Thousands of post-2006 cars are now being written off by high road tax in the UK, as Vehicle Excise Duty rates climb to unsustainable levels. From April 2026, annual road tax of up to £790 is rendering many otherwise reliable vehicles too costly to keep, leading owners to scrap, export, or abandon them entirely.

Key takeaways:

- Post-2006 petrol and diesel cars fall into the highest VED tax bands

- Family and practical models, not just luxury vehicles, are being affected

- Road tax can now exceed the resale value of the vehicle

- Many well-maintained cars are scrapped purely due to cost, not condition

Why Are So Many Cars Being Written Off by High Road Tax in 2026?

Cars are being written off across the UK, not because they are broken, but because Vehicle Excise Duty is now making them uneconomical to keep. According to data from the RAC Foundation, the average age of cars on British roads is nearing 10 years.

Drivers are holding onto their older vehicles longer, often to avoid the cost and complexity of newer models. But now, many are being forced to scrap even reliable cars due to skyrocketing tax bills.

From April 2026, any car emitting more than 225 grams of CO2 per kilometre and registered after March 2006 will fall into VED Band L or M. These are subject to taxes as high as £790 a year.

The charges apply to many family cars, older saloons, and modest 4x4s. For numerous drivers, it is no longer viable to pay hundreds of pounds in road tax annually for a car worth less than that amount.

Rather than risk continued expense, many drivers are choosing to part with these cars altogether.

What Changed in April 2006 and Why Does It Still Matter?

Understanding how thousands of vehicles became cars written off by high road tax begins with changes made in April 2006. That year, the UK government introduced a new taxation model aimed at reducing emissions. Instead of taxing vehicles by engine size, cars were now taxed based on their CO2 emissions.

Introduction of Emissions-based VED Bands

Cars registered after March 2001 were grouped into emissions-based bands ranging from A to M. This was designed to penalise cars producing more carbon dioxide. However, the full impact was delayed until April 2006, when Band L and M were added.

Specifics of Band L and M Changes for Cars Emitting Over 225g/km

Post-April 2006 cars that emit between 226 and 255 grams of CO2 fall under Band L. Cars exceeding 255g/km are placed in Band M. In 2026, Band L road tax rises to £760 and Band M to £790 annually. These tax brackets were originally designed for “gas guzzlers” but now include family estates and modest all-wheel drives.

Comparison With Older Engine-size Tax Brackets

Older vehicles, especially those registered before 2001, are taxed based on engine size rather than emissions. Cars below 1,549cc pay £229 per year, and anything above pays £360.

Cars registered between 2001 and March 2006 are capped at Band K, currently £430, making them far more affordable than identical models registered a few weeks later.

April 2026 Rise from £735 to £760–£790

Starting April 2026, the top VED bands will increase. Band L climbs from £735 to £760, while Band M rises from £750 to £790. These increases cement the status of high-emission post-2006 cars as financially unattractive.

Monthly and Six-month Payments Pushing Annual Tax Over £830

Drivers who cannot pay in one lump sum will pay more. Monthly instalments raise the cost of taxing a Band M car to £798 annually. Six-month payments are even worse, increasing the total to £836. This financial pressure is the tipping point for many, pushing even reliable cars to the scrapyard.

The rule change from 2006 continues to punish owners of practical vehicles nearly 20 years later. The upcoming 2026 increases only reinforce that burden.

Which Cars Are Being Scrapped Due to High Road Tax?

It is not just high-end performance vehicles being written off by high road tax. Many standard family models, MPVs, and small 4x4s are now too costly to keep due to their placement in the highest tax brackets.

Practical vehicles that once sold well for their versatility and comfort are now being scrapped at alarming rates.

Wayne Lamport, who runs Stone Cold Classics in Kent, sees this firsthand. He notes how buyers often express initial interest in affordable classics like the Chrysler PT Cruiser, only to back out once they learn of the tax cost.

“They go off the idea when they realise the annual cost of taxing it. A lot of these cars are virtually unsellable,” he explains. For many, the annual tax exceeds the car’s value. That’s led to a market collapse for these models, with many either being broken for parts or shipped abroad.

Popular Cars and Their VED Costs in 2026:

| Model | Engine | CO2 Emissions (g/km) | Annual Tax 2026 | Status |

|---|---|---|---|---|

| Ford Mondeo V6 | 2.5L | 249 | £760 | Scrapped |

| VW Golf R32 | 3.2L | 257 | £790 | Exported |

| Audi TT 1.8T | 1.8L | 226 | £760 | Declining value |

| Saab 900 Convertible | 2.0L | 240 | £760 | Scrapped |

| Land Rover Freelander i6 | 3.2L | 265 | £790 | Broken for parts |

These examples show clearly how cars written off by high road tax are often everyday vehicles rather than extravagant indulgences.

