Yes, I generally have to declare my pension lump sum in the UK, especially when any part of it is taxable. While up to 25% of my pension is usually tax-free, capped at £268,275, anything above that amount counts as income and must be declared to HMRC.

My pension provider will usually deduct tax before paying me, but I still need to make sure it’s reported correctly and that it doesn’t affect any benefits I claim.

Key points to remember:

- 25% tax-free lump sum (up to £268,275 cap)

- Remaining pension income is taxable

- Self-assessment may be required

- Tax can affect benefits eligibility

- Responsibility lies with me to ensure proper reporting

Why Are Pension Lump Sums Taxed in the UK?

Pension lump sums are taxed in the UK because pensions receive favourable tax treatment during the contribution phase. When I pay into my pension, those contributions usually benefit from tax relief either directly from my salary or claimed by my provider. Since I’ve received those benefits upfront, the government recovers tax when I start withdrawing my pension in retirement.

To maintain fairness, only a portion of my pension pot is allowed as tax-free; the rest is treated as taxable income. This structure prevents pensions from becoming tools for tax avoidance and ensures they’re used to provide a sustainable income during retirement.

It’s important to understand that once I begin withdrawing from my pension, the taxable portion is added to my income for the year and assessed using normal income tax bands. So, even though my provider may handle tax deductions through PAYE, I must be sure the correct rates and thresholds are being applied based on my total annual income.

What Is the Tax-Free Pension Lump Sum Limit?

In the UK, I can usually take up to 25% of my pension pot as a tax-free lump sum, up to a maximum of £268,275, known as the Lump Sum Allowance (LSA).

This limit applies across all my pension schemes combined, not per pension. If my 25% entitlement exceeds this cap, only £268,275 is tax-free, and the rest is taxed as income.

For example, if I have a pension pot worth £240,000, I can withdraw £60,000 tax-free under the 25% rule. However, if my total pension pot is £1.5 million, the 25% would equal £375,000, but I’m only allowed to take £268,275 tax-free due to the Lump Sum Allowance cap. The remaining £106,725 becomes taxable income.

Here’s how it breaks down:

| Pension Pot Value | 25% Calculation | Tax-Free Amount | Taxable Amount |

|---|---|---|---|

| £80,000 | £20,000 | £20,000 | £60,000 |

| £250,000 | £62,500 | £62,500 | £187,500 |

| £1,200,000 | £300,000 | £268,275 | £931,725 |

This limit was introduced in April 2024 after the Lifetime Allowance was abolished. Some older pensions may still benefit from protected tax-free amounts under historical arrangements. It’s essential I speak to my pension provider to check how much of my tax-free allowance I’ve already used across all schemes.

When Must I Declare My Pension Lump Sum to HMRC?

Even when tax is deducted by my pension provider, I may still be required to declare my pension lump sum to HMRC. This depends on the amount I’ve withdrawn, how it’s taxed, and whether I already complete a Self Assessment return.

Situations Where I Must Declare My Lump Sum

I need to declare my lump sum to HMRC when:

- The withdrawal exceeds my tax-free allowance of £268,275.

- My total income for the tax year enters a higher income tax band.

- I have other income streams such as rental income, dividends, or employment.

- HMRC does not have complete information on my tax situation.

- I want to claim a refund because too much tax was deducted (e.g. emergency tax).

If I’m receiving small lump sums from different pensions, I also need to consider the cumulative impact on my total annual income.

What My Pension Provider Handles vs What I Must Ensure?

My pension provider usually applies PAYE and deducts Income Tax before sending me the lump sum. They also report this to HMRC. However, they do not have full visibility of my other sources of income. That means:

- It’s my duty to ensure the correct tax code was applied.

- I must verify whether the provider used an emergency tax code.

- I must keep records of how much of my lump sum has been withdrawn tax-free vs taxed.

If I don’t stay on top of this, I might underpay or overpay tax, both situations I want to avoid.

When PAYE Is Enough and When Self Assessment Applies?

