Understanding the dwp state pension age change 2026 is becoming increasingly important if you are planning your retirement in the UK.

You might have heard speculation about an abrupt rise to 67 in 2026 but the reality is more gradual and structured. The government is preparing for a phased increase that reflects changes in life expectancy and long term financial planning.

This shift affects millions of workers and knowing what it means for you can help you make confident decisions about your future. As the new timetable begins in 2026 you may find that your retirement date is only moving by a few months rather than by a whole year.

This blog guides you through the facts so you can clearly understand how the change will apply to your own pension age and financial plans.

What Is the DWP State Pension Age Change in 2026?

The dwp state pension age change 2026 marks the beginning of the transition from age 66 to age 67 and it will happen gradually rather than overnight.

Instead of introducing a single date where everyone suddenly faces a later pension age the government will phase the rise from April 2026 until April 2028.

This phased increase means you will see your State Pension age shift by a number of months depending on your date of birth. The change has been legislated under the Pensions Act 2014 and reflects long term demographic pressures highlighted through the official State Pension age review.

During this period the move from 66 to 67 will follow a structured timetable. The transition is designed to be predictable so that you can plan your retirement with clarity.

The government aims to ensure that each generation spends a balanced share of life contributing to and drawing from the State Pension system.

This section closes by highlighting the core point that the increase does not happen in a single moment and understanding this timeline is vital as you consider your next steps.

Who Will Be Affected by the State Pension Age Increase?

The people most directly affected by the DWP state pension age change 2026 are those born between 6 April 1960 and 5 March 1961. If your birthday falls within this period your State Pension age will rise by a number of months rather than a full year.

This gradual rise means your exact pension age could be 66 years and 1 month or up to 66 years and 11 months depending on your birth month. For example someone born in May 1960 may reach pension age at 66 years and 1 month while someone born in February 1961 may reach it at 66 years and 11 months.

The following groups are affected:

- Individuals born from April 1960 to early March 1961

- Workers approaching retirement who must adapt their plans

- People calculating future entitlement based on individual National Insurance history

This phased structure is intended to reduce the effect of a sudden change and offer more predictability. If you fall just after the defined birth date window your State Pension age will be 67.

In closing this section emphasises that understanding your birth date in relation to the timetable is the most important step for knowing exactly how you are affected.

How Can You Check Your Exact State Pension Age?

The easiest way to find out how the dwp state pension age change 2026 affects you is by checking your personalised pension age using the official tools provided by the government.

Because the rise is phased the month of your birth determines the precise point at which you qualify for your State Pension. Even small differences in birth dates can lead to different outcomes so using an accurate calculator is essential.

You can check your State Pension age using:

- The GOV UK State Pension age calculator

- Age UK resources that explain eligibility and provide guidance

- National Insurance record tools that help you understand qualifying years

These tools give you a specific date rather than an estimate which helps you plan your retirement income more effectively. You will also be able to check how many National Insurance years you have built up and any gaps you might need to fill to achieve the full State Pension.

To close this section remember that checking your date now is the strongest step you can take to prepare and avoid unexpected changes in your retirement timeline.

Why Is the UK Government Increasing the State Pension Age?

The increase linked to the dwp state pension age change 2026 is driven by long term demographic and economic pressures highlighted in the official State Pension age reviews. The UK population is living longer, and this means more people are drawing the State Pension for a longer period of time.

The State Pension system is funded on a pay as you go basis, where current workers contribute to the National Insurance Fund, which pays today’s pensioners. As life expectancy grows the government must ensure the fund remains sustainable for future generations.

Independent experts were appointed under the Pensions Act 2014 to examine the factors shaping this decision. These include life expectancy trends, fiscal sustainability and the importance of giving each generation a fair balance between working years and retirement years. Other countries sometimes use automatic adjustment systems to link pension age to life expectanc,y but the UK does not currently apply that approach.

To conclude this section the government considers the increase necessary to protect the long term stability of the State Pension and to keep it reliable for the future.

What Is the Full Timetable for the Pension Age Change?

