The case of Caoimhe Jennings’ pension struggle has shed light on severe flaws in the UK’s civil service pension system. Diagnosed with a terminal brain tumour, Caoimhe spent her final months battling not just illness but the administrative delays of a system that failed her at a critical time.

Her case was only resolved after political intervention at the highest level, revealing a broader issue affecting thousands across the UK.

Key Takeaways:

- Capita’s inherited backlog severely delayed Caoimhe’s ill-health pension

- A direct plea during PMQs led to a swift resolution for Caoimhe

- Thousands more could face similar pension delays without strong advocacy

- The UK civil service pension system faces a growing credibility crisis

Who is Caoimhe Jennings and What Is Her Story?

Caoimhe Jennings, a 27-year-old woman from Claudy in County Londonderry, found herself navigating an unimaginable personal crisis when she was diagnosed with a brain tumour in October 2025. What started with a routine optician appointment soon turned into a devastating revelation as doctors confirmed her illness was terminal.

Despite facing a grim prognosis, Caoimhe remained determined to make the most of her remaining time, marrying her partner Ollie while continuing her medical treatments.

In addition to undergoing chemotherapy, 30 rounds of radiotherapy, and multiple surgeries to relieve fluid pressure on her brain, Caoimhe had to face a parallel and distressing battle with bureaucracy.

Her efforts to claim an ill-health retirement pension from her former employer, HMRC, were met with delays, confusion, and a lack of urgency. Rather than spending precious time focusing on her health and loved ones, she was forced to engage in repeated phone calls and email exchanges with pension administrators.

Caoimhe’s story isn’t just a personal tragedy; it’s a reflection of a broken system that adds undue pressure on the most vulnerable in society.

What Went Wrong With Caoimhe Jennings’ Pension Claim?

Caoimhe’s pension journey was plagued with delays and inefficiencies from the very beginning, amplifying the emotional toll of her terminal diagnosis. The issues arose not from a lack of eligibility or incomplete documentation but from a multi-layered failure in how her case was handled and escalated. Below is a breakdown of what went wrong in her pension claim.

Ill-health retirement pension claim

After her diagnosis, Caoimhe applied for an ill-health retirement pension, a benefit available to individuals who are medically unfit to continue working. This should have been processed urgently, especially considering the critical nature of her condition.

However, the response she and her husband received was neither prompt nor reassuring. They were told her case would be prioritised, but the reality did not reflect that assurance.

Timeline of submission (HMRC → Civil Service Pensions → Capita)

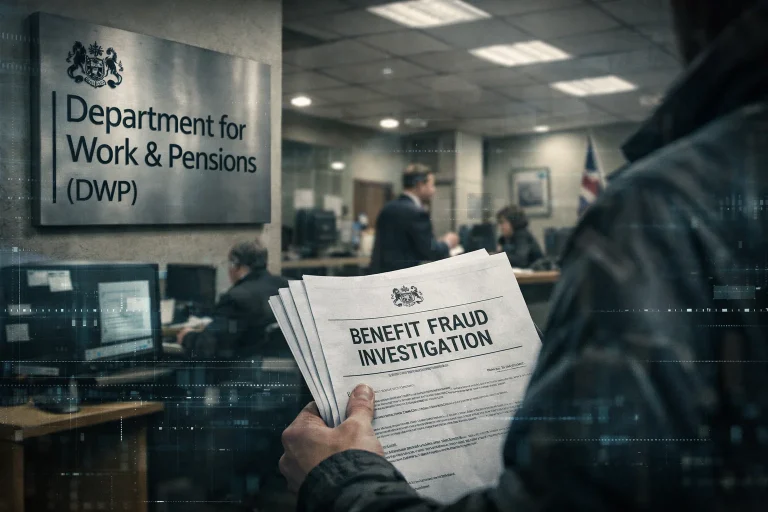

Her employer, HMRC, submitted the necessary documentation to the Civil Service Pensions team. From there, the paperwork was supposed to be handled by Capita, the new administrator of the Civil Service Pension Scheme, which had only recently taken over in December 2025.