If I have no other income and my provider deducts tax accurately, I might not need to do anything further.

But in cases where:

- I receive multiple pension payments,

- My tax code is incorrect,

- Or I cross into a higher tax bracket,

Then I must submit a Self Assessment tax return to declare my total income correctly. Ultimately, even with PAYE in place, HMRC expects me to make sure everything lines up.

Example:

In my case, when I took a £40,000 lump sum from a personal pension, £10,000 was tax-free, and the rest was taxed at emergency tax rates.

HMRC hadn’t received all my income data yet, so I ended up filing a Self Assessment to claim a refund of overpaid tax. It reminded me that even if tax is deducted at source, checking for accuracy is still my responsibility.

Do I Always Have to Use Self Assessment for Pension Lump Sums?

Not always, but in many cases, completing a Self Assessment tax return becomes necessary when I take a pension lump sum. It depends on the complexity of my tax affairs and how the lump sum affects my total income.

When am I’m Required to Use Self Assessment?

I must register for and file a Self Assessment return if:

- I have total income above £100,000 (from all sources including pensions).

- I receive multiple pension lump sums in the same tax year.

- HMRC sends me a notice to file based on other income.

- I’m self-employed or receive rental income.

- I want to claim back tax that was over-deducted.

Even if my provider deducted tax, that doesn’t always mean it’s the correct amount. Large lump sums may lead to unexpected tax bills or refunds, both of which require me to report through Self Assessment.

How I Can Check If My Lump Sum Has Been Reported?

I should check:

- My HMRC Personal Tax Account to see how much income has been logged.

- My P60 or pension payslip to see tax deductions applied.

- My tax code, which should reflect my current income situation.

If these documents show discrepancies, I may need to contact HMRC or complete Self Assessment to correct it.

Automatic HMRC Reporting vs My Manual Responsibilities

Although my pension provider submits Real Time Information (RTI) to HMRC, it’s not always perfect.

HMRC may receive the figures but still miscalculate if:

- The emergency tax code was used.

- My income fluctuates across the year.

- I take several lump sums at different times.

That’s why I must still manually verify that everything adds up. If I overpay, I can claim a refund using forms like P55, P53Z, or through Self Assessment. If I underpay, declaring voluntarily helps me avoid penalties.

How Are Pension Lump Sums Taxed in Practice?

When I take a pension lump sum, the tax treatment depends on the amount, timing, and method of withdrawal. It’s not just about what I receive, but also how it fits into my total income for the year.

How the Tax-Free and Taxable Portions Are Calculated?

Normally, I can take 25% of my pension pot tax-free. The remaining 75% is taxable and treated like any other income. So, if I withdraw £100,000, the first £25,000 is tax-free, and £75,000 is taxed at my income tax rate.

It’s important to remember that if I’ve already used part of my Lump Sum Allowance elsewhere, less of this amount will be tax-free.

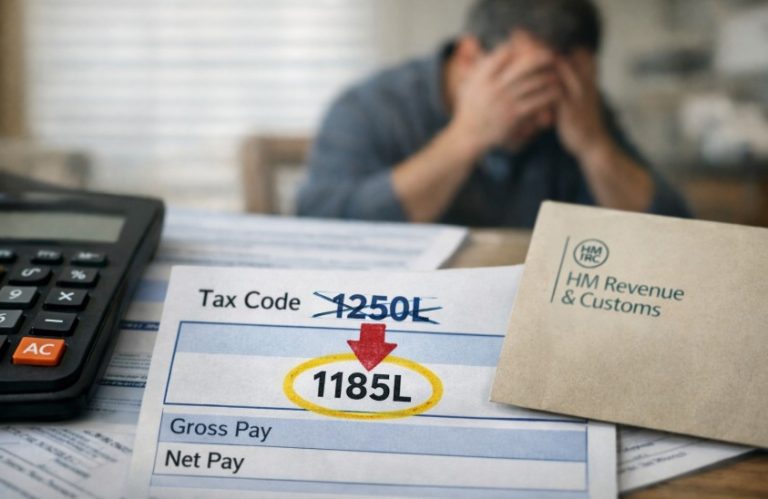

Why Emergency Tax Codes Often Apply?