The timetable created for the dwp state pension age change 2026 outlines how the rise from 66 to 67 will unfold step by step from April 2026 to April 2028. This gradual approach helps individuals prepare for the adjustment and prevents sudden impacts on retirement planning.

If you were born between April 1960 and early March 1961, your State Pension age will increase in monthly increments. People born after 5 March 1961 will have a standard State Pension age of 67.

Below is a simplified version of the official timetable that shows how the increase progresses. Use this table to see how your birth date aligns with the phased rise.

| Date of Birth Range | State Pension Age |

|---|---|

| 6 April 1960 to 5 May 1960 | 66 years 1 month |

| 6 May 1960 to 5 June 1960 | 66 years 2 months |

| 6 June 1960 to 5 July 1960 | 66 years 3 months |

| 6 July 1960 to 5 August 1960 | 66 years 4 months |

| 6 August 1960 to 5 September 1960 | 66 years 5 months |

| 6 September 1960 to 5 October 1960 | 66 years 6 months |

| 6 October 1960 to 5 November 1960 | 66 years 7 months |

| 6 November 1960 to 5 December 1960 | 66 years 8 months |

| 6 December 1960 to 5 January 1961 | 66 years 9 months |

| 6 January 1961 to 5 February 1961 | 66 years 10 months |

| 6 February 1961 to 5 March 1961 | 66 years 11 months |

| After 5 March 1961 | 67 |

While the table gives the core pattern, the exact date you qualify depends on the specific day you were born. The section finishes by noting that understanding this timetable gives you a clear view of when your retirement begins and helps you plan how to manage your income.

How Will This Change Impact Your Retirement Plans?

The dwp state pension age change 2026 can influence your retirement in various ways, depending on your financial plans, career choices, and expected income sources.

If your State Pension age increases by several months, you may need to adjust your work timeline or savings strategy accordingly. Since many people rely on a mix of State Pension, private pensions, and personal savings, even small shifts in timing can affect long term financial stability. The phased increase gives you time to prepare, but it is still important to review your goals and income needs.

Ways the change may affect your planning:

- You might remain in employment longer before receiving your State Pension

- Your private pension withdrawals may need to bridge a slightly longer gap

- You may want to reassess savings contributions to support a smooth transition

- Deferring the State Pension could become part of your strategy if you want to increase your weekly amount

This section concludes by pointing out that preparing early ensures you keep control of your retirement journey and remain confident about your financial future.

What Benefits Can You Claim at or After Your State Pension Age?

When the dwp state pension age change 2026 takes effect, you will still gain access to a range of support when you reach your qualifying age. These benefits are designed to help older adults manage living costs and provide financial security in retirement.

Some benefits become available only once you reach State Pension age, while others remain unchanged but still offer useful assistance. Understanding what you can claim ensures that you do not miss out on help that you are entitled to.

Attendance Allowance

Attendance Allowance supports you if you have care needs and are over State Pension age. It is not based on income and helps with the extra costs of managing health conditions.

Winter Fuel Payment

Winter Fuel Payment assists with heating costs during colder months. The amount varies depending on age and living circumstances and is available once you meet the qualifying age and conditions.

Pension Credit

Pension Credit helps boost your income if your weekly earnings are below a certain threshold. It can also provide access to other types of assistance, including help with housing and health costs.

In addition to these core benefits you may also be eligible for:

- A free bus pass once you reach State Pension age

- A free TV licence at age seventy five if you receive Pension Credit

- A Senior Railcard at age sixty, which offers reduced travel costs

- Additional regional suppor,t depending on where you live in the UK

This section concludes by reminding you that reviewing your eligibility as you approach State Pension age ensures you receive the full range of support available.

What Benefits Stop Once You Reach State Pension Age?

When you reach your qualifying age under the dwp state pension age change 2026 certain benefits will no longer continue because they are designed specifically for working age adults.

Understanding which benefits end at State Pension age helps you prepare for adjustments in your income and plan future support needs. Income based working age benefits usually stop at this stage and you may transition to other types of help that are tailored to pensioners.

