Choosing the right pension provider in the UK can feel overwhelming, especially with so many platforms offering different features, fees, and investment options. Whether you’re just starting to save, looking to consolidate old workplace pensions, or planning your retirement income, it’s important to find a provider that matches your goals.

In 2026, pension platforms have become more flexible, digital, and tailored to different types of savers. Some are built for low-cost investing, while others focus on ethical portfolios or mobile-first experiences.

To help you navigate the options, we’ve put together a list of the top 10 pension providers in the UK this year, covering everything from fees and fund choices to user experience and who each provider is best suited for.

Let’s explore which platforms are leading the way and how they can help you build a better retirement.

Why Choosing the Best Pension Provider in the UK Matters?

Choosing the right pension provider is one of the most critical decisions for anyone looking to secure a stable and comfortable retirement in the UK. In 2026, with rising living costs and increasing life expectancy, it’s more vital than ever to ensure your money is managed by a reliable and efficient platform.

A trusted pension provider not only offers competitive fees and diversified investment options but also equips you with tools to manage your pension pot wisely.

Beyond features, reputation and regulation are also crucial. You’ll want to work with a provider authorised by the Financial Conduct Authority and listed with The Pensions Regulator.

These safeguards protect your savings and ensure the firm acts in your best interests. Additionally, providers differ in how well they support flexible withdrawals, consolidation of old pensions, and drawdown options. Ultimately, your provider should help maximise returns, minimise fees, and make pension planning clear and accessible.

What to Look for in a UK Pension Provider in 2026?

In 2026, the UK pension market has evolved, offering consumers more control and digital convenience. When evaluating providers, several critical factors should be weighed.

Start by ensuring the provider is regulated and reputable. Reviews from current users and financial comparison tools can shed light on real-world experiences. A solid reputation signals stability and strong customer service.

Key features to consider:

- Investment Range: Look for providers with a broad fund selection, including ethical and ESG options.

- Fee Structure: Understand if fees are flat or percentage-based, and watch for hidden costs.

- Platform Tools: Digital dashboards, mobile apps, and retirement forecasters enhance user control.

- Flexibility: Some platforms are designed for consolidating multiple pensions, others for drawdown or passive investing.

- Support Options: Access to free guidance like Pension Wise or adviser networks is a big plus.

A good provider should offer transparency, low-cost access, and support tailored to your life stage.

Top 10 Best Pension Providers UK in 2026

The UK pension market in 2026 is filled with a wide range of providers offering unique benefits tailored to specific saver profiles. From passive investors seeking low fees to freelancers needing flexibility, these ten standout pension platforms provide some of the most comprehensive and competitive solutions available. Here’s an in-depth look at the best pension providers in the UK right now.

1. Vanguard – Low-Cost, Passive Investing Made Simple

Vanguard is a firm favourite among UK pension savers who want a straightforward, low-fee approach to building retirement wealth. Known globally for its index-tracking funds,

Vanguard has enhanced its offering in 2026 with lower LifeStrategy fund fees and no platform fee on pot balances above £250,000. These changes make Vanguard particularly appealing to long-term investors looking for cost-efficient growth with minimal effort.

Vanguard SIPP (2026) Details

Best For Passive investors seeking low fees

Annual Platform Fee 0.15% (Capped at £375)

Trading Charges £0 (Funds), £7.50 (Live ETFs)

Investment Range 80+ Vanguard Index Funds and ETFs

Minimum Contribution £100/month or £500 lump sum

Vanguard remains the gold standard for those who want a “set and forget” pension strategy, offering simplicity, transparency, and exceptional value for money.

2. AJ Bell – Powerful Platform for DIY Investors

AJ Bell has carved a strong position in the UK pension market by offering one of the most comprehensive DIY investment platforms.

In 2026, their integration with the Dodl app has improved accessibility for beginners while still catering to experienced investors. With over 24,000 investment options, it’s perfect for those who prefer full control over their portfolio.

AJ Bell SIPP (2026) Details

Best For DIY investors with flexible goals

Annual Platform Fee 0.25% (Capped at £120 for shares)

Trading Charges £1.50 (Funds), £5.00 (Shares)

Investment Range 24,000+ Stocks, Funds, ETFs

Minimum Contribution £25/month or £500 lump sum

Whether you’re actively managing your pension or building a diversified portfolio, AJ Bell offers a robust platform with competitive fees and extensive investment flexibility.

3. Interactive Investor (ii) – Ideal for Large Pots with Flat Fees

Interactive Investor is one of the few UK platforms offering a flat-fee model, making it highly attractive for those with larger pension pots.