When I take my first pension withdrawal, my provider might use an emergency tax code, assuming I will receive that amount every month. This can lead to an overpayment. I may end up paying 40% tax even if I’m a basic rate taxpayer.

To resolve this:

- I can wait for HMRC to adjust it automatically.

- Or I can file form P55 (for drawdowns) or P53Z (for full withdrawals) to claim a refund sooner.

How It Affects My Tax Band and Total Liability?

The taxable portion of my lump sum is added to all my other income. If that pushes me above:

- £50,270, I start paying 40% tax on income above that.

- £125,140, I may be subject to the 45% additional rate.

This makes timing crucial. I may decide to:

- Split lump sums over two tax years.

- Reduce other income in the same year.

- Use ISAs and other tax-efficient tools to manage my brackets.

Without proper planning, a large pension lump sum could leave me with an unexpected tax bill at year-end.

Do Small Pension Pots and Trivial Commutation Need to Be Declared?

If my total pension pot is valued at £30,000 or less, I may be able to take it as a trivial commutation lump sum, or under the small pot rules, without triggering standard pension withdrawal rules. In such cases, 25% is tax-free, and the rest is subject to Income Tax.

For personal pensions, I can take up to three pots of £10,000 or less. For workplace pensions, there’s no limit to how many small pots I can access under the same condition. Even though tax is usually deducted through PAYE, I may need to use form P53 if too much tax was withheld.

Whether or not I must declare the withdrawal to HMRC depends on my overall income, and if tax was over or underpaid. Even small pots can affect means-tested benefits, so I must be mindful and report to DWP if required.

Example to add:

A neighbour took a £9,500 pension pot under the small pots rule. She didn’t realise the 25% tax-free amount applied, and that the provider would automatically deduct tax. Since her total income was below the Personal Allowance, she submitted form P53 and got a refund for the overpaid tax.

Can Taking a Pension Lump Sum Affect My Benefits?

Yes, withdrawing a pension lump sum can significantly affect my entitlement to means-tested benefits. When I take a lump sum, the Department for Work and Pensions (DWP) may treat it as either income or capital, depending on my age and circumstances.

If I’m above State Pension age, both my accessible pension income and any actual withdrawals can be treated as notional income, potentially reducing benefits like Pension Credit or Housing Benefit. If I take out a lump sum and spend it quickly, DWP could still treat it as part of my capital and question whether I spent it to gain more benefits.

For those under State Pension age, only the amount I physically withdraw is considered as capital or income. Regardless of age, I must inform the DWP about any lump sum withdrawal, or I risk overpayment, penalties, or reassessment. Careful planning ensures I stay within the benefit eligibility rules.

What Are My Options for Withdrawing a Pension?

When it comes to accessing my pension pot, I have several flexible options, each with different tax and planning implications. The way I choose to withdraw my pension can influence how much tax I pay and whether my income remains sustainable in retirement.

Here are the common withdrawal methods available:

- Take the whole pot in one go – 25% is tax-free, the rest is taxable.

- Take smaller lump sums as needed – each time, 25% is tax-free and the rest is taxed.

- Buy an annuity – I get a regular guaranteed income for life; I can take 25% as a tax-free lump sum before buying it.

- Use income drawdown – I leave the money invested and withdraw amounts when needed.

- Combine options – e.g. take part as a lump sum and use the rest for drawdown or annuity.

The best option depends on my goals, tax band, and whether I need steady income or flexibility over time.

Should I Speak to a Financial Adviser Before Withdrawing?

Yes, speaking to a regulated financial adviser before I withdraw my pension is highly advisable, especially if my pension pot is large or I have other sources of income. A financial adviser helps me understand how much tax I might owe, how my benefits may be affected, and how to structure withdrawals tax-efficiently.

