Have you ever wondered why some British pensioners living overseas never receive annual increases to their State Pension? While pensioners in the UK benefit from the triple lock, those abroad often see their payments frozen indefinitely.

This issue, which has affected more than 450,000 UK citizens worldwide, has once again come under the spotlight in 2025. Campaigners and MPs are raising their voices louder than ever, urging the government to end what many consider an outdated and unfair policy.

Despite pressure and mounting public awareness, the UK government continues to defend the existing framework, citing cost and legal limitations. As we explore the latest developments, financial impact, and political debate, you’ll discover exactly how this policy affects you or your loved ones, and what could change in the future. Let’s dive into the full story behind the most pressing frozen state pension news of the year.

What Is a Frozen State Pension and How Does It Affect You?

A frozen state pension refers to a UK State Pension that stops increasing annually once the pensioner resides in certain countries. Under normal circumstances in the UK, State Pensions are adjusted each year using the triple lock, which ensures they rise by the highest of inflation, average wage growth, or 2.5 percent.

However, if you move to a country without a reciprocal social security agreement with the UK, your pension remains fixed at the rate when you first started receiving it. This lack of uprating applies even if inflation continues to rise globally.

For those affected, this policy means your income does not keep up with the cost of living over time. While you may have paid the same National Insurance contributions as those who live in the UK, the country you reside in now determines whether your pension increases or stays frozen.

Unfortunately, unless you return to the UK or relocate to a country where pensions are uprated, the amount will never increase, and you won’t receive any backdated payments.

The implications are severe for retirees who rely solely on their State Pension. Many see their standard of living decline significantly over the years. This policy disproportionately affects older pensioners, many of whom moved abroad to be closer to family or due to cost-of-living factors.

Which Countries Receive UK State Pension Increases – and Which Don’t?

Where you live abroad plays a critical role in whether your UK State Pension continues to rise or becomes frozen. The UK only increases pensions in countries with a reciprocal social security agreement or specific legal arrangements for pension uprating. Unfortunately, many popular retirement destinations are excluded.

Some countries, like those in the European Economic Area (EEA), Switzerland, the USA, and Jamaica, offer full annual increases because of such agreements. However, most Commonwealth countries, including Canada, Australia, New Zealand, and India, do not have agreements covering annual pension upratings, which results in frozen pensions.

Here is a quick look at the situation:

| Country/Region | Pension Uprated? | Notes |

|---|---|---|

| Australia | No | No uprating despite being a Commonwealth country |

| Canada | No | Most affected expat group |

| United States | Yes | Covered by bilateral agreement |

| EU/EEA Countries | Yes | Full uprating as per EU agreement |

| India | No | No reciprocal pension agreement |

| Jamaica | Yes | Legal agreement for uprating |

| New Zealand | No | Not covered under pension increase agreement |

| UK | Yes | Full triple lock benefits apply |

This list often surprises retirees, especially those in historically connected Commonwealth countries. It highlights the inconsistencies in the current system and is a key point of contention for campaigners.

Why Are State Pensions Frozen for Some UK Expats?

The reason your State Pension might be frozen after moving abroad lies not in how much you paid, but where you live. The UK government only uprates State Pensions in countries where a reciprocal agreement specifically includes annual increases.

These agreements vary widely and are negotiated individually. Some may include healthcare cooperation or benefit coordination but exclude pension uprating. That’s why you could receive a full pension in the USA but not in Canada, even though both have large British expat communities.

Key points to understand include:

- It’s not based on contributions: Two people who worked the same years and paid the same National Insurance can receive different pensions depending on where they live.

- Agreements vary in scope: Some countries have broad social agreements without pension clauses.

- Pensions remain frozen indefinitely: Once frozen, your pension will never increase unless you return to the UK or move to an uprating country.

This policy is widely criticised for being arbitrary and geographically discriminatory. It punishes pensioners for making lawful lifestyle choices and undermines the contributory principle of the UK pension system.

How Much Could You Lose Over Time from a Frozen Pension?

The financial consequences of a frozen state pension become more severe the longer you live abroad. While the pension amount may appear adequate when first paid, inflation steadily erodes its real value.

Over time, pensioners receiving frozen payments fall further behind those whose pensions increase annually under the triple lock. This widening gap has become a central focus of frozen state pension news in 2025, as more long-term expats share their experiences publicly.

