Have you heard that the Department for Work and Pensions (DWP) plans to check bank accounts, even for those not claiming benefits? This policy marks a major change in how benefit fraud is investigated across the UK.

While many understand the need to protect public funds, others worry about privacy, oversight, and unintended consequences. The DWP’s approach focuses on using data-sharing technology, financial indicators, and targeted investigations to identify suspicious behaviour linked to fraud.

But does this mean everyone’s financial information is up for review? Not exactly. The new system will not spy on every citizen but will zero in on specific eligibility red flags, like unexplained income or savings above £6,000. In this blog, you’ll find everything you need to know, from how the checks will work to when they’ll begin and how they may affect you.

Why is the DWP Launching Bank Account Checks for Non-Claimants?

The Department for Work and Pensions (DWP) is ramping up its anti-fraud efforts to tackle a growing problem in the UK benefits system.

With benefit fraud accounting for nearly 40% of all crime in recent statistics, and following widespread concern about misuse of Universal Credit, the DWP is now implementing stricter oversight policies, including bank account checks for individuals not actively claiming benefits.

In 2022–23, the government stopped a staggering £18 billion from going into the wrong hands. Secretary of State for Work and Pensions, Mel Stride, stated:

We are scaling up the fight against those stealing from the taxpayer, building on our success in stopping £18 billion going into the wrong hands in 2022–23. With new legal powers, better data and thousands of additional staff, our comprehensive plan ensures we have the necessary tools to tackle the scourge of benefit fraud.

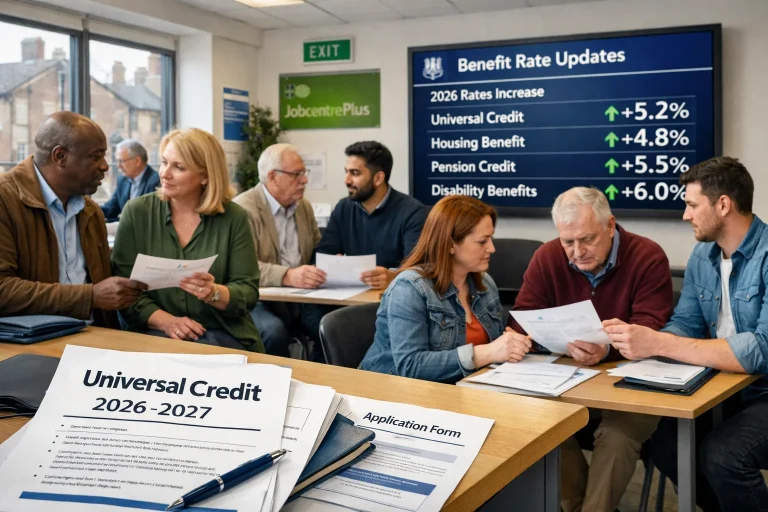

This initiative forms part of a wider strategy, which includes hiring over 2,500 staff, introducing civil penalties, and modernising data collection through new legislation. The goal is to save £9 billion by 2027/28, ensure accurate benefit delivery, and restore public confidence in the welfare system.

How Will the DWP’s Bank Account Checks Work in Practice?

The system the DWP is implementing uses a combination of automated technology, bank cooperation, and legal powers to spot potentially fraudulent behaviour early. It relies on collaboration between the DWP, banks, building societies, and HMRC to share limited but crucial financial data.

What Kind of Data Will Banks Provide to the DWP?

Banks will not share your full transaction history. Instead, they’ll provide summary-level data that highlights financial behaviour inconsistent with benefit eligibility.

This includes:

- Account balances exceeding savings limits, such as the £6,000 or £16,000 threshold

- Unusual patterns like frequent large deposits or multiple bank accounts

- International transfers or indicators suggesting someone is living abroad

This data is provided without revealing personal spending details. Banks are instructed to share only what’s necessary and relevant to fraud detection.

Will All Accounts Be Monitored or Only Specific Ones?

