Many people have recently asked me whether the Universal Credit loophole £1500 claim is real. The direct answer is no. There is no official loophole, secret payment, or hidden government scheme that allows claimants to unlock £1500 outside the normal Universal Credit rules.

The rumour circulating online in 2026 is largely based on confusion about benefit elements, Budgeting Advances, or combined support schemes. Universal Credit is a structured, formula based system managed by the Department for Work and Pensions, and payments are calculated according to strict eligibility criteria. Below is a clear summary of what this article explains.

| Key Point | Summary |

|---|---|

| Is there a £1500 loophole | No official loophole exists |

| Source of rumour | Social media and misinformation |

| Possible confusion | Combined elements or Budgeting Advances |

| Is £1500 possible | Only through legitimate combined entitlement |

| Scam risk | High risk of phishing and fraud |

| Safe verification | Check GOV.UK or Citizens Advice |

Is the “Universal Credit Loophole £1500” Claim Actually True in 2026?

The Universal Credit loophole £1500 claim suggests there is a secret method, overlooked rule, or technical workaround that allows people to receive a £1500 payment from the Department for Work and Pensions. There is no evidence that such a mechanism exists.

Universal Credit operates through a structured digital assessment system. Every claimant submits details about income, savings, housing, and household circumstances. The system then calculates entitlement based on predefined criteria. There is no discretionary shortcut built into the system that can be triggered by wording an application differently or selecting specific options.

The persistence of this rumour is largely due to how complex benefit calculations can appear to the public. When people see examples of households receiving over £1500 per month in total support, it can create the impression of an exceptional payment. In reality, those figures reflect combined entitlement, not a hidden benefit.

In 2026, there has been no statement on GOV.UK announcing a £1500 Universal Credit loophole, bonus, or correction scheme. Official announcements regarding benefits are always published publicly and widely reported by established UK media outlets.

Where Did the £1500 Universal Credit Loophole Rumour Start?

The rumour appears to have emerged from a combination of online speculation and misunderstanding of existing support mechanisms.

During the cost of living crisis, the government introduced various support packages. Payments were sometimes made in instalments across different months. When individuals added these together, it created the perception of a larger single payment.

At the same time, short form video platforms amplified simplified or misleading explanations of benefit rules. Phrases such as hidden payment, government secret, or loophole were used to increase engagement.

Several contributing factors include:

- Misinterpretation of cumulative monthly support

- Confusion between grants and repayable advances

- Outdated cost of living payment information being reshared

- Fake screenshots claiming DWP confirmation

Once a claim is repeated frequently online, it gains perceived credibility even if it has no official basis.

What Might People Be Confusing With the £1500 Universal Credit Payment?

Are Universal Credit Elements Being Misunderstood?

Universal Credit is made up of a standard allowance and additional elements. The final amount a claimant receives can vary significantly depending on personal circumstances.

Below is an overview of the core elements available under Universal Credit in 2026.

| Universal Credit Element | Who It Applies To | Purpose |

|---|---|---|

| Standard Allowance | All claimants | Basic living support |

| Child Element | Claimants with children | Support for dependent children |

| Housing Element | Renters and some homeowners | Help with housing costs |

| Limited Capability for Work | Those with health conditions | Additional support if unable to work |

| Carer Element | Unpaid carers | Support for caring responsibilities |

When multiple elements apply, total support can increase substantially.

For example:

| Scenario | Combined Monthly Elements | Estimated Monthly Total |

|---|---|---|

| Single person with no children | Standard Allowance only | Approx £368 |

| Single parent with two children and rent | Standard + Child + Housing | Over £1,200 |

| Individual with health condition and housing costs | Standard + LCWRA + Housing | Potentially £1,500 or more |

This demonstrates how monthly entitlement may exceed £1500 in specific situations. However, this is not an exploit or loophole. It is the result of policy design that recognises different household needs.