According to Ollie, her husband, the problem likely emerged during the transition phase between the Civil Service Pensions and Capita. The 1 December data transfer appeared to be the breaking point, after which no further progress was made.

The couple attempted to get clarity by calling Capita on multiple occasions. On 12 January, after four hours on hold, they finally spoke to a representative who admitted that the request had never actually gone through. This meant that critical months had been lost in bureaucratic confusion.

Lump sum issues and delays

Eventually, a lump sum was paid to Caoimhe, but even that was riddled with issues. The couple noted that the payment was incomplete and potentially short by as much as £15,000. This further contributed to their financial strain during an already difficult period. Instead of being able to plan for medical care and comfort, they had to navigate financial uncertainty and incomplete payments.

This entire ordeal could have been prevented if a better tracking and escalation system was in place. A failure to act swiftly, combined with a lack of ownership between departments, created a nightmare scenario for a young woman already facing the biggest challenge of her life.

Why Did Capita Fail to Process the Pension on Time?

Capita’s failure to process Caoimhe Jennings’ pension claim was not an isolated error but rather part of a broader administrative collapse that occurred during a period of transition. In December 2025, Capita officially took over the administration of the Civil Service Pension Scheme. However, it became evident that the firm had inherited a much larger backlog of unresolved cases than it had anticipated.

This backlog meant that even priority cases, such as ill-health retirements, were caught in limbo. Capita underestimated the complexity and volume of cases it would need to handle, and the internal systems in place were not ready to deal with such a surge.

As a result, thousands of pensioners were impacted, and many, like Caoimhe, were left waiting with no income or clarity on the status of their pensions. Capita has since admitted its shortcomings, but the damage caused during this period speaks to a systemic lack of preparedness and planning.

How Did the Pension Struggle Impact Caoimhe and Her Family?

The effect of the pension struggle on Caoimhe and her family went beyond inconvenience; it added unnecessary emotional and financial burden to an already dire situation.

At a time when they should have been focusing on treatment and time together, they were instead forced to chase after payments and wait in uncertainty.

Financial uncertainty during terminal illness

The delayed pension payout meant the family had to cope without financial support during a highly stressful period. Without a timely lump sum, planning for care, treatment, and even basic living expenses became increasingly difficult. The uncertainty surrounding their finances only deepened the sense of instability in their lives.

- Lack of funds for medical support and comfort

- Difficulty managing day-to-day expenses during treatment

- No access to expected retirement benefits at a critical time

Emotional stress of delayed payments

Repeatedly calling government departments, spending hours on hold, and being passed from one agency to another placed immense emotional pressure on Caoimhe and Ollie. What was supposed to be a period focused on healing and spending meaningful moments together turned into a bureaucratic battle.

- Increased mental stress alongside physical illness

- Time lost on advocacy instead of care

- Strain on relationships and morale

Incorrect lump sum amount

Even when Capita processed the claim, the final payout was incorrect. Caoimhe and Ollie believe they are still owed as much as £15,000, but there is no clear communication on how or when that will be resolved.

This financial discrepancy left them uncertain and without closure. They continue to question the reliability of the information and calculations provided.

These compounded factors created a situation that could have been avoided if urgency and accuracy had been applied from the beginning.

Who Stepped In to Support Caoimhe Jennings?

With no resolution in sight, Caoimhe and Ollie turned to their local MP, Gregory Campbell of the Democratic Unionist Party (DUP). His intervention proved critical. Campbell took their case to the House of Commons, raising it directly during Prime Minister’s Questions (PMQs). Within 20 minutes of raising the matter, he received a call from Capita looking to address the issue.

This political pressure finally broke the impasse, resulting in a payment, albeit an incorrect one, to Caoimhe. Campbell later commented that while he was able to use his position to help, there are “many thousands of people in similar positions” who won’t have that level of advocacy. This highlights a broader problem: systemic delays that require political intervention to resolve are not sustainable or fair.

What Does Capita Say About the Backlog and Apology?

