The Department for Work and Pensions (DWP) now has legal powers to check the bank details of people claiming Universal Credit, Pension Credit, and ESA.

The move, launched under new 2025 legislation, aims to prevent fraud, correct overpayments, and ensure claimants receive what they’re entitled to without misuse or error. These checks are targeted, controlled, and limited to specific data.

Key Takeaways:

- DWP can request limited financial data under new powers

- Only applies to Universal Credit, Pension Credit, and ESA

- Transaction history is not shared, only eligibility indicators

- Human oversight remains central to any benefit decision

- Claimants must report changes in finances to stay compliant

What Has Changed in the DWP’s Powers in 2026?

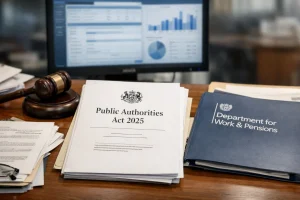

In 2026, the DWP’s ability to detect potential fraud has been significantly enhanced by the introduction of Eligibility Verification Notices (EVNs).

These notices stem from the Public Authorities (Fraud, Error and Recovery) Act, giving the department authority to request banks to verify whether benefit claimants still meet the eligibility requirements for specific welfare payments.

This does not mean a complete surveillance system. Instead, it enables the DWP to flag accounts that show specific indicators, such as holding more in savings than permitted under benefit rules.

Importantly, the system ensures that personal financial privacy is protected, as banks are only required to confirm whether an account meets predefined eligibility triggers.

For instance, they may verify whether a claimant has over £16,000 in savings, which is the capital threshold for Universal Credit.

The intention is not to penalise but to maintain accuracy in the benefits system by identifying and correcting errors before they escalate into larger debts.

Which Bank Accounts Can the DWP Check?

The DWP is limited to examining accounts directly linked to benefit payments under the new rules. This ensures the checks are not random or broad but highly targeted.

The legislation covers only those who receive certain means-tested benefits, namely:

- Universal Credit

- Pension Credit

- Employment and Support Allowance (ESA)

Other payments like the State Pension or Disability Living Allowance are excluded. This legal framework ensures the checks are focused on high-risk areas where means-testing requires financial accuracy.

Banks can also be asked to review linked accounts, these are secondary or joint accounts connected to the main claimant. The purpose is to check for red flags like exceeding capital thresholds or having unreported income.

It’s important to note that no one’s entire financial history is shared, only specific accounts linked to benefit eligibility are checked for compliance.

Key eligibility limits include:

- Universal Credit: Capital limit of £16,000

- Pension Credit: Savings over £10,000 may reduce payments

- ESA: Capital over £16,000 generally disqualifies claimants

These checks are designed to improve fairness and accuracy, not surveillance.

How Does the Eligibility Verification Notice Work?

The Eligibility Verification Notice (EVN) is the formal document the DWP sends to banks requesting specific checks. This request is highly restricted and only applies to accounts that have received benefits listed under the new powers.

Banks do not hand over full account histories. Instead, they run internal checks against a set of eligibility indicators defined by the DWP.

If the account matches any of these indicators such as exceeding the savings limit or showing regular unexplained income, the bank flags the account back to the DWP.

The banks can confirm:

- Account ownership and matching personal details

- Whether account balance exceeds a defined threshold

- Signs of income that may affect benefit eligibility

They cannot share:

- Purchase or transaction history

- Details about spending habits

- Unrelated financial information

Every request must be deemed necessary and proportionate, and is governed under the UK GDPR and Data Protection Act. Banks are warned not to overshare and can face penalties if they do. The DWP’s own code of practice ensures transparency, while independent annual oversight reports are submitted to Parliament.

Which Banks Are Involved in Sharing Information with the DWP?

A wide range of high street and digital banks are now legally required to cooperate with the DWP under the EVN process.

These institutions are not choosing to share data voluntarily; they are complying with legislation that mandates controlled sharing of relevant information.

The banks that are currently part of the programme include:

- Bank of Scotland

- Barclays

- Halifax

- HSBC

- Lloyds Bank

- Metro Bank

- Monzo Bank

- NatWest

- Nationwide

- Santander

- Starling Bank

- The Co-operative Bank

- Royal Bank of Scotland (RBS)

- TSB

- Yorkshire Bank

These banks are required to review customer accounts flagged in the DWP’s EVNs and return only the data points outlined in the notice. All shared data must directly relate to the benefit being reviewed and remain limited in scope.

Financial institutions risk regulatory consequences if they exceed the bounds of the EVN. Therefore, strict processes are in place to ensure compliance with data protection standards and to protect customers from unnecessary intrusion.

What Triggers a Bank Check by the DWP?

Bank checks under this scheme are not random. The DWP initiates a check only when certain triggers or red flags arise from its internal systems or cross-agency data.

These triggers may include:

- Claimants reporting savings far below what banks show

- Accounts that receive frequent large deposits

- Evidence of unreported employment or income

- Suspicion of undeclared cohabitation

- Inconsistent travel history suggesting extended time abroad

- Transfers that don’t align with reported income or assets

If any of these indicators surface, the DWP may issue an EVN to the relevant bank. The EVN will include specific instructions and data parameters.

The bank will review its customer records for accounts that meet the criteria, and if found, will return a limited dataset.