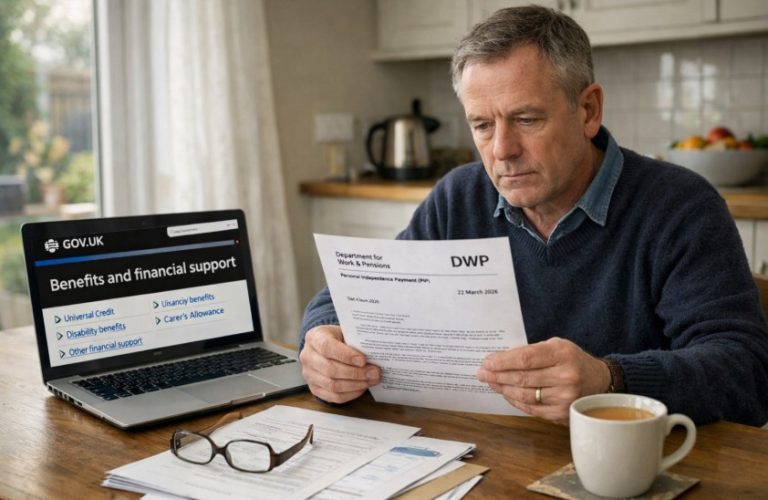

Why Are These Cars Losing Value So Quickly?

The reason cars written off by high road tax are losing value so rapidly is not just due to the tax itself, but because of how buyers and dealers are reacting to it.

Road Tax Higher Than Resale Value

In many cases, the annual tax is as much or more than the vehicle’s worth. This deters new buyers and forces owners to accept rock-bottom prices or scrap the car entirely.

Dealers Avoiding Post-2006 Models

Dealers have grown cautious.

Wayne Lamport confirms this, saying,

“We have to be very careful when we buy stock which is 2006 or more recent.” Even reliable models like the Jaguar X-Type are avoided because buyers will not accept a £700+ tax bill.

What Dealers and Garages Say About High Road Tax?

Lamport and Knight, lamport gives the example of the PT Cruiser, a model that some buyers initially like. “A lot of people love them and think it will be a novelty,” he says, “but they go off the idea when they realise the annual cost.”

Russ Knight, of Gloucester Land Rover, shares similar stories. He says, “People come in for a service and MOT. We give them an estimate, they add on the cost of the tax, and they decide not to bother. They just tell me to keep the car.” These are often well-maintained, family 4x4s that get abandoned simply because of their annual tax bills.

Personal Stories and Tax Decisions

Some customers are emotionally attached to their cars but cannot justify paying a combined MOT, repair, and tax bill that exceeds the vehicle’s resale value. This has led to many walkaways, even at reputable garages.

Exports to Africa and Ukraine Increasing

Knight mentions that many of the vehicles left behind are exported. “Some are broken up for parts or sold for export to Africa. Many 4x4s are going to Ukraine now,” he adds. These markets do not penalise high emissions the way the UK does, making export a financially viable option for dealers.

These factors combined explain the drastic drop in market value and the surge in scrappage and exports.

Is It Cheaper to Keep an Old Car or Buy a New One?

Financially, keeping an older petrol or diesel car often looks like the smarter choice, until you factor in the rising cost of VED. The first-year tax on newer petrol or diesel cars can be substantial, especially for high-emission models, often reaching several thousand pounds.

However, Mike Berners-Lee, writing in The Guardian, points out that manufacturing a new car can produce more than 17 tonnes of CO2e. That’s almost three years of household energy usage. For many, the greener and cheaper option may be keeping an older car in good condition rather than scrapping it too soon.

Pros and Cons Table:

| Option | Pros | Cons |

|---|---|---|

| Keep old petrol/diesel | Lower cost, avoids new manufacturing emissions | High VED, possible restrictions |

| Buy new hybrid | Lower emissions, smaller tax bands | High purchase cost |

| Switch to electric | Low or zero tax, clean energy future | Charging limitations, expensive upfront |

For many UK drivers, it remains a case of balancing long-term savings against rising annual taxation.

