Have you ever received a cash gift from a family member or friend and wondered whether you should tell HMRC? You’re not alone. Many people in the UK are unsure when cash gifts need to be declared, and what the tax implications might be.

While gifts may seem straightforward, the rules set by HM Revenue and Customs (HMRC) can be complex, especially when Inheritance Tax (IHT) becomes a factor.

Not all gifts are taxable, but there are specific limits, conditions, and timelines you must be aware of. If you’re giving or receiving cash, keeping records and understanding exemptions could save you from future complications.

In this guide, you’ll find everything you need to know about when and how to declare cash gifts to HMRC in the UK, and what happens if you don’t.

What Counts as a Cash Gift in the UK?

In the UK, a cash gift refers to any money given from one individual to another without expecting anything in return. This includes one-time transfers, birthday or Christmas money, and even payments made on someone else’s behalf.

HMRC considers a gift to be any transfer of value, so if you give away money or sell something for less than it’s worth, the difference can count as a gift too.

For example, if a parent sells a home valued at £500,000 to a child for £300,000, the £200,000 difference is treated as a gift. Similarly, if you give away jewellery, personal items, or pay for holidays or tuition fees, these could all fall under the category of gifts for Inheritance Tax purposes.

It’s also important to note that gifts are only classed as such if you no longer benefit from them. If you still benefit after gifting, say, you gift a home but continue to live in it, it may be seen as a gift with reservation.

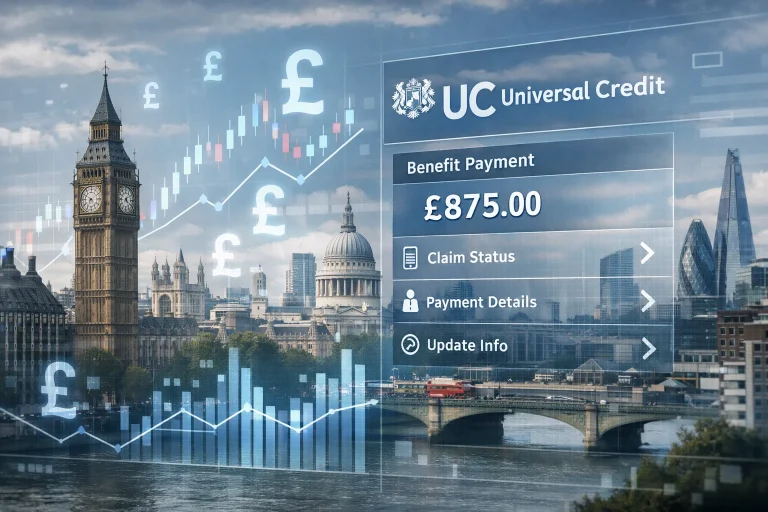

Are Cash Gifts Taxable in the UK?

Cash gifts are generally not subject to Income Tax in the UK, meaning you do not pay tax simply for receiving money. However, Inheritance Tax (IHT) may apply later depending on the circumstances, such as the value of the gift and how soon the giver dies after giving it.

Here’s a breakdown of when a gift could become taxable:

- If the donor dies within 7 years of giving the gift

- If the total value of gifts exceeds the £325,000 tax-free threshold

- If the gift was made without using any of the HMRC exemptions

The UK has no specific “gift tax,” but IHT rules make certain gifts taxable.

Below is a table showing taxable status of different gifts:

| Gift Type | Taxable? |

| £3,000 per year (Annual Exemption) | No |

| £5,000 Wedding Gift to a Child | No |

| £50,000 Cash Gift (Donor dies in 3 yrs) | Yes – IHT applies with taper |

| £250 Small Gift to Multiple People | No |

Even if no tax is due immediately, keeping records is highly recommended for future reference and potential tax assessments.

When Do You Need to Declare a Cash Gift to HMRC?

Generally, you don’t need to declare cash gifts to HMRC immediately unless they form part of the estate after a person’s death.

The obligation to declare arises if the donor passes away within 7 years and the gift affects the Inheritance Tax liability. In such cases, the executor of the estate must report these gifts using form IHT403, alongside other Inheritance Tax paperwork.