Not all bank accounts will be automatically reviewed. The checks are not universal or random. Instead, the system uses specific eligibility indicators to highlight accounts that warrant further investigation. These flags may appear if someone is linked to a benefit claim or suspected of providing false information.

How Does the System Flag Potentially Fraudulent Activity?

The process begins with banks using algorithms to automatically flag anomalies. Once flagged, summary information is securely passed to the DWP, which may then conduct a deeper investigation.

This system is part of the Data Protection and Digital Information Bill, ensuring checks are GDPR compliant and data is only accessed when necessary. The goal is to make the process smarter, faster, and more focused, protecting public funds while minimising intrusion.

Who Could Be Affected by These New Checks?

You might assume that these checks only apply to people actively receiving benefits, but that’s not the case. The DWP’s new policy is designed to include a wider range of individuals, including those not currently claiming benefits but suspected of fraudulently receiving payments or hiding undeclared savings or income.

If you receive Universal Credit, Employment and Support Allowance, or Pension Credit, your bank data may be reviewed if certain red flags appear. Even if you’re not a benefit recipient, you could be scrutinised if the DWP has reason to believe you’re wrongly accessing support or have undeclared capital affecting your eligibility.

There are, however, notable exemptions. The State Pension is excluded from these new powers, meaning pensioners solely relying on it will not be targeted.

Additionally, the system focuses on specific indicators rather than mass monitoring, so you won’t be checked unless something in your financial profile triggers a review. This targeted approach is intended to reduce unnecessary anxiety among genuine claimants or unaffected individuals.

What Exactly Triggers a DWP Investigation Into Your Bank Account?

The DWP will not randomly access bank accounts. Specific financial behaviours, known as eligibility indicators, are required to trigger a bank check or investigation. These indicators have been developed to identify possible fraud or incorrect claims while avoiding unnecessary data gathering.

One of the most common triggers is savings exceeding certain thresholds, which can impact benefit eligibility. For instance, under Universal Credit rules, you typically cannot have more than £16,000 in savings and still qualify, unless a specific exemption applies. If a flagged bank account shows savings above that amount and the individual has not declared it, the DWP may initiate a deeper inquiry.

Other triggers include undeclared income, frequent large deposits, or international transactions suggesting someone may not be residing in the UK while claiming benefits. These patterns are reviewed in relation to the specific benefit rules.

Importantly, no decision will be made based on these financial flags alone. The DWP will assess each case individually before taking further action, ensuring that genuine claimants are not penalised unfairly.

When Will These New Measures Be Rolled Out?

The DWP’s new bank account check system will not begin overnight. It will follow a staged rollout, starting with pilot testing in 2025 and 2026. These early trials will allow the department to work with selected banks and technology providers to fine-tune the fraud detection process and address any legal or technical issues.

Full national implementation is expected to begin in 2027, with the system being fully operational by 2028. This timeline aligns with the government’s broader five-year plan to modernise the welfare system and tackle fraud more effectively.

By testing the system beforehand, the DWP aims to ensure that the checks are not only accurate but also fair, secure, and compliant with data protection laws.

During the pilot, the department will assess the performance of fraud detection algorithms, the flow of secure data between banks and the DWP, and the clarity of communication with those being flagged. The government has committed to transparency throughout the rollout, with updates likely to be published annually as the system evolves.

What Are the Legal and Privacy Implications of This Policy?

With the rise in digital fraud prevention, questions naturally arise about privacy and legal safeguards. The DWP insists that its approach complies with the UK GDPR and the Data Protection and Digital Information Bill, which is currently being finalised in Parliament.

The policy does not grant access to full transaction histories. Instead, it relies on high-level financial data provided by banks under strict legal guidelines. Banks will only share relevant data, such as account balances or unusual patterns if specific triggers are met.

Key privacy safeguards include:

- End-to-end encryption of all shared data

- Limited data sharing, focused only on relevant financial indicators

- Independent audits and DWP oversight procedures

- Automatic deletion of data once investigations are complete

Importantly, individuals are not randomly selected. Each case must present a clear eligibility mismatch before the DWP can proceed. These systems aim to ensure that public funds are protected without overstepping legal boundaries or eroding citizens’ rights.

