Are you a UK pensioner worried about reports of a £500 bank deduction confirmed by HMRC? You’re not alone. This announcement has left many retirees wondering whether their accounts are at risk.

While headlines may sound alarming, the reality is more nuanced. The £500 deduction is not a blanket tax or penalty but is tied to tax corrections based on income, savings, and benefits received throughout the year.

As HMRC enhances real-time data checks and reconciliation processes, certain pensioners may see adjustments, particularly around mid-December, when these rules come into full effect.

This blog offers an in-depth, question-based guide to help you understand what’s happening, who’s affected, and what steps to take now. With rising living costs and tighter household budgets, staying informed is more crucial than ever. Let’s break down what this HMRC confirmation really means and how you can prepare effectively.

What is the HMRC £500 Deduction?

The £500 deduction mentioned by HMRC is not a new fee or tax targeting all pensioners. Instead, it represents an average recovery figure HMRC may deduct when it discovers that a pensioner has underpaid tax or received incorrect payments throughout the tax year.

This situation can arise from discrepancies between reported income, such as bank interest, private pension withdrawals, or unreported savings. HMRC regularly reviews financial data shared by banks, pension providers, and the Department for Work and Pensions (DWP).

When inconsistencies are flagged, such as income exceeding allowances or tax codes being outdated, a reconciliation process is triggered. If tax has been underpaid, HMRC initiates recovery, often through updated tax codes or reduced pension payments.

The £500 is not fixed. Some pensioners may owe less or more depending on their financial situation. The figure has gained attention because it’s a common deduction range seen during recent reconciliations. It’s also not applied instantly but may be recovered gradually or over time through your PAYE-linked income streams.

Why is HMRC Enforcing This Deduction Now?

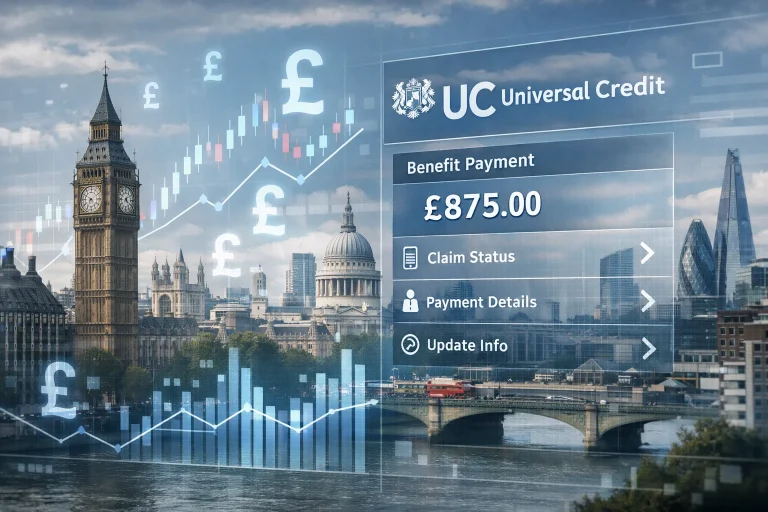

HMRC’s enforcement of the £500 deduction aligns with their year-end tax reconciliation strategy, especially as December marks a critical review period.

From mid-December, HMRC applies updated account monitoring and tax adjustment rules to reconcile income against tax paid. These checks help ensure pensioners pay the correct amount of tax, especially if they have multiple income sources.

The decision to enforce this now is also tied to HMRC’s access to real-time data. Since April, banks and pension providers have been required to report income more frequently. December provides the window to act on this data before the final tax quarter begins.

Additionally, this timing aligns with winter support payments and pension upratings, making it easier for HMRC to factor in these elements when assessing liabilities. By reconciling early, HMRC reduces the risk of larger deductions later in the tax year, providing more manageable adjustments.

In short, the timing is strategic, it allows HMRC to act on discrepancies quickly while also giving pensioners the chance to address any errors promptly.

Who is at Risk of the Deduction?

Not every pensioner will face a £500 deduction. However, certain groups are more likely to be affected based on how their income and tax affairs are structured. HMRC targets deductions only when there is evidence of underpaid tax or overpaid benefits.