You should declare gifts in the following situations:

- The gift was above the annual allowance, and the donor passed away within 7 years

- You received a gift with reservation, where the donor continued benefiting from the asset

- The total value of gifts within 7 years exceeds £325,000

Here’s a simplified table showing when declaration is required:

| Situation | Declaration to HMRC Required? |

| Donor alive, gift under £3,000 | No |

| Donor dies within 7 years, gift above allowances | Yes |

| Gift with reservation (e.g., continued use of home) | Yes |

| Small gifts (£250 or less per person) | No |

It’s worth noting that although most gifts aren’t declared immediately, it is wise to keep personal records in case they become relevant later. Executors can face penalties if gifts aren’t declared correctly, especially when values are significant.

What Are the HMRC Gift Allowances and Exemptions?

Understanding HMRC’s allowances and exemptions can help you give cash gifts without triggering Inheritance Tax. The annual exemption allows you to gift up to £3,000 per tax year without it being added to the value of your estate.

You can split this amount across multiple people or give it to one individual. If you didn’t use the exemption in the previous tax year, you can carry it forward, allowing you to gift up to £6,000 tax-free.

Additionally, you can give small gifts of up to £250 to as many people as you like, provided they haven’t already received part of your annual exemption. These are perfect for birthdays or holidays.

Here are more HMRC exemptions:

- Wedding gifts: £5,000 for children, £2,500 for grandchildren or great-grandchildren, and £1,000 for anyone else

- Regular gifts from income: If you can show that gifts are part of your normal expenditure and don’t affect your standard of living, they are exempt

- Spouse or civil partner gifts: Unlimited if both live permanently in the UK

- Gifts to charities and political parties: Always tax-free

These exemptions can be combined in some cases, but not all. For example, a wedding gift and annual exemption can be used together, but the £250 small gift allowance cannot be used on the same person as the annual exemption. Using these allowances wisely helps avoid unnecessary tax complications.

What Is the 7-Year Rule for Gifts and Inheritance Tax?

The 7-year rule is central to understanding when a cash gift becomes liable for Inheritance Tax. If you give a gift and survive for at least seven years, it is exempt from Inheritance Tax, no matter the amount. However, if you pass away within seven years of making the gift, it may become taxable.

This rule helps HMRC prevent individuals from giving away assets shortly before death to avoid tax. If the total value of the gifts given in the seven years before death exceeds the £325,000 threshold, the excess is taxed.

The amount of tax depends on how many years before death the gift was made. This is known as taper relief, which gradually reduces the tax rate applied to the gift.

Here’s a table that shows taper relief rates:

| Years Between Gift and Death | Tax Rate Applied |

| 0 to 3 years | 40% |

| 3 to 4 years | 32% |

| 4 to 5 years | 24% |

| 5 to 6 years | 16% |

| 6 to 7 years | 8% |

| 7 years or more | 0% |

Note that taper relief only applies to gifts exceeding the nil-rate band. If all gifts fall below the threshold, no tax is due even if the donor dies within seven years. Proper planning and timing can reduce tax burdens significantly.

Do You Need to Report Gifts on Your Tax Return?

In most cases, you do not need to report cash gifts on your income tax return. That’s because cash gifts are not classed as income, and therefore, not subject to Income Tax in the UK.

However, if a gift becomes relevant for Inheritance Tax after a person’s death, it must be reported by the executor of the estate, not the person who received it.

If you’re the recipient of a large or regular gift, it’s wise to keep a clear record, especially if the giver is elderly or ill. This makes things easier for the executor in the future. The relevant form for reporting lifetime gifts to HMRC is IHT403, which is submitted during the probate process.

Although not reported through your personal Self Assessment, gifts can still affect your financial planning. Transparency and record-keeping are key.

You don’t want HMRC questioning a large unexplained deposit in your bank account, even if it’s not taxable now. Gifts are simple to receive, but not always simple to track later.

What Are the Rules on Gifts from Abroad?

Receiving a cash gift from someone outside the UK may seem straightforward, but there are specific considerations that apply depending on the source, amount, and the tax residency of the giver.

