-keeping throughout the tax year. Whether you use traditional or cash basis accounting, you must record every eligible cost accurately.

Start by saving receipts, invoices, and bank statements for each business-related transaction. Categorise these according to HMRC’s allowable expense categories, such as travel, office costs, or stock. This makes year-end calculations smoother.

At the end of the tax year, add up your allowable expenses and subtract the total from your business income to calculate your taxable profit. Report this figure on your Self Assessment tax return.

You can also choose simplified expenses for things like mileage or home office use to reduce admin. Accounting software like Xero or FreeAgent can automate expense tracking, flag deductible items, and generate reports for filing. These tools also align with HMRC’s Making Tax Digital initiative.

Keeping accurate records not only simplifies filing but ensures you claim all you’re entitled to, helping you pay the right amount of tax and avoid issues during HMRC checks.

What Happens If I Use Something for Both Business and Personal Use?

When an expense has both business and personal use, HMRC only allows you to claim the business portion. You must calculate the split fairly and be able to justify it with a reasonable method.

For example, if your annual mobile phone bill is £240 and you use 60 percent of it for work, you can claim £144 as an allowable expense. The remaining 40 percent for personal use must be excluded. A common way to calculate shared usage is by time spent or space used.

Here’s a quick example:

| Expense Type | Total Annual Cost | Business Use (%) | Claimable Amount |

| Broadband Bill | £360 | 50% | £180 |

| Mobile Bill | £240 | 60% | £144 |

If you work from home, calculate by number of rooms and hours used. If you use a vehicle for both personal and work trips, track your business mileage.

Accurate records of how you divided the usage, including logs or calculations, are essential. This not only ensures your expense claim is correct, but also protects you in case of HMRC queries.

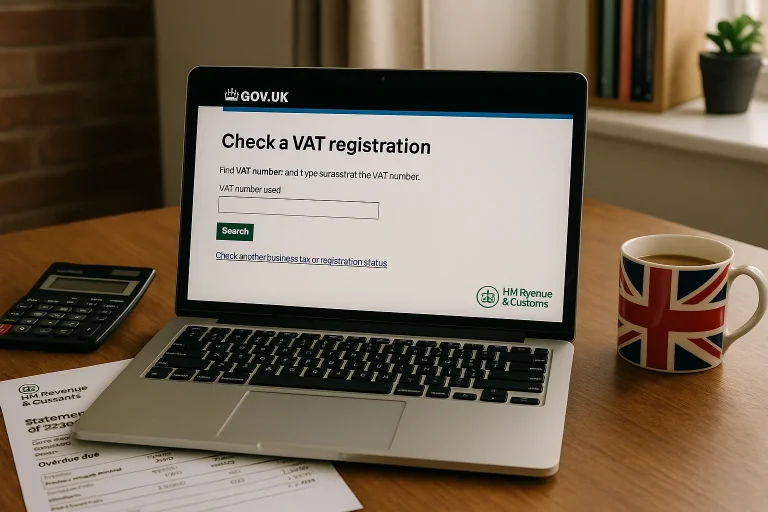

Do I Need to Keep Receipts and Proof for HMRC?

Yes, HMRC requires you to keep accurate records of your business expenses. While you don’t need to submit receipts with your tax return, you must retain them in case of a future inspection or audit.

You should keep all invoices, bank statements, mileage logs, and receipts related to your business transactions. These records need to be kept for at least five years after the 31 January submission deadline of the relevant tax year.

You can store records digitally using accounting software, apps, or cloud storage, which helps reduce paperwork and aligns with the Making Tax Digital regulations. Some tools also categorise expenses automatically, saving time at year-end.

If your records are incomplete or inaccurate, HMRC can disallow expense claims and issue penalties. Keeping organised records not only ensures smoother Self Assessment filings but also builds credibility and trust in your business.

Make it a regular habit to review and back up your financial documents so you stay compliant and ready if asked to provide evidence.