A welfare policy professional I consulted explained it clearly:

“Universal Credit is formula driven. There is no switch or gap that suddenly releases £1500. If someone receives that amount, it is because multiple eligible elements apply and the calculation supports it.”

This clarifies that higher payments are structured outcomes rather than hidden opportunities.

Is the £1500 Linked to Budgeting Loans or Advances?

Another major source of confusion is the Budgeting Advance.

Claimants who have been receiving Universal Credit for a certain period may apply for a Budgeting Advance to cover emergency expenses such as furniture, moving costs, or essential household items.

Below is a simplified breakdown:

| Household Type | Maximum Budgeting Advance |

|---|---|

| Single person | Up to £348 |

| Couple | Up to £464 |

| With children | Up to £812 |

| Exceptional higher limits in certain cases | Can approach £1500 |

The key point is that a Budgeting Advance is a loan. It must be repaid through deductions from future Universal Credit payments. It is not an extra benefit or bonus payment.

Some online posts fail to explain the repayment requirement, leading people to believe it is free money.

How Does Universal Credit Actually Work in the UK?

Universal Credit is assessed monthly.

Each claimant has an assessment period that reviews:

- Earnings from employment

- Self-employed income

- Changes in household composition

- Savings and capital levels

Savings above £6000 begin to reduce entitlement. Savings above £16000 generally remove eligibility altogether.

Below is a simplified capital rule structure.

| Savings Level | Impact on Universal Credit |

|---|---|

| Under £6000 | No reduction |

| £6000 to £16000 | Reduced payment calculation |

| Over £16000 | Not eligible |

Income also affects payments through a taper rate. For every additional pound earned above the work allowance, Universal Credit is reduced by a set percentage.

This system is designed to ensure support decreases gradually as earnings increase. It is not designed to contain hidden payout triggers.

The same welfare professional added:

“The idea of a loophole misunderstands how automated the system is. Every assessment period recalculates entitlement. There is no unused fund sitting in the background.”

That perspective reinforces how tightly monitored and structured the system is.

Are There Any Legitimate £1500 Universal Credit Payments in 2026?

There is no official £1500 Universal Credit loophole payment in 2026. However, it is important to distinguish between a rumour and legitimate combined support.

In certain cases, total support across multiple schemes may appear high when added together.

These may include:

- Universal Credit monthly entitlement

- Local authority Household Support Fund grants

- Council tax reductions

- Discretionary housing payments

Below is an example of how combined support might look.

| Support Type | Example Amount |

|---|---|

| Universal Credit Monthly | £1,200 |

| Council Tax Reduction | £150 |

| Household Support Fund | £300 |

| Total Combined Support | £1,650 |

This is not a single payment. It is the cumulative effect of separate schemes with distinct eligibility criteria.

Government support packages are always formally announced and documented. If a new payment is introduced, it will be clearly detailed on GOV.UK with guidance notes.

Why Are Universal Credit Scams Increasing Online?

The Universal Credit loophole £1500 rumour has created an opportunity for scammers.

Financial hardship increases vulnerability. When people see promises of quick financial relief, they may be tempted to investigate further.

Common scam characteristics include:

