Verifying a company’s VAT registration is essential for ensuring compliance and protecting your business from financial and legal risks.

In the UK, businesses must be VAT registered to charge VAT, and confirming this status before processing transactions is a crucial step.

While official tools are available for verification, the process varies depending on whether you have the VAT number. This guide outlines how to check if a company is VAT registered using reliable methods and official resources.

What Does It Mean for a Business to Be VAT Registered in the UK?

In the UK, VAT registration indicates that a business has registered with HMRC to charge and collect Value Added Tax. This is a legal requirement for businesses with a taxable turnover above £85,000.

Businesses that expect to cross this threshold must register in advance, while others may choose to register voluntarily to recover VAT on business expenses and improve their credibility.

Once registered, the business receives a unique VAT number which must appear on all VAT invoices, receipts, and tax documents. This number serves as an identifier and a sign that the business is compliant with tax regulations.

Businesses must:

- Charge VAT on taxable sales

- Submit VAT returns, usually quarterly

- Maintain accurate VAT records

- Pay HMRC the VAT they collect

Failure to do so can lead to penalties, surcharges, or deregistration.

Why Would You Need to Verify a Company’s VAT Registration?

There are several reasons why it’s important to verify the VAT registration status of a company, particularly when engaging in B2B transactions. Most crucially, reclaiming VAT on purchases is only valid when the supplier is officially VAT registered.

Key reasons include:

- Ensuring the supplier is authorised to charge VAT

- Reducing the risk of dealing with fraudulent businesses

- Protecting your business from rejected VAT reclaims

- Providing evidence of due diligence in case of HMRC audits

For businesses working with new vendors, performing this check is a precaution that supports financial and legal compliance. If a company is found to be charging VAT without being registered, HMRC may reject any related VAT reclaims and initiate investigations.

How to Check if a Company is VAT Registered?

Verifying whether a company is VAT registered depends on whether you have access to its VAT number. While the process is straightforward when you have the number, the options are limited without it.

Checking with a VAT Number

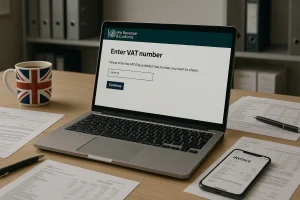

If you already have the company’s VAT number, the easiest and most reliable method is to use the official HMRC VAT number checker. This online tool allows users to verify whether a VAT number is currently active and registered with HMRC.

When using the HMRC tool, you can:

- Enter the company’s VAT number

- View the official business name and address as recorded by HMRC

- Optionally input your own VAT number to receive a unique reference number, which serves as proof that the check was completed

This reference is useful for audit purposes and is an important part of maintaining accurate VAT records. It demonstrates that your business has performed the necessary due diligence when accepting VAT-charged invoices.

What to Do If You Don’t Have a VAT Number?

If the business has not provided its VAT number, it becomes much more difficult to verify its VAT status through official channels. HMRC does not offer a name-based VAT number lookup, meaning you cannot search by company name alone using government resources.

Some third-party websites claim to offer VAT number search by business name. These platforms typically rely on publicly available data but are not affiliated with HMRC and therefore may not always provide reliable or up-to-date information.

Potential issues with using unofficial sources include:

- Outdated or incorrect VAT numbers

- Display of VAT numbers that have since been de-registered

- Exclusion of companies that are part of a VAT group, where the parent group VAT number is used instead

Because of these limitations, the best approach when a VAT number is not provided is to ask the supplier directly for an official invoice. Any VAT-registered business is legally required to include their VAT number on invoices issued for taxable goods or services.

Confirming VAT Numbers from Other Sources

If you manage to find a VAT number through alternative means—such as a business’s website, third-party search, or company directories—it’s essential to verify that number using HMRC’s official checker before processing payments or reclaiming VAT.

Relying on unverified VAT numbers could result in financial losses or compliance issues with HMRC, particularly if the number has been fabricated or is no longer valid.

Legal Risks of Inaccurate VAT Charges

It is a serious offence for a company to charge VAT when not registered to do so. If HMRC identifies that VAT has been charged unlawfully, the business responsible can be penalised. Penalties can reach up to 100% of the VAT incorrectly invoiced.

There are also risks for the buyer. If your business has paid VAT on an invoice issued by a company that is not VAT registered:

- HMRC will not treat the VAT as recoverable, regardless of the invoice amount

- The transaction may be flagged during a VAT audit

- HMRC may open an enquiry into your supplier or your company, depending on the circumstances

How Can You Use the HMRC VAT Number Checker?