Capita acknowledged the distress caused by their delays and responded with a public statement following the media attention surrounding Caoimhe’s case. They confirmed that the issue was part of a larger problem inherited from the previous administration process and expressed regret over the delays.

Key points from Capita’s response:

- They issued a sincere apology to Caoimhe and her family

- Confirmed that her case was part of a backlog inherited in December 2025

- Promised to prioritise ill-health retirement and hardship cases going forward

- Committed to working with the Cabinet Office and increasing resources

While these words were welcomed, the delay in action and the initial failure to communicate responsibly continues to erode public confidence in Capita’s handling of pensions.

Are Others Affected by the Capita Pension Delays?

Caoimhe’s case, though high-profile, is not an isolated incident. According to her MP and reports from various civil servants, thousands of others have experienced similar delays in pension payments.

Wider Impact:

- Many former public sector employees went a full month with no income

- The data transfer and backlog have affected both retirees and terminally ill applicants

- Delays have led to mounting pressure on Capita and the UK Government to respond

This reveals a systemic issue that goes far beyond one case and signals the urgent need for reform across the entire civil service pension process.

What Can Be Done to Prevent More Cases Like Caoimhe’s?

The failure in Caoimhe’s case has prompted calls for systemic reform and stronger oversight of pension administration in the UK. Preventing such incidents will require immediate and long-term changes.

Potential solutions:

- Establish a dedicated escalation pathway for ill-health and hardship cases

- Improve communication between government departments and administrators

- Introduce legally binding response timelines for pension processing

- Conduct regular independent audits of pension administrators

Implementing these measures would prevent vulnerable individuals from being caught in administrative delays that could drastically affect their lives.

What Can the UK Public Learn from Caoimhe Jennings’ Pension Struggle?

Caoimhe Jennings’ experience offers a stark lesson in the importance of advocacy, awareness, and reform. UK citizens must be informed about their rights and know how to navigate pension processes effectively.

Takeaways for the public:

- Understand your ill-health retirement rights and entitlements

- Don’t hesitate to involve your local MP in unresolved matters

- Keep written records and timelines when dealing with pension authorities

- Raise awareness about systemic issues through appropriate channels

Her case underlines the need for persistence and the importance of speaking out, not just for oneself but for others facing similar battles.

Conclusion: Caoimhe’s Fight Sparks a Call for Change

Caoimhe Jennings’ story is one of both courage and systemic failure. While her medical battle was unavoidable, the bureaucratic obstacles she faced were entirely preventable. Her case highlights serious gaps in the UK’s pension system, particularly in how ill-health retirement claims are managed during times of organisational transition.

The public response, combined with media and political attention, has ignited a call for reform. Thousands of people depend on pension systems functioning efficiently, especially during times of crisis.

The need for accountability and efficiency in such vital matters can no longer be ignored. Caoimhe’s struggle should not be in vain; it should be the turning point that drives permanent change.

FAQs

What is an ill-health retirement pension in the UK?

An ill-health retirement pension is provided to employees who can no longer work due to serious medical conditions. It’s often available through public sector schemes like Civil Service Pensions.

Who administers civil service pensions in the UK?

Capita currently manages the administration of Civil Service Pensions. They took over the role in December 2025.

What caused delays in Caoimhe Jennings’ pension claim?

Her claim was delayed due to a backlog inherited by Capita and data transfer issues during their takeover. These errors caused missed communications and processing failures.

Can an MP help with pension issues?

Yes, MPs can raise pension cases in Parliament or directly with administrators. In Caoimhe’s case, this led to a quick resolution.

How many people are affected by the Capita pension delays?

Thousands of former civil servants have faced delays and missed payments. Capita admitted the issue stems from a significant case backlog.

What actions has Capita taken since the incident?

Capita apologised, promised to prioritise urgent cases, and increased staffing. They are working with the Cabinet Office to improve systems.

What should pension claimants do if facing delays?

Claimants should document all interactions and escalate unresolved issues. Contacting an MP or using official complaints processes can help.