Table with Estimated Financial Losses Over Time:

| Years Retired Abroad | Estimated Loss Compared to Uprated Pension |

|---|---|

| 5 Years | £5,000 to £7,000 |

| 10 Years | £12,000 to £18,000 |

| 15 Years | £20,000 to £26,000 |

| 20 Years | £30,000 or more |

These figures are based on typical annual increases applied within the UK and highlight how frozen pensions steadily fall behind current payment levels.

Real-Terms Impact on Quality of Life

As prices rise, pensioners with frozen incomes often face difficult choices. Healthcare, housing costs, and daily essentials take up a growing share of limited funds. Many report cutting back on heating, nutrition, and social activities just to manage basic living expenses. The longer the pension remains frozen, the more pronounced the decline in financial security becomes.

Examples from Long-Term Expats

British retirees who moved abroad decades ago often receive pensions that are now a fraction of current UK rates. Some expats in Canada and Australia receive less than half of what a UK resident with identical contribution records receives today. These long-term effects illustrate why campaigners argue the policy creates lasting inequality and hardship.

What Are Campaign Groups and MPs Demanding in 2025?

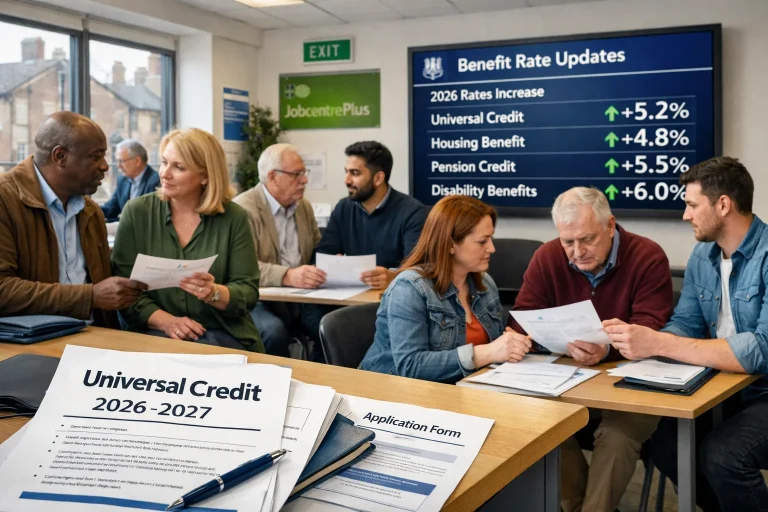

In 2025, pressure to reform the frozen pension policy has intensified significantly. Campaign groups representing overseas pensioners, along with expat associations and advocacy organisations, are calling for an end to what they describe as a discriminatory system. Their efforts have gained political traction, with several MPs openly supporting reform initiatives.

A major milestone this year has been a public petition demanding pension uprating for all UK retirees, regardless of where they live. The petition has gathered more than 173,000 signatures, demonstrating widespread concern both domestically and among overseas communities.

Campaigners are pushing for several key changes:

- Equal treatment for all pensioners based on contributions, not residence

- A formal government review of the frozen pension policy

- Transparent cost assessments and phased reform options

MPs supporting reform argue that the current policy damages the UK’s reputation and undermines trust in the pension system. As media coverage grows, campaign groups believe sustained political pressure could eventually force the issue onto the legislative agenda.

Has the Government Responded to the Pressure to End Frozen Pensions?

Despite rising pressure, the UK government has not announced any plans to end the frozen pension policy. The Autumn Budget 2025 reaffirmed the government’s commitment to the triple lock for UK residents while leaving overseas pension arrangements unchanged. This decision disappointed campaigners who had hoped for at least a review timetable.

The government maintains that pensions are only uprated where a legal obligation or reciprocal social security agreement exists. Officials argue that extending uprating globally would involve significant long-term costs and set a precedent for other overseas benefits. As a result, countries such as Canada and Australia remain excluded.

While ministers acknowledge the concerns raised by pensioner groups, they continue to defend the policy as fiscally responsible. For now, frozen state pension news confirms that reform is not imminent, though the issue remains under scrutiny in parliamentary discussions.

What Role Does the Triple Lock Play in the Frozen Pension Debate?