How Is the DWP Using Technology to Detect Benefit Fraud?

The DWP is backing its anti-fraud campaign with £70 million in advanced data analytics and AI systems, aiming to automate the detection of irregularities across millions of claims. These systems are now complemented by human decision-makers, ensuring a fair review process before any action is taken.

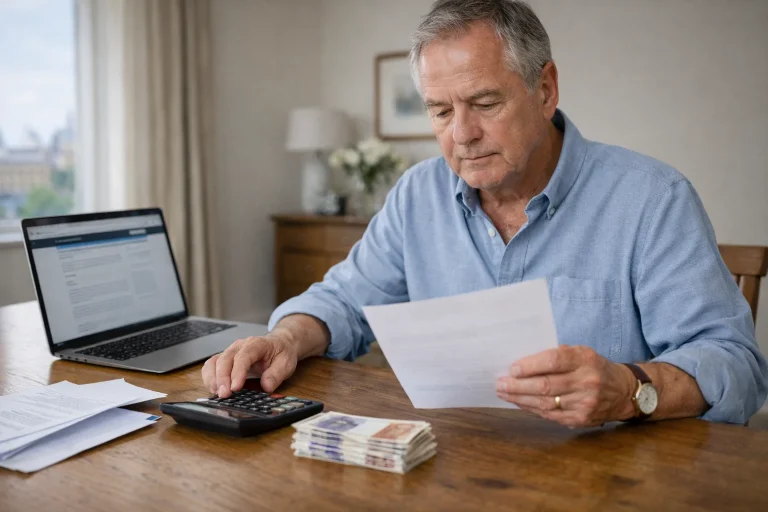

The core of this strategy lies in automated systems that cross-reference bank data with declared benefit information. When mismatches occur, such as reporting £2,000 in savings while a bank balance shows £10,000, the system flags it for further review.

Technology highlights include:

- Machine learning algorithms to detect suspicious patterns

- Cross-checking tools across banks, DWP, and HMRC databases

- Automated prompts for claimants to update details

This shift is part of the broader Fraud Plan, including increased checks on self-employment income and capital declarations. Together, these measures aim to prevent misuse before it happens, improving benefit accuracy and efficiency.

What Are Experts and Privacy Campaigners Saying About This?

The DWP’s expanded powers and bank checks have sparked national debate. While some view the policy as a logical next step in modernising welfare, others argue it treads a fine line between fraud prevention and government overreach.

What Concerns Have Privacy Advocates Raised?

Groups like Big Brother Watch warn that even limited financial data sharing could set a precedent for broader surveillance. Their concern is that once this system is active, it might become easier for the government to access deeper financial information without strict oversight.

They highlight the need for clear boundaries, continuous auditing, and public transparency, so citizens don’t feel unduly monitored when claiming help they’re entitled to.

How Are Banks and MPs reacting to This Policy?

Banks have raised concerns about the technical and legal complexities of creating secure systems to share data. MPs across party lines have called for transparency and assurances that the system won’t lead to wrongful investigations or deter people from seeking support. Some MPs have also asked for an appeals process and strong safeguards for those flagged incorrectly.

Is This Being Compared to Surveillance?

Yes. While the DWP maintains that it will only access summary data and not track purchases, critics argue that any system monitoring financial behaviour could slide into surveillance territory if not carefully monitored.

Digital ethics experts like Dr Rachel Coldicutt say these checks could be effective if oversight remains strong, adding that public trust must be maintained at every stage of implementation. Without that, even well-intentioned policies could have long-term reputational damage.

Will These Checks Improve or Undermine Public Trust in the Welfare System?

Public trust in the welfare system hinges on fairness, transparency, and the responsible use of power. The DWP hopes these new checks will reassure taxpayers that public money is being protected and only going to those who truly qualify.