In 2026, their Core Plan now covers portfolios up to £100,000, giving cost-conscious investors excellent value over time. The platform provides access to global shares, ETFs, and managed funds all under one monthly fee.

ii Core Plan (2026) Details

Best For Portfolios over £50,000

Annual Platform Fee £71.88 (£5.99/month) flat

Trading Charges £3.99 (UK & US shares)

Investment Range 40,000+ Global Securities

Minimum Contribution No minimum to open

Interactive Investor is an excellent choice for seasoned investors looking to reduce long-term costs without compromising on investment scope or platform features.

4. PensionBee – Seamless Pension Consolidation and Mobile Access

PensionBee has transformed the pension experience for UK savers with its easy-to-use digital platform. Specialising in consolidating old workplace pensions, the app-based provider now offers a tiered fee system with significant discounts on pots over £100,000.

In 2026, their managed portfolios include ethical and fossil-fuel-free options to suit growing demand for sustainable investing.

PensionBee (2026) Details

Best For Pension consolidation and simplicity

Annual Platform Fee 0.50%–0.95% (Tiered)

Trading Charges £0 (All-inclusive)

Investment Range 9 Managed Plan Options

Minimum Contribution £0 (Transfer-in required)

With its high customer ratings and mobile-first approach, PensionBee is ideal for modern savers looking to simplify their pensions with minimal admin.

5. Hargreaves Lansdown – Premium Support and Broad Investment Choice

Hargreaves Lansdown offers a high-touch pension platform supported by expert research and a wide selection of investments.

In 2026, their Ready-Made Pension range features auto-rebalancing and simplified options for those preferring guidance. Although their fees are slightly higher, the value lies in access to financial tools, market analysis, and responsive customer support.

HL SIPP (2026) Details

Best For Investors wanting expert insights

Annual Platform Fee 0.45% (Capped at £200 for shares)

Trading Charges £0 (Funds), £11.95 (Shares)

Investment Range 3,000+ Funds and Global Shares

Minimum Contribution £25/month or £1,000 lump sum

If you want a premium investing experience backed by data-driven research and robust platform tools, Hargreaves Lansdown delivers comprehensive retirement planning support.

6. Fidelity International – Family-Focused with ESG Strength

Fidelity International is known for its global presence and focus on ethical investing. Their SIPP offers low platform fees, and their Junior SIPP is a top choice for parents.

In 2026, the provider continues to prioritise customer satisfaction, scoring over 90% in service ratings, while offering ESG-compliant funds and a simple interface for hands-on and hands-off investors alike.

Fidelity SIPP (2026) Details

Best For Ethical investing and family plans

Annual Platform Fee 0.35% (Capped at £90 for shares)

Trading Charges £0 (Funds), £7.50 (Shares)

Investment Range 3,000+ Funds and ETFs

Minimum Contribution £25/month or £1,000 lump sum

Fidelity offers a future-focused solution for both individual savers and families, combining great service with a strong ethical investment framework.

7. Royal London – Mutual Value for Advised Clients

Royal London is the UK’s largest mutual pension provider, meaning it’s owned by its members, not shareholders. Their pension products are generally accessed through financial advisers and include features like Governed Portfolios.

In 2026, the average member received a 0.15% Profit Share, highlighting the provider’s unique member-focused value model.

Royal London (2026) Details

Best For Advised clients seeking long-term growth

Annual Platform Fee ~1.00% (Reduced for larger pots)

Trading Charges Included in annual charges

Investment Range Governed Portfolios

Minimum Contribution Subject to adviser terms

If you’re working with a financial adviser and want added value through profit sharing, Royal London offers a compelling pension solution in 2026.

8. Aviva – Flexible Drawdown and Retirement Planning

Aviva offers one of the UK’s most reliable personal pensions, especially for those approaching retirement. In 2026, the MyAviva app includes AI-driven forecasting and smart drawdown planning.

With hundreds of funds available and support for flexible income withdrawals, it remains a top choice for those who want control and visibility.

Aviva Pension (2026) Details

Best For Near-retirees needing income flexibility

Annual Platform Fee 0.40% (Tiered)

Trading Charges £0 (On most funds)

Investment Range 300+ Selected Funds

Minimum Contribution £50/month or £1,000 lump sum

Aviva’s strength lies in bridging the gap between savings and income, offering a digital-first solution backed by a trusted brand name.

9. Penfold – Flexible Pensions for Freelancers and Contractors

Penfold is designed for the growing number of UK workers who are self-employed or on flexible incomes. Its app-first interface makes it easy to start, pause, or increase contributions instantly. In 2026, Penfold is rated number one for digital service quality among fintech pension providers.

Penfold (2026) Details

Best For Self-employed and freelancers

Annual Platform Fee 0.75% (Capped on pots over £100k)

Trading Charges £0 (All-inclusive)

Investment Range 4 Managed Portfolios

Minimum Contribution £0

Penfold is perfect for those who want total control of their pension without being tied to fixed payment schedules or traditional paperwork.