- Requests for personal identification documents

- Links that mimic official government websites

- Claims that an application must be completed urgently

- Fake testimonials

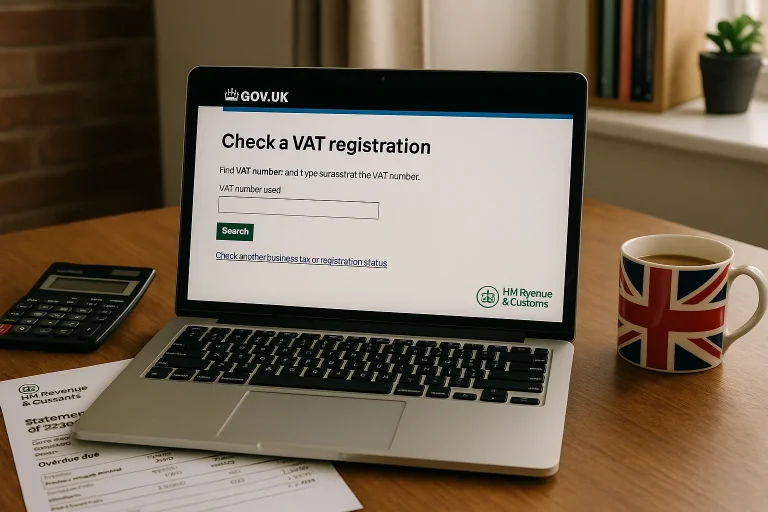

Scammers often replicate official branding to appear legitimate. However, genuine government websites always use the gov.uk domain.

It is important to remember that the DWP communicates through secure online journals, official letters, or verified contact channels. They do not request confidential details through random social media messages.

How Can You Check Official Universal Credit Updates Safely?

Verifying information is straightforward when using trusted sources.

Official updates can be found through:

- The GOV.UK Universal Credit section

- Direct messages in your Universal Credit journal

- Citizens Advice

- Recognised UK news publications

When I began researching the Universal Credit loophole £1500 claim, I checked official publications first. I found no policy updates, no legislative amendments, and no Treasury announcements supporting the rumour. That absence of documentation is telling. Genuine benefit changes are always transparent.

It is also useful to understand how government communications are structured. Policy updates go through formal publication stages. They are not introduced through anonymous online posts.

What Should You Do If You Have Encountered a £1500 Universal Credit Claim Online?

If you come across content promoting a Universal Credit loophole £1500 opportunity:

- Avoid entering personal information into unfamiliar websites.

- Verify claims directly on GOV.UK.

- Contact Citizens Advice for clarification.

- Report suspicious activity to Action Fraud UK.

- Inform others not to share unverified claims.

Protecting personal data is essential. Benefit related scams often aim to capture National Insurance numbers, bank details, or login credentials.

The ongoing presence of the Universal Credit loophole £1500 rumour demonstrates how easily misinformation can spread when financial uncertainty exists. By understanding how Universal Credit calculations genuinely work and by relying on official information channels, claimants can avoid falling victim to false promises.

Accurate information remains the most effective safeguard against benefit misinformation in 2026.

Conclusion: Is the Universal Credit Loophole £1500 Real or Just Another Internet Myth?

The Universal Credit loophole £1500 claim is a myth.

There is no hidden payment, no secret application method, and no government-approved workaround that unlocks free money. The rumour likely stems from misunderstandings about benefit elements, repayable budgeting advances, or past cost of living schemes.

Universal Credit is calculated using a structured formula based on individual circumstances. If your entitlement reaches or exceeds £1500 in a month, it is because your situation qualifies for multiple elements, not because of a loophole.

If you want accurate information, always rely on official government sources or trusted advisory services. In 2026, clarity matters more than ever, especially when misinformation can spread in minutes.

Frequently Asked Questions About Universal Credit and £1500 Claims

Can Universal Credit ever pay more than £1500 in one month?

Yes, depending on circumstances such as housing costs, children, and health-related elements. However, this is based on eligibility rules, not a loophole.

Is there a government bonus payment of £1500 in 2026?

There is no confirmed £1500 bonus payment linked directly to Universal Credit in 2026.

Are Budgeting Advances free money?

No. Budgeting Advances must be repaid through deductions from future Universal Credit payments.

How can I check if I qualify for additional Universal Credit elements?

You can use official GOV.UK benefits calculators or speak with Citizens Advice for personalised guidance.

Can social media posts about DWP payments be trusted?

Only if they link directly to official GOV.UK sources. Otherwise, they should be treated cautiously.

What should I do if I gave my details to a suspected scam?

Contact your bank immediately and report the incident to Action Fraud UK.

Does the DWP contact people through social media about payments?

No. Official communication is typically through your Universal Credit journal, official letters, or verified channels.