This may include:

- Confirmation that the account exists

- Whether the account balance exceeds savings thresholds

- Basic identity match (name and date of birth)

- Signs of consistent income from employment or business

These checks are designed to catch both deliberate fraud and accidental overpayments before they result in significant financial problems for the claimant or the state.

Will My Benefits Be Stopped If My Account Is Flagged?

A flagged account does not automatically result in the suspension or termination of benefits. This is a key point that the DWP has consistently clarified in their communications. Instead, the flagged information serves as a starting point for further investigation.

Once an account is flagged, DWP officials will:

- Cross-reference it with existing benefit information

- Assess whether the data conflicts with reported circumstances

- Possibly contact the claimant for clarification

- Initiate a compliance interview if needed

Any major decisions, such as pausing or adjusting a benefit, are only taken after a full human review. Artificial Intelligence (AI) may assist in data analysis, but no automated system will make a final decision on a person’s entitlement.

Furthermore, a flagged bank account could trigger a review of other related benefits, particularly in cases where eligibility overlaps, such as Housing Benefit or Council Tax Support. But again, no actions are taken without proper procedures and claimant input.

How Can You Avoid Being Flagged by the DWP?

The best way to avoid being flagged under these new powers is to ensure that your information with the DWP is always current and accurate. Most issues arise when claimants forget or delay reporting key changes that affect benefit entitlement.

Here’s what you should do:

- Report changes in your savings, income, or living situation promptly

- Keep all financial documents like bank statements, payslips, and investment summaries

- Avoid hiding income from side jobs, freelance work, or self-employment

- Respond quickly to any letters or messages from the DWP

- Inform the DWP if you’re travelling abroad for an extended period

- If you move in with a partner, notify them immediately

Staying proactive is the easiest way to remain compliant and avoid triggering unnecessary checks. Remember, many errors are not intentional, but failing to report them can have serious consequences later.

If flagged, being cooperative and transparent during follow-ups often resolves the situation without penalty.

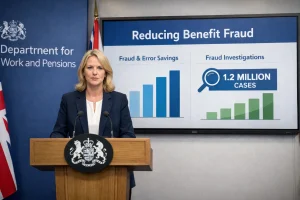

What Is the Government’s Justification for These Checks?

The UK Government says that the expansion of bank-checking powers is crucial to reducing fraud, error, and benefit overpayments.

These measures were introduced in response to growing concerns about public funds being misused or wrongly distributed due to outdated or inaccurate claimant information.

Key justifications include:

- £10 billion in benefit fraud and error identified in 2024–2025

- Claimants sometimes fail to report increases in savings or changes in circumstances

- Verification delays lead to unpaid debts and long-term hardship

- Recovered funds can be redirected to those in genuine need

- The Eligibility Verification Measures (EVM) process is limited in scope and proportionate

- It prevents taxpayer money from being lost to fraud

The government has been clear: this is not about criminalising benefit claimants. It’s about improving the accuracy and fairness of the system while reducing systemic weaknesses.

They emphasise that the checks are about justice and protection, not punishment, ensuring everyone who is entitled to help receives it, and those who are not do not unfairly benefit.

What Should You Do Next If You’re Receiving Benefits?

If you currently receive Universal Credit, Pension Credit, or ESA, now is the time to double-check your details. Make sure all financial information submitted to the DWP is accurate and up to date.

Any significant change in income, savings, or household status should be reported as soon as possible.

Start by:

- Reviewing your most recent bank statements

- Ensuring your savings are below the thresholds for your benefit

- Notifying the DWP if you’re working part-time or receiving another form of income

- Checking if you’re listed on joint accounts or savings that might count towards your capital

If you’re unsure, seek advice from a benefits advisor or local authority. Being proactive could prevent overpayments and avoid a lengthy investigation. If you are contacted by the DWP as part of a bank check, respond promptly and provide all requested documentation.

Conclusion

The DWP’s new powers to check bank details under the Eligibility Verification Measures represent a major shift in how benefit compliance is monitored. For those claiming Universal Credit, Pension Credit, or ESA, understanding how these checks work is vital.

While the system is designed to identify fraud, its true aim is to ensure fairness, reduce costly errors, and protect the integrity of the welfare state.

These checks are not constant surveillance, they are targeted, controlled, and only affect accounts tied to specific benefits.

As long as claimants remain transparent and report changes promptly, there is little reason to worry. Awareness and accuracy are the best safeguards under the new system.

Frequently Asked Questions

Can the DWP see what I spend money on?

No, the DWP does not get access to your transaction history. They only receive limited data like balance and eligibility indicators.

What happens if I go over the £16,000 limit briefly?

If your savings exceed the threshold, you must report it immediately. Temporary changes can still impact your benefit entitlement.

Will the DWP tell me if my account is being checked?

Not always. The checks are discreet and you may only be contacted if an issue is found or clarification is needed.

Does this apply to people on State Pension?

No, State Pension is excluded from these checks. The powers apply only to means-tested benefits like Universal Credit and ESA.

Can I refuse the bank check?

No, banks are legally obligated to comply with EVNs. You cannot opt out if your account is flagged under the rules.

Can a flagged account affect other benefits I receive?

Yes, if one benefit is reviewed, others may be reassessed. For example, changes in Pension Credit could impact Housing Benefit.

Will AI decide if I lose my benefits?

No, all final decisions are made by DWP staff. AI may help identify patterns, but humans handle every outcome.