The triple lock is central to the debate surrounding frozen pensions. Designed to protect pensioners from inflation and wage stagnation, it guarantees that the UK State Pension increases annually by the highest of inflation, average earnings growth, or 2.5 percent. However, this protection does not extend to pensioners living in frozen pension countries.

This disparity has intensified criticism of the current system:

- UK residents benefit fully from annual increases

- Pensioners in EEA and agreement countries receive uprating

- Pensioners in frozen countries receive no increases at all

As the State Pension continues to rise under the triple lock, the income gap between uprated and frozen pensions widens each year. Campaigners argue that this creates two classes of pensioners despite identical contribution histories. The triple lock, while beneficial domestically, has inadvertently highlighted the inequalities faced by British retirees abroad.

Are You Being Pulled Into the Tax System Due to Frozen Thresholds?

Alongside frozen pensions, tax policy has added further pressure on pensioners. The personal income tax allowance has been frozen at £12,570 and is expected to remain so until at least 2028. As the State Pension rises under the triple lock, more pensioners are crossing the tax threshold for the first time.

This situation affects both UK residents and returning expats. While the government states that pensioners with only State Pension income will not pay tax, those with additional income sources may face new liabilities.

Key contributing factors include:

- Frozen tax allowances

- Rising State Pension payments

- Increased living costs

For pensioners already struggling with frozen pensions abroad, returning to the UK can introduce unexpected tax complications. This overlap of pension and tax policy has become a growing concern in late 2025 discussions.

What Can You Do If You’re Affected by a Frozen State Pension?

Although frozen pensions are determined by government policy, there are practical steps you can take to manage your situation. Understanding your options can help reduce financial uncertainty and ensure you receive everything you are entitled to.

Possible actions include:

- Contacting the International Pension Centre for personalised guidance

- Checking eligibility for voluntary National Insurance contributions

- Exploring private pension or savings options

- Considering relocation to an uprating country if feasible

If you are planning to return to the UK, notifying the Pension Service and HMRC is essential to ensure correct payments and tax treatment. While these steps do not unfreeze pensions retrospectively, they can help protect your income and avoid administrative issues.

Will Frozen State Pensions Be Reformed Anytime Soon?

The future of frozen state pensions remains uncertain. While no immediate reform has been announced, the issue has regained political momentum in 2025. Increased media attention, parliamentary submissions, and public campaigns have kept the topic firmly in the public eye.

Potential developments could include:

- A formal government review

- Partial uprating for selected countries

- Inclusion of pension uprating in future reciprocal agreements

However, without a clear policy commitment, change may be gradual. What is clear is that frozen state pension news will continue to attract attention as affected pensioners and advocacy groups maintain pressure on policymakers.

Conclusion

Frozen state pensions remain one of the most contentious issues facing UK retirees abroad. Despite paying into the system throughout their working lives, hundreds of thousands of pensioners continue to receive unequal treatment based solely on where they live.

The latest frozen state pension news in 2025 highlights growing frustration, renewed campaigning, and increased parliamentary scrutiny. While the government remains committed to its current policy, public awareness is rising, and calls for reform are becoming harder to ignore.

For affected pensioners, staying informed and seeking advice remains essential. Whether meaningful change arrives soon or not, the debate is far from over, and its outcome will shape the financial security of generations of British pensioners overseas.

FAQs

What does a frozen state pension mean?

A frozen state pension means your UK State Pension does not receive annual increases if you live in certain countries abroad. The payment remains fixed at the rate when it first started.

Which countries have frozen UK State Pensions?

Countries such as Canada, Australia, New Zealand, India, and South Africa do not receive annual pension increases. This is due to the absence of specific uprating agreements.

Can a frozen state pension ever increase?

A frozen pension can only increase if you return to live in the UK or move to a country where uprating applies. No backdated increases are paid.

Does the triple lock apply to frozen state pensions?

No, the triple lock does not apply if you live in a frozen pension country. Only pensioners in the UK or agreement countries benefit from it.

Is the UK government planning to end frozen state pensions?

As of late 2025, no policy change has been announced. Campaigners and MPs continue to push for reform and review.

Can I claim my UK State Pension while living abroad?

Yes, you can claim your State Pension abroad if you meet the contribution requirements. Payments can be made to UK or overseas bank accounts.

Who should I contact for help with my overseas pension?

The International Pension Centre provides guidance on claiming, payments, and changes in circumstances for pensioners abroad.