While most gifts from abroad are not immediately taxable, you must understand how HMRC views international transfers.

Non-resident Givers

If the person gifting you money lives permanently outside the UK and is not a UK tax resident, the gift is generally not subject to Inheritance Tax in the UK.

However, this changes if the donor dies within seven years of gifting and is still considered domiciled in the UK for tax purposes. Domicile is not the same as residency, it reflects where HMRC considers their permanent home to be.

HMRC View on Gifts Received From Overseas

HMRC does not automatically charge tax on incoming foreign gifts. However, large transfers may trigger anti-money laundering checks by banks.

It’s best to keep documentation showing the origin of the gift, including the sender’s details and their relationship to you. If the donor still holds UK-based assets or has recently left the UK, there might still be tax implications under Inheritance Tax laws.

Money Transferred to UK Bank Accounts

The act of receiving money into a UK bank account doesn’t trigger a tax event unless it starts generating interest or investment income, in which case that income must be declared.

If the gift is part of a deceased person’s estate that includes UK property or other assets, HMRC may include it for Inheritance Tax calculations.

If you are unsure whether a gift from abroad may be taxed, seek professional advice. It’s also wise to keep records in case questions arise later from either UK or foreign tax authorities. Documentation can protect you from unintentional non-compliance.

What Happens If You Don’t Declare a Taxable Gift?

Failing to declare a taxable gift to HMRC can lead to serious consequences, especially if the donor passes away within seven years of making the gift.

When gifts that should be included in the Inheritance Tax calculation are not reported, it may result in penalties, interest charges, or tax liability shifting to the recipient.

HMRC expects executors to make reasonable efforts to uncover any gifts made by the deceased within the past seven years.

This includes speaking to family members, checking bank statements, and reviewing financial records. If gifts are omitted due to negligence or deliberate concealment, both the recipient and the executor may face liability.

Common risks of not declaring gifts include:

- Financial penalties for inaccurate Inheritance Tax reporting

- Personal liability for executors if HMRC finds they didn’t perform due diligence

- Retrospective interest on unpaid taxes

- Investigations by HMRC which can delay probate

For example, in a notable case (Hutchings v HMRC 2015), the deceased’s son failed to disclose a £440,000 gift. Although the executors had asked about gifts, the son deliberately withheld information.

HMRC imposed a penalty of £87,000 and demanded tax on the gift, which the son had to pay personally.

The best way to avoid issues is to stay transparent, declare large gifts properly, and maintain clear records. This ensures both you and your loved ones are protected from future tax complications.

How Much Can You Gift Tax-Free in the UK?

The UK provides various tax-free allowances for gifting money, allowing you to make financial contributions to loved ones without creating tax liability. These allowances are key tools for estate planning and reducing Inheritance Tax exposure.

Each individual has an annual exemption of £3,000 per tax year. This amount can be gifted to one person or divided among multiple people. If unused, you can carry it forward for one year only, giving you a potential £6,000 tax-free limit.

Other tax-free allowances include:

- Small gift exemption: You can give up to £250 to as many individuals as you like each tax year, provided they have not received any part of your £3,000 annual exemption.

- Wedding or civil partnership gifts: You can give £5,000 to a child, £2,500 to a grandchild or great-grandchild, and £1,000 to any other individual.

- Gifts between spouses or civil partners: Unlimited and completely exempt from tax if both parties are UK residents.

- Gifts from surplus income: If you can demonstrate that regular gifts come from your income and don’t impact your living standard, they are exempt.

Here’s a helpful overview table:

| Gift Type | Tax-Free Limit |

| Annual Exemption | £3,000 |

| Small Gifts | £250 per person |

| Wedding Gift (child) | £5,000 |

| Wedding Gift (grandchild) | £2,500 |

| Spouse/Civil Partner Gift | Unlimited (if UK resident) |

Using these allowances consistently helps prevent unexpected tax liabilities in the future.

How to Keep Track of Gifts for HMRC Purposes?

Keeping accurate records of your cash gifts is one of the most important things you can do to avoid potential issues with HMRC in the future.