You may be at higher risk if you:

- Receive both State Pension and a private or workplace pension

- Have savings interest that exceeds the Personal Savings Allowance

- Recently withdrew taxable lump sums from a defined contribution pension

- Were previously overpaid in benefits

- Had a change in tax code that went unreviewed

- Earn income from self-employment after retirement

- Did not report additional income to HMRC

Those on basic State Pension only and with no additional income sources are less likely to be impacted. These individuals are typically flagged through HMRC’s automated matching systems that cross-check data from banks, DWP, and pension providers. The risk increases when pensioners fail to update HMRC with income changes or rely on outdated tax codes to manage deductions.

How the £500 Deduction is Applied?

Many pensioners are concerned that HMRC might directly deduct £500 from their bank accounts without notice. In reality, the recovery process is more regulated and generally avoids abrupt transactions.

The deduction is most often applied through:

- Adjusted tax codes, leading to higher deductions from private pensions

- Reduced private pension payments, especially those administered via PAYE

- One-off adjustments, spread over several months, to lessen the financial impact

- In rare cases, through direct recovery requests from bank accounts

HMRC uses the Direct Recovery of Debts (DRD) framework, but it must follow strict guidelines before applying it.

A deduction from your bank account is a last resort and only happens if:

- You’ve received written notice

- You’ve been given time to respond

- Your account has enough funds above the protected minimum balance

Most pensioners will experience the deduction through their pension payments or tax code changes. The aim is to ensure minimal disruption while recovering underpaid tax efficiently and fairly.

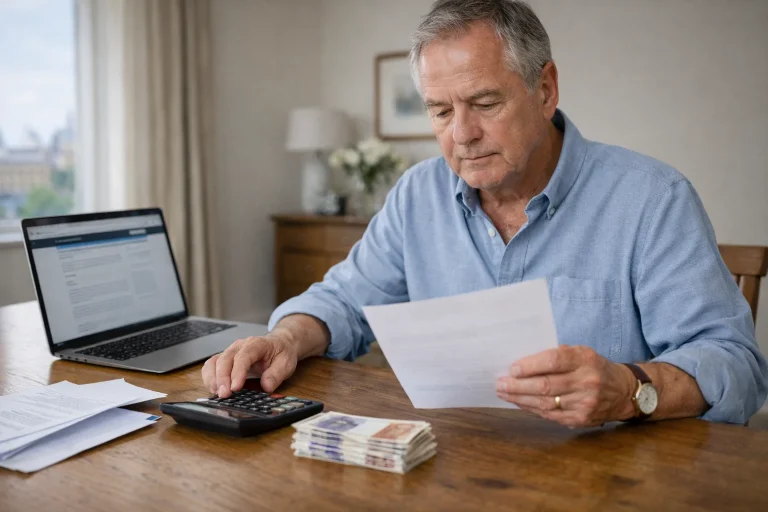

How to Check if You’re Affected?

It’s crucial to check if your finances are under HMRC review, especially if you’ve had income changes this year. Fortunately, there are several ways to identify if you’re at risk of a deduction or if a review is pending.

Start by:

- Logging into your HMRC Personal Tax Account online to check current tax codes and income details

- Reviewing recent letters or digital messages from HMRC about tax corrections or payment adjustments

- Checking your private pension payslips for changes in deductions

- Reviewing bank statements for interest earned above the personal allowance

Look out for:

- Unexpected tax code changes

- Notices titled “Underpayment recovery”

- A new tax code suffix like “T” or “BR” indicating multiple income sources

Being proactive by checking your financial records regularly can help you avoid surprises. If you’ve recently received an unexpected deduction or changed your income, it’s worth contacting HMRC to clarify your status and ensure your tax record is accurate and up to date.

What to Do if You Receive a Warning Letter?

Receiving an HMRC warning letter can be worrying, but it doesn’t always mean a deduction will happen immediately. The first thing to do is read the letter thoroughly. It typically outlines the reason for the review, the amount HMRC plans to recover, and what steps you can take.

You should:

- Verify the deduction amount against your pension income and bank interest

- Compare the stated income sources with your own records

- Check if the date range of the underpayment makes sense

If you find discrepancies or don’t understand the claim, contact HMRC immediately via the phone number or link provided in the letter.