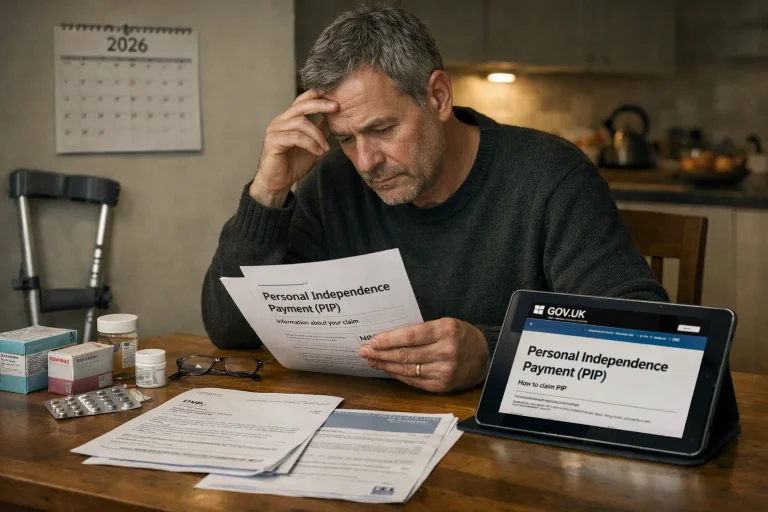

How Can UK Drivers Avoid Getting Caught in the 2026 Road Tax Trap?

Avoiding the 2026 road tax trap requires awareness of both emission rates and registration dates. The most important tip is to avoid buying cars registered after 23 March 2006. These cars fall into the expensive Band L and M brackets if they exceed 225g/km in CO2 emissions.

Before buying, check the V5 registration document to confirm both the date and official emissions. This step is crucial, especially when the car carries a private plate that could mask its actual age.

Other useful tips include:

- Opt for cars under 225g/km CO2 emissions

- Consider pre-2006 models still in good mechanical condition

- Use the DVLA’s online checker to confirm tax bands

- Always calculate road tax before finalising any second-hand purchase

A few minutes of research can save hundreds in annual costs and prevent an unintended purchase of a car already headed toward scrappage.

What Does the Future Hold for Post-2006 Petrol and Diesel Cars?

The outlook for post-2006 petrol and diesel cars is increasingly uncertain. These vehicles are in the crosshairs of multiple government strategies aimed at cutting emissions, and many will continue to face higher taxes, increased ULEZ restrictions, and declining resale value.

While some models may eventually qualify for “classic” car exemptions, most are too young or too common to benefit. Without updates to the taxation system, the market for these vehicles is expected to shrink even further.

Manufacturers are moving quickly toward electric and hybrid platforms, leaving traditional petrol and diesel models behind. For current owners, the choice may become either to sell now, before values drop further, or to keep the vehicle until it is no longer viable.

Are These Cars Truly Written Off by Road Tax?

Yes, many cars on UK roads are now being effectively written off by high road tax alone. These vehicles are not breaking down. They are not failing MOTs. They are simply no longer affordable to tax.

Drivers, dealers, and garage owners alike are reporting an uptick in perfectly good cars being scrapped or exported due to taxation policy.

Both Wayne Lamport and Russ Knight agree that a shift is needed. Lamport calls it “criminal to throw away good cars like these,” while Knight sees the effects daily in the vehicles left at his workshop.

This is not only an economic issue. It is also an environmental and social concern. Removing usable vehicles from circulation adds pressure on the supply chain, contributes to waste, and limits affordable options for drivers across the country.

Without reform, road tax will continue to act as the final blow for thousands of otherwise perfectly functional vehicles.

Conclusion

The reality of cars being written off by high road tax reflects how outdated legislation is having modern consequences. Vehicles once prized for their reliability and practicality are now disappearing from the roads, not for mechanical failure, but because their annual tax bill exceeds their worth.

April 2026 will be a turning point. The increased VED rates in Bands L and M will push more vehicles into financial oblivion. Unless policy changes, even more families and individual owners will be forced into scrapping good vehicles.

By understanding emissions bands, checking registration dates, and using tools like the V5 logbook, UK drivers can make smarter, cost-effective choices. For now, however, many post-2006 petrol and diesel cars are facing the same fate: written off, not by breakdown, but by bureaucracy.

FAQs About Cars Written Off by High Road Tax

Which cars are most affected by high road tax?

Cars registered after April 2006 with emissions above 225g/km face the highest VED bands and are most affected.

Why is road tax higher than some cars are worth?

Because resale values have dropped while VED continues to increase, making tax costs disproportionate.

Can a private number plate affect road tax?

Yes, personalised plates can hide the true registration year. Always check the V5C document.

Are family cars really being scrapped?

Yes, many practical models like the Mondeo, Zafira, and Golf are being scrapped due to tax.

Is exporting a car cheaper than keeping it?

In some cases, yes. Export markets like Africa and Ukraine accept these cars without UK tax penalties.

Are electric cars completely tax free?

Currently, most EVs are VED exempt, but future taxation changes may include them.

Is keeping an old car better for the environment?

Yes, in many cases. Avoiding new car manufacturing can significantly lower total CO2 impact.