While there’s no requirement to report every gift as you make it, documentation becomes essential if Inheritance Tax comes into play, especially when a donor dies within seven years of giving a significant gift.

You should maintain a simple log that records the date, amount, recipient’s name, and purpose of each gift. If you’re giving regularly, note whether it was from surplus income or part of a specific exemption. Saving copies of bank transfers or payment receipts will further support your records.

For estate executors, these logs provide crucial information when completing Inheritance Tax forms like IHT403. It also demonstrates transparency and reduces the risk of penalties for missed or incorrect disclosures.

Being organised now means your loved ones won’t face difficult questions later. A simple spreadsheet or notebook can protect both your finances and their peace of mind.

Conclusion

Cash gifts in the UK are not automatically taxed, but they are far from being tax-free in every situation. Knowing when you need to declare them to HMRC depends largely on the amount, the relationship between the giver and receiver, and most importantly, whether the donor survives for seven years.

By understanding exemptions, the annual allowance, and the impact of the 7-year rule, you can plan your gifting in a way that avoids unnecessary tax burdens.

From gifts between spouses to generous wedding contributions and regular payments from surplus income, the UK’s system allows many opportunities for tax-free giving. Still, clear record-keeping and honest disclosure are vital.

If you’re ever uncertain about whether a gift should be declared, it’s best to seek professional advice or consult HMRC directly. Being proactive today can prevent complex issues tomorrow.

FAQs

Can HMRC track cash gifts in the UK?

HMRC can investigate financial records during estate assessments, especially when large gifts are suspected. Keeping documented evidence helps avoid issues.

What forms do you use to declare gifts for Inheritance Tax?

Executors use Form IHT403 when reporting lifetime gifts during probate. This helps HMRC calculate any Inheritance Tax due.

Are gifts from parents to children taxable in the UK?

Not immediately, but if a parent dies within seven years and gifts exceed the threshold, Inheritance Tax may apply.

Can grandparents give grandchildren tax-free gifts?

Yes, using the annual exemption or small gift allowance. They can also give £2,500 tax-free as a wedding gift to a grandchild.

What happens if I don’t declare a gift that becomes taxable?

You could face fines or interest charges. Executors may also be held liable if they fail to declare a gift during probate.

Are overseas cash gifts taxable in the UK?

Usually not, unless the giver has UK assets or is still domiciled in the UK. Still, it’s wise to keep a record for transparency.

Do I need to include cash gifts in my Self Assessment?

No, cash gifts are not classed as income and don’t need to be reported on your Self Assessment tax return.

{

“@context”: “http://schema.org/”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Can HMRC track cash gifts in the UK?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “HMRC can investigate financial records during estate assessments, especially when large gifts are suspected. Keeping documented evidence helps avoid issues.”

}

},

{

“@type”: “Question”,

“name”: “What forms do you use to declare gifts for Inheritance Tax?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Executors use Form IHT403 when reporting lifetime gifts during probate. This helps HMRC calculate any Inheritance Tax due.”

}

},

{

“@type”: “Question”,

“name”: “Are gifts from parents to children taxable in the UK?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Not immediately, but if a parent dies within seven years and gifts exceed the threshold, Inheritance Tax may apply.”

}

},

{

“@type”: “Question”,

“name”: “Can grandparents give grandchildren tax-free gifts?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, using the annual exemption or small gift allowance. They can also give £2,500 tax-free as a wedding gift to a grandchild.”

}

},

{

“@type”: “Question”,

“name”: “What happens if I don’t declare a gift that becomes taxable?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “You could face fines or interest charges. Executors may also be held liable if they fail to declare a gift during probate.”

}

},

{

“@type”: “Question”,

“name”: “Are overseas cash gifts taxable in the UK?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Usually not, unless the giver has UK assets or is still domiciled in the UK. Still, it’s wise to keep a record for transparency.”

}

},

{

“@type”: “Question”,

“name”: “Do I need to include cash gifts in my Self Assessment?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “No, cash gifts are not classed as income and don’t need to be reported on your Self Assessment tax return.”

}

}

]

}