The main benefits that stop at State Pension age include:

- Income-based Jobseekers Allowance and Income related Employment and Support Allowance

- Income Support and Universal Credit once you reach your qualifying age

- New Style Jobseekers Allowance and Contributory Employment and Support Allowance

- New claims for Disability Living Allowance Adult Disability Payment and Personal Independence Payment

You may continue receiving some of these only if you were already claiming them before pension age and meet specific eligibility rules. This section ends by explaining that knowing which benefits change ensures you are not surprised by adjustments and can plan ahead for replacement support.

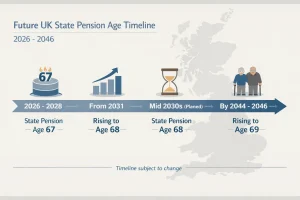

What Is Changing in the Future After 2026?

The dwp state pension age change 2026 is only the beginning of a wider pattern of adjustments as the UK responds to long term demographic shifts. After the rise from 66 to 67 is completed in 2028, the next planned increase is the move from 67 to 6,8 which is scheduled to take place between 2044 and 2046.

This longer term timetable has been outlined in existing legislation, although future State Pension age reviews may recommend changes depending on life expectancy, economic data, and the balance of working years and retirement years. There is also the possibility that future governments could propose alternative dates.

Previous reviews have explored whether pension ages should be tied more directly to life expectancy and whether adjustments should be made more frequently to reflect demographic change. Although the UK does not currently use automatic adjustment systems these discussions remain active.

To conclude this section it is important to recognise that any future changes will go through parliament and clear timetables will be provided to help you prepare.

How Should You Prepare for the State Pension Age Change?

Preparing for the dwp state pension age change 2026 is an important step for anyone approaching retirement. Since your qualifying age may increase by several months, planning ahead can ensure you have enough financial support before the State Pension begins.

Reviewing your savings and understanding how your private pension works will help you build a realistic timeline for when you want to stop working. Checking your National Insurance record is also essential because it affects how much State Pension you qualify for.

Helpful steps to prepare:

- Check the GOV UK calculator to confirm your exact State Pension age

- Review your National Insurance record for gaps and consider voluntary contributions

- Assess private pension arrangements and how they can support you before State Pension payments begin

- Consider whether working slightly longer supports your plans

- Explore whether Pension Credit or other support may apply when you reach pension age

This section finishes by emphasising that early preparation gives you confidence and stability as you move into the next stage of your life.

Conclusion

The dwp state pension age change 2026 marks an important shift in how retirement planning works for people across the UK. With the transition from age 66 to 67 taking place gradually you have time to prepare and understand exactly how your own retirement age will be affected.

The phased timetable offers clarity by showing how each birth date fits into the new rules and it reflects the wider changes in life expectancy and population needs.

As you consider the next stage of your life it is vital to use the official tools available to check your qualifying age and understand how your National Insurance record shapes your entitlement. By planning ahead you can ensure that your income remains steady and that you make informed decisions about work and retirement. This change is significant but with preparation you can navigate it confidently.

FAQs

Will I still qualify for the full State Pension under the new age rules?

You can still qualify for the full State Pension if you have the required National Insurance years. The age change does not alter the number of qualifying years needed.

Can I claim State Pension and continue working past my qualifying age?

Yes you can keep working and still receive your State Pension. Your income from work does not reduce your State Pension amount.

What happens if I choose to defer my State Pension after the age increase?

Deferring your State Pension increases the amount you receive later. This can help you build a higher income if you do not need to claim immediately.

How does the age change affect carers who have gaps in work history?

Carers can still receive credits that protect their National Insurance record. This helps ensure they are not disadvantaged when the State Pension age rises.

What if I have worked abroad during my career?

Time spent working in certain countries may count towards your qualifying years. Checking your record is important to understand how overseas work affects your entitlement.

Can I rely on my partner’s National Insurance record to increase my pension?

The State Pension is mostly based on your own National Insurance history. In limited cases you may inherit some of your partner’s entitlement if they passed away.

Are there any regional differences in how the pension age change applies across the UK?

The increase applies equally across England Scotland Wales and Northern Ireland. Local authorities may offer different support but the State Pension age is the same nationwide.