10. Nest – Government-Backed Pension with Low Fees

Nest is the default workplace pension scheme for many UK employers and employees. Its simple structure, low fees, and ethical fund options make it a practical and trusted solution. In 2026, Nest now manages over £40 billion in assets and continues to expand its core investment offerings.

Nest (2026) Details

Best For Auto-enrolled employees and new savers

Annual Platform Fee 0.30% (Ongoing)

Trading Charges 1.80% (On contributions)

Investment Range 5 Core Ethical/Retirement Funds

Minimum Contribution Based on auto-enrolment thresholds

Nest remains a dependable, low-maintenance option for workers who want a government-backed pension without the complexities of active investing.

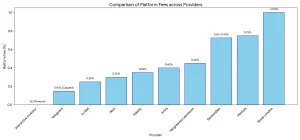

Comparison Table: Best UK Pension Providers in 2026

Choosing the right pension provider becomes easier when comparing side-by-side. Here’s a look at the core features that differentiate the top players.

Provider Platform Fee Best For Investment Options Minimum Contribution

Vanguard 0.15% (Capped) Passive investors 80+ Funds/ETFs £100/month or £500

AJ Bell 0.25% DIY investors 24,000+ Instruments £25/month or £500

Interactive Investor £5.99/month High-value portfolios 40,000+ Securities None

PensionBee 0.50–0.95% Pension consolidation 9 Plans £0 (Transfer-in)

Hargreaves Lansdown 0.45% Premium service 3,000+ Funds/Shares £25/month or £1,000

Fidelity 0.35% Family plans & SIPPs 3,000+ Funds/ETFs £25/month or £1,000

Royal London ~1.00% Advised portfolios Governed Portfolios Adviser-dependent

Aviva 0.40% Near-retirees 300+ Funds £50/month or £1,000

Penfold 0.75% Self-employed, contractors 4 Managed Portfolios £0

Nest 0.30% Auto-enrolment workers 5 Core Funds Auto-enrolment rules

These comparisons help assess what’s most important, whether that’s cost, choice, service, or flexibility.

How to Choose the Right Pension Provider for Your Needs?

Selecting the right provider starts with defining your financial goals. Are you consolidating old pensions, planning for early retirement, or just starting to save? These answers guide your decision.

- For ease and simplicity, PensionBee offers digital consolidation.

- If low fees are critical, Vanguard and Nest are top contenders.

- For hands-on investing, AJ Bell or ii give total control.

- For those nearing retirement, Aviva and Royal London provide income planning and advice.

Review fund options, flexibility, digital tools, and whether you want guided or self-directed investing. The best choice aligns with your retirement strategy.

What Are the Mistakes to Avoid When Selecting a Pension Provider?

Making the wrong choice in pension providers can cost you in fees and lost growth. Avoid these common pitfalls.

- Ignoring platform or fund fees that can eat into returns over time

- Choosing a provider without proper FCA regulation

- Not considering digital access or fund variety

- Overlooking your pot size when comparing flat versus percentage fees

- Failing to understand withdrawal or transfer penalties

Do your research, use comparison tools, and read reviews from real users before committing. It’s easier to switch early than regret it later.

What Are the Tips for Maximising Your UK Pension in 2026?

Getting the most out of your pension requires more than just regular contributions. Strategic planning is key.

- Increase contributions whenever possible to boost compound growth

- Take full advantage of employer-matched pension schemes

- Delay withdrawals if you can, to allow more tax-free growth

- Use pension calculators and apps to track your income projections

- Explore all tax reliefs available to you, including additional-rate relief

A combination of smarter saving, timing, and investment choice will significantly improve your retirement outlook.

Conclusion

Finding the best pension provider UK in 2026 is less about a single winner and more about aligning a provider with your personal financial journey.

Whether you’re a first-time saver, a self-employed professional, or nearing retirement, the options today are better than ever, digital, flexible, and transparent.

Evaluate providers based on fees, fund choices, ease of use, and retirement planning support. With the right plan in place, your future self will thank you for making a smart decision today.

FAQs About UK Pension Providers in 2026

What is the safest pension provider in the UK right now?

Vanguard, Nest, and Aviva are among the safest due to their regulation, reputation, and long-term market presence.

Can I move my pension to another provider without penalty?

Yes, though you should check for any exit or transfer fees from your current provider before switching.

Is it better to use a pension provider or a financial adviser?

Advisers offer tailored guidance, while pension platforms are suitable for those confident managing their own funds.

How much does it cost to manage a pension in the UK?

Costs range from 0.15% to 1.00% annually depending on the provider and investment type.

Which provider is best for self-employed workers in the UK?

Penfold and AJ Bell are excellent for freelancers due to flexible contributions and digital tools.

What is a good pension growth rate in 2026?

Most balanced portfolios aim for a 4–6% annual return, though this can vary based on market performance.

Can I have more than one private pension in the UK?

Yes, you can hold multiple pensions and consolidate them later if needed.