The HMRC VAT number checker is the most reliable way to confirm whether a UK company is VAT registered. It is free to use and provides real-time results based on official HMRC data.

How to use the tool:

- Go to the HMRC VAT number checking page

- Enter the VAT number of the business you want to verify

- Review the returned results, which include:

- The legal business name

- The registered business address

If you are VAT registered, entering your own VAT number allows HMRC to generate a reference number. This serves as evidence that the check was performed and can be used for record-keeping or in case of a VAT audit.

If the tool indicates that the number is invalid, the business may not be registered, or there could be a typographical error. It’s advisable to double-check with the supplier or request their VAT registration certificate for confirmation.

What Is the VAT Information Exchange System (VIES) and When Should You Use It?

The VAT Information Exchange System (VIES) is the European Commission’s online system for validating VAT numbers issued in EU member states.

For UK businesses working with companies in the EU, VIES is the official tool to verify that their trading partners are properly registered for VAT.

VIES operates across all EU tax authorities and provides information including whether the business is currently VAT registered and eligible for zero-rated intra-community supplies.

However, VIES does not show detailed company names or addresses for all countries, due to local data protection rules.

This table compares the HMRC checker and the VIES system:

| Feature | HMRC VAT Checker | VIES VAT Checker |

|---|---|---|

| Applicable Region | United Kingdom | European Union |

| Details Provided | Business name, address | VAT registration status only |

| Reference Number Available | Yes | No |

| Language | English | Multilingual |

| Real-Time Verification | Yes | Varies by member state |

| Data Accuracy | High | Depends on local authorities |

Use VIES when:

- Trading with EU suppliers or customers

- Validating zero-rated sales under the EU VAT rules

- Requiring confirmation of a company’s intra-community trade status

How Do You Know If a VAT Number Is Valid or Fake?

A VAT number must follow a specific structure and be officially issued by HMRC or a relevant EU tax authority. In the UK, VAT numbers usually begin with “GB” followed by nine digits.

Fake VAT numbers often appear in the wrong format or do not match registered business details. They may also be reused from deregistered businesses or created by unregistered traders seeking to inflate their prices under the guise of adding VAT.

How to identify a fake or invalid VAT number:

- Cross-check the number using HMRC or VIES

- Ensure the company name and address match the VAT number

- Ask for the business’s VAT registration certificate

- Review the invoice for inconsistencies in VAT calculation

Any inconsistencies should be followed up with the supplier. If doubts remain, refrain from making payments until confirmation is obtained.

Can You Check a Company’s VAT Status Without a VAT Number?

Verifying VAT registration without a VAT number is challenging. There is no official UK government tool that allows you to search for VAT numbers using only a business name. However, some third-party websites claim to provide this service by cross-referencing company data.

These sites are not always accurate or up to date and may include old VAT numbers that are no longer valid. If a business is part of a VAT group, their individual entity may not have a separate VAT number listed.

Alternative actions you can take:

- Request an invoice showing the VAT number

- Ask the business directly for their VAT registration certificate

- Check Companies House for publicly listed information (though this won’t confirm VAT registration)

- Review the business website, which may publish the VAT number for transparency

In the absence of a VAT number, assume the business is not registered and avoid paying VAT until official confirmation is obtained.

What Information Will You See When You Verify a VAT Number?

When using the HMRC VAT checker, the information returned will generally include:

- The full legal name of the business

- The registered address

- Confirmation that the number is currently valid

- The date the verification was carried out

- An optional reference number if your VAT number was entered

These details should match the business’s invoice and other communications. If there is a discrepancy, it is essential to follow up before proceeding with payments or recording the transaction in your VAT return.

This second table outlines the typical data returned from a VAT verification:

| Data Field | Provided by HMRC VAT Checker |

|---|---|

| Business Name | Yes |

| Business Address | Yes |

| VAT Number Status | Yes |

| Reference Number | Yes (optional) |

| Verification Date | Yes |

Keeping a copy of this verification, especially the reference number, supports compliance and proves that reasonable steps were taken to validate the transaction.

What Are the Risks of Dealing With a Non-VAT Registered Business?

Accepting invoices with VAT from unregistered businesses carries significant risks. If the business is not registered, any VAT charged is invalid, and your company will not be able to reclaim it. In addition, you could face scrutiny from HMRC and potential penalties.