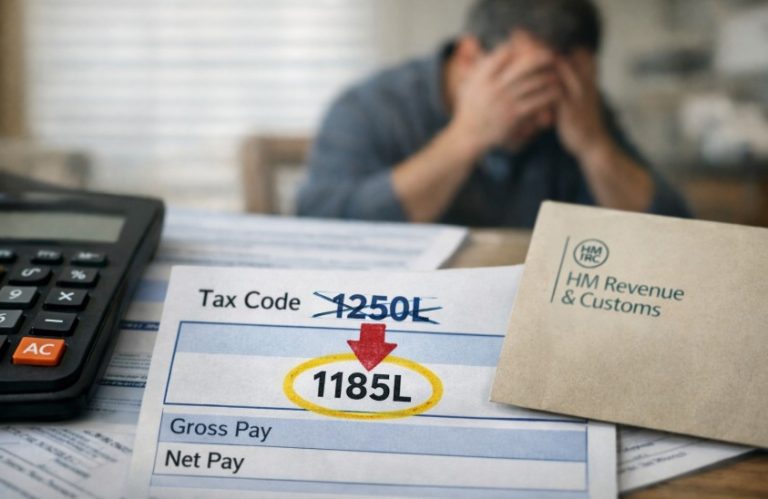

What Happens If I Overclaim or Make a Mistake?

Overclaiming or incorrectly reporting business expenses can lead to serious consequences, including fines, interest, or HMRC investigations. Mistakes may be genuine, but they still need to be corrected.

If you realise you’ve made an error, it’s best to amend your Self Assessment as soon as possible. You can do this online within 12 months of the original submission deadline. For example, for the 2023-24 tax year, you have until 31 January 2026 to make changes.

Honest mistakes are treated more leniently than deliberate fraud. If HMRC believes you’ve intentionally overclaimed to reduce your tax liability, they may investigate and apply penalties of up to 100% of the tax owed.

To avoid errors, use reliable accounting software and keep up-to-date records. If you’re unsure about an expense, consult a qualified accountant or check HMRC’s official guidance.

Taking time to check and understand your claims helps protect your business from unnecessary stress and financial setbacks. Accuracy and transparency are key when dealing with tax responsibilities.

Conclusion

Understanding what expenses you can claim as self employed gives you a powerful advantage when it comes to managing your finances and reducing your tax bill.

From claiming for home office use to travel, marketing, and training, knowing what’s allowable helps you stay compliant and in control of your business expenses.

Whether you choose simplified expenses or detailed calculations, the key is consistency, accuracy, and proper record-keeping. Using tools like accounting software or consulting a professional can make the process smoother and more efficient.

HMRC allows a broad range of claims, but also expects full transparency and justification. Always keep evidence and be prepared to explain how each cost supports your business. Done correctly, expense claims help you keep more of your profit while staying on the right side of the law.

FAQs

Can I claim food and drink as a business expense?

You can claim meals during overnight business trips, but not for day-to-day meals or entertaining clients.

What’s the easiest way to calculate self-employed expenses?

Use simplified expenses where possible, or accounting software to track and categorise actual costs.

Can I claim for a car used for both personal and business use?

Yes, but you must only claim the business portion, either by using mileage rates or splitting actual costs.

Is insurance for my business deductible?

Yes, business-related insurance policies like public liability and professional indemnity are fully allowable.

Can I deduct the cost of my phone bill?

Only the business portion of your phone bill can be claimed. You must divide personal and business usage fairly.

Are software subscriptions deductible?

Yes, subscriptions for business-related software are deductible if they support daily operations or services.

Can I claim training for a new business idea?

No, training must relate to your current business. Courses for new ventures are not considered allowable.

{

“@context”: “http://schema.org/”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Can I claim food and drink as a business expense?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “You can claim meals during overnight business trips, but not for day-to-day meals or entertaining clients.”

}

},

{

“@type”: “Question”,

“name”: “What’s the easiest way to calculate self-employed expenses?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Use simplified expenses where possible, or accounting software to track and categorise actual costs.”

}

},

{

“@type”: “Question”,

“name”: “Can I claim for a car used for both personal and business use?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, but you must only claim the business portion, either by using mileage rates or splitting actual costs.”

}

},

{

“@type”: “Question”,

“name”: “Is insurance for my business deductible?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, business-related insurance policies like public liability and professional indemnity are fully allowable.”

}

},

{

“@type”: “Question”,

“name”: “Can I deduct the cost of my phone bill?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Only the business portion of your phone bill can be claimed. You must divide personal and business usage fairly.”

}

},

{

“@type”: “Question”,

“name”: “Are software subscriptions deductible?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, subscriptions for business-related software are deductible if they support daily operations or services.”

}

},

{

“@type”: “Question”,

“name”: “Can I claim training for a new business idea?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “No, training must relate to your current business. Courses for new ventures are not considered allowable.”

}

}

]

}