They can also ensure I don’t accidentally trigger unwanted limits like the Money Purchase Annual Allowance (MPAA) or withdraw too much at once, which could push me into a higher tax bracket. Advisers are particularly useful if I’ve built up several pensions, or if I hold protected allowances from older schemes.

If I can’t afford an adviser, I can still book a free session with Pension Wise, a government-backed guidance service. However, for tailored advice, especially involving multiple pots or large sums, professional advice can save me more than it costs in the long run.

Summary: Declaring Pension Lump Sums the Right Way

Declaring my pension lump sum properly is not just a legal responsibility, it’s vital to protecting my income, avoiding over-taxation, and staying eligible for any benefits I receive.

Although my provider usually deducts tax under PAYE, I must check that it was deducted correctly, that the right tax code was used, and whether the income pushes me into a higher tax band.

When needed, I should complete a Self Assessment return or submit the appropriate HMRC form to claim back any overpaid tax. I also need to understand how withdrawals may impact my Lump Sum Allowance (LSA) and whether any remaining allowance is available.

Lastly, if I’m on means-tested benefits, I must always report pension withdrawals to the DWP. Being proactive means I avoid surprises and ensure I’m getting the most out of my retirement savings while staying compliant with UK tax law.

Tax Treatment of Pension Lump Sums Based on Pot Size

The way my pension lump sum is taxed depends on the total value of the pot, how much of the Lump Sum Allowance I’ve used, and whether I’m accessing multiple pots.

The table below shows how different pension pot sizes are taxed in practice:

| Pension Pot | 25% Tax-Free Amount | Taxable Amount | Need to Declare? | Reporting Method |

|---|---|---|---|---|

| £50,000 | £12,500 | £37,500 | Possibly | PAYE or Self Assessment |

| £100,000 | £25,000 | £75,000 | Yes | PAYE or Self Assessment |

| £200,000 | £50,000 | £150,000 | Yes | Self Assessment |

| £1.2 million | £268,275 (maxed LSA) | £931,725 | Yes | Self Assessment |

| £20,000 (small pot) | £5,000 | £15,000 | Sometimes | Form P53 if overtaxed |

Even when tax is automatically deducted, I still need to make sure it’s accurate. If I’ve crossed into a higher tax bracket or received multiple payments, I may need to file a tax return or contact HMRC directly.

Conclusion

Pension lump sums can give me the freedom to fund major purchases, reduce debt, or enjoy retirement, but only if I understand how they’re taxed.

While I usually don’t need to declare the tax-free 25%, any amount above my Lump Sum Allowance must be treated as income and reported to HMRC.

Whether it’s handled by PAYE or through Self Assessment, I have a duty to make sure everything is accurate, especially if I have other income sources or claim benefits. Taking a bit of time to plan and understand how the tax rules apply to my personal situation can help me keep more of my money, avoid penalties, and make smarter retirement decisions.

Before taking action, I should check with my provider, consider professional advice, and always stay updated on current HMRC and DWP guidance. The right decision today will protect my financial security tomorrow.

Frequently Asked Questions

Do I have to declare my pension lump sum to HMRC?

Yes, if the taxable part exceeds your personal allowance or if PAYE hasn’t covered your full liability.

Is the 25% tax-free amount always guaranteed?

Yes, up to £268,275 across all pensions. Anything above this is taxable income.

What if I were taxed too much on my lump sum?

You can claim a refund using forms like P55 or P53Z, or via Self Assessment.

Will my lump sum affect my benefits?

Yes, it may impact means-tested benefits like Housing Benefit or Pension Credit.

Can I take multiple lump sums from different pots?

Yes, but you must monitor your tax-free allowance and report income properly.

Is self-assessment always required?

No, but it’s recommended if your income is high or your lump sum is large.

What happens if I don’t declare my pension income?

You could face penalties or underpayment notices from HMRC.