By reducing fraudulent claims, more resources can be directed toward individuals and families in genuine need. However, some fear the opposite may happen.

Critics argue that the policy could create a culture of suspicion where even honest claimants worry about being wrongly targeted. People facing mental health challenges or older adults may hesitate to claim benefits, fearing that their bank accounts will be under watch.

Important factors that could influence public trust include:

- Whether the DWP communicates clearly and regularly with citizens

- Transparency in how flagged accounts are handled

- Availability of support for wrongly flagged individuals

The DWP must walk a fine line. To maintain public confidence, it must act proportionately, avoid heavy-handed measures, and reassure citizens that privacy and fairness remain top priorities.

What’s the Difference Between DWP Fraud Checks Now and After the New Powers?

The DWP’s approach to fraud detection is undergoing a significant transformation. Until now, investigations largely relied on manual checks and information directly provided by claimants.

The new system moves towards a more automated, data-driven approach, with banks and algorithms playing a much larger role.

Previously, the DWP focused on claimants who were already receiving benefits, relying on internal databases and information shared with HMRC. With these new powers, the department can also investigate non-claimants if there’s reason to believe they may be receiving benefits fraudulently or have undeclared savings.

Here’s a quick comparison:

| Aspect | Before New Policy | After New Policy |

|---|---|---|

| Data Access | Claimants only | Claimants and flagged non-claimants |

| Source of Data | DWP & HMRC records | Banks, building societies, HMRC |

| Fraud Detection | Manual case-by-case checks | Automated flagging with AI-based analysis |

| Privacy Oversight | GDPR standard | Updated with enhanced digital safeguards |

| Implementation Style | Reactive checks | Continuous, proactive data monitoring |

Is the DWP’s New Approach Justified or Overreaching?

Opinions are divided on whether the DWP’s expanded approach is a necessary evolution or a potential overreach. On one hand, the numbers are compelling.

The government recently saved £1.3 billion in a single year, and broke up a £53.9 million fraud ring, the largest benefit scam ever prosecuted in the UK.

To push further, the DWP is targeting £9 billion in savings by 2028, powered by new laws, enhanced data collection, and thousands of trained investigators. The use of civil penalties and AI-backed fraud detection tools show a determined shift toward modernising enforcement.

However, critics fear these tools may go too far. Some warn that surveillance-like features could deter honest claimants or unfairly penalise those with complex finances.

The reality may lie somewhere in between. If the government maintains oversight, protects personal data, and handles investigations transparently, this policy could indeed improve the welfare system. But if misused, it risks undermining public confidence and deterring rightful claims.

Conclusion

The DWP’s plan to launch bank account checks for those not claiming benefits represents a new era in digital fraud prevention. It’s a bold move aimed at protecting public money, but one that must balance efficiency with privacy.

While the system promises to target only those accounts that show strong eligibility red flags, its success depends on careful implementation, transparency, and trust. Public concern is justified, especially around privacy and potential misuse, so the DWP must continue to reassure the public with clear communication and fair processes.

As implementation begins from 2025 onward, individuals are advised to keep their benefit records accurate and financial disclosures transparent. With careful monitoring, this policy could create a stronger, fairer, and more fraud-resistant welfare system, provided it respects the rights of the people it serves.

FAQs

When will the DWP start checking bank accounts?

The pilot phase begins in 2025 with full rollout expected in 2027.

Who will the DWP check first?

Initial checks will focus on benefit claimants, expanding to flagged non-claimants later.

Will the DWP see all my bank transactions?

No. Only summary data like balances and patterns are shared, not individual purchases.

Can I refuse DWP access to my bank details?

No. Under the new bill, DWP can request data without your consent for fraud detection.

How can I protect my privacy under the new system?

Ensure your financial records are honest and accurate, and know your data rights.

Are State Pension claimants included in these checks?

No. Those only receiving the State Pension are exempt from these measures.

What if my account is flagged incorrectly?

You’ll be contacted and can provide evidence. An appeal process is available if needed.