Common risks include:

- HMRC rejecting VAT claims made on invalid invoices

- Exposure to VAT fraud investigations

- Financial loss due to irrecoverable VAT payments

- Damage to your company’s credibility and compliance record

If you suspect that VAT is being incorrectly charged, suspend payments and investigate the business’s VAT registration status. HMRC provides a channel for reporting such issues, and it is in your interest to act promptly.

What Should You Do If You Suspect VAT Fraud?

VAT fraud undermines the integrity of the tax system and poses risks to legitimate businesses. If you believe a business is charging VAT unlawfully or using a fake VAT number, there are several actions you can take:

- Use the HMRC VAT checker to confirm the number is invalid

- Contact the business and request clarification

- Refuse to pay the VAT amount until proof of registration is provided

- Report the suspected fraud to HMRC using their online VAT fraud form

- Retain all related documents, emails, and invoices as evidence

Being proactive in these cases is not only a good business practice but also a legal safeguard. HMRC takes VAT fraud seriously and relies on reports from businesses and the public to detect and pursue offenders.

How to Keep a Record of VAT Verification for Your Business?

Good record-keeping ensures your VAT claims are defendable in case of an audit. It also streamlines your accounting processes and improves financial transparency.

Recommended practices:

- Save a screenshot or PDF of the verification results

- Record the date and reference number provided by HMRC

- Include the verified VAT number in your supplier records

- Perform periodic rechecks for long-term suppliers

- Use accounting tools that support automatic VAT validation

Digital solutions such as accounting software with HMRC integration can simplify this process and help you stay compliant without manual effort.

Conclusion

Confirming a company’s VAT registration is not only a matter of best practice but a vital compliance requirement. Using official tools like the HMRC VAT checker helps safeguard your business from VAT fraud, invalid claims, and potential penalties.

Whether you’re verifying a new supplier or conducting routine checks, ensuring VAT numbers are valid protects your operations and maintains HMRC compliance.

Always validate any VAT number received and keep records as part of a sound financial strategy.

FAQs About Checking VAT Registration

How long does it take to verify a VAT number?

Verification using HMRC or VIES tools is usually instant. If the systems are undergoing maintenance, there may be delays.

Can sole traders be VAT registered in the UK?

Yes, sole traders can register for VAT if their taxable turnover exceeds the threshold or they choose to register voluntarily.

What happens if I reclaim VAT from a non-registered business?

HMRC will disallow the VAT reclaim, and you may face penalties during an audit. It’s essential to verify before making claims.

Do I need to check VAT registration for every invoice?

Not necessarily, but regular checks especially for new or high-risk suppliers—are recommended as part of financial best practices.

Is there a free way to check VAT numbers online?

Yes, both HMRC (for UK) and VIES (for EU) offer free VAT checking tools.

How often should I verify a supplier’s VAT number?

At the beginning of a business relationship and periodically afterwards, especially if their VAT number appears suspicious or changes.

Can I get in trouble for not checking VAT numbers?

While you may not be penalised directly, HMRC can reject VAT claims if you haven’t conducted reasonable checks. Repeated errors can raise red flags in audits.

{

“@context”: “http://schema.org/”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How long does it take to verify a VAT number?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Verification using HMRC or VIES tools is usually instant. If the systems are undergoing maintenance, there may be delays.”

}

},

{

“@type”: “Question”,

“name”: “Can sole traders be VAT registered in the UK?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, sole traders can register for VAT if their taxable turnover exceeds the threshold or they choose to register voluntarily.”

}

},

{

“@type”: “Question”,

“name”: “What happens if I reclaim VAT from a non-registered business?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “HMRC will disallow the VAT reclaim, and you may face penalties during an audit. It’s essential to verify before making claims.”

}

},

{

“@type”: “Question”,

“name”: “Do I need to check VAT registration for every invoice?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Not necessarily, but regular checks especially for new or high-risk suppliers—are recommended as part of financial best practices.”

}

},

{

“@type”: “Question”,

“name”: “Is there a free way to check VAT numbers online?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes, both HMRC (for UK) and VIES (for EU) offer free VAT checking tools.”

}

},

{

“@type”: “Question”,

“name”: “How often should I verify a supplier’s VAT number?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “At the beginning of a business relationship and periodically afterwards, especially if their VAT number appears suspicious or changes.”

}

},

{

“@type”: “Question”,

“name”: “Can I get in trouble for not checking VAT numbers?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “While you may not be penalised directly, HMRC can reject VAT claims if you haven’t conducted reasonable checks. Repeated errors can raise red flags in audits.”

}

}

]

}