You may challenge the amount if:

- The calculation appears incorrect

- You weren’t informed of the issue previously

- The claim involves old debts or causes hardship

Prompt action can delay or even prevent the deduction. Don’t ignore the letter, as failing to respond might fast-track enforcement. HMRC generally allows time for clarification, negotiation, or dispute resolution before initiating recovery.

Can You Stop the Deduction Before It Happens?

Yes, there are several ways you can prevent the £500 deduction if you act quickly and appropriately. HMRC provides multiple options for those facing unexpected tax adjustments, especially pensioners on limited incomes.

Here’s what you can do:

- Request a payment plan, allowing the debt to be recovered in smaller, manageable amounts

- Submit a formal dispute if you believe the deduction is in error

- Apply for financial hardship protection, which may pause or reduce the recovery amount

- Update your income records to correct outdated or incorrect data

In many cases, HMRC is open to reviewing your financial situation if you provide supporting documents. Acting swiftly after receiving notice is critical to stop or adjust the deduction before it’s finalised. If the issue is due to a reporting error, you might avoid repayment entirely.

The key is communication. HMRC generally avoids aggressive recovery from pensioners who respond in good faith and provide timely, verifiable information.

Support Available for Pensioners

If a £500 deduction poses a financial strain, you are not alone, and support is available. HMRC has implemented several safeguards to protect pensioners from sudden hardship.

You may qualify for:

- A Time-to-Pay arrangement, spreading the deduction over several months

- Reduced instalments if your income is very limited

- Temporary suspension of recovery in extreme hardship cases

- A deduction review, where you can dispute the figure or reason

Beyond HMRC, other organisations offering free guidance include:

- Age UK, which provides tailored financial advice for retirees

- Citizens Advice, which can help you negotiate with HMRC or access benefits

- MoneyHelper UK, a government-backed service for pensions and tax

You should never hesitate to ask for help, especially if this deduction would impact essentials like housing, heating, or food. The sooner you speak up, the more options are available to soften or prevent the financial impact.

Impact on Pensioners During Cost-of-living Crisis

The introduction of this deduction has hit hard, especially during a cost-of-living crisis already straining pensioners’ finances. With winter approaching, essential expenses such as heating, food, and medical costs are rising, leaving little room for surprise deductions.

A sudden £500 recovery in December, a high-spending month, can disrupt household budgets and impact basic needs. For many retirees, even a slight drop in income may mean skipping meals, missing bills, or falling behind on rent.

This rule has increased anxiety among pensioners, many of whom believed their tax affairs were straightforward. Those relying solely on State Pension or small savings often lack the financial flexibility to absorb unexpected losses.

Charities and financial experts urge pensioners to act early, check their tax records, and seek support if needed. Staying proactive can help prevent deductions from worsening your financial situation during a time of year when every pound counts.

Common Misunderstandings (Myths vs Reality)

There’s been a lot of confusion surrounding the £500 HMRC deduction, especially on social media and forums. It’s important to separate facts from fiction to avoid unnecessary panic.

| Myth | Reality |

|---|---|

| Every pensioner will lose £500 | Only those with underpaid tax or incorrect income reporting are affected. |

| This is a new tax introduced by the government | It’s a recovery of previously underpaid tax or benefit overpayments. |

| HMRC will deduct money from any bank account without notice | Direct deductions are rare and only happen after multiple warnings. |

| It affects your actual State Pension amount | The State Pension isn’t reduced. Deductions usually affect private pensions or via tax coding. |

| The £500 is a flat rate everyone must pay | £500 is an average figure. The actual amount may be more or less depending on your situation. |

Understanding these facts can help you stay calm and take the correct steps to address any issues with HMRC if contacted.

What Happens After 15/18 December?

The dates 15 and 18 December mark when HMRC’s updated reconciliation rules take effect, triggering automated tax checks across pensioner records. This change doesn’t mean every pensioner will be impacted immediately, but it significantly increases the chances of discrepancies being flagged earlier than before.

From these dates, HMRC systems begin more frequent matching of:

- Pension income from both State and private sources

- Bank interest reported by financial institutions

- Current tax codes and historical payments

If a mismatch or unpaid amount is identified, HMRC may issue notices or initiate deductions starting in late December or January. This staged rollout helps HMRC avoid overwhelming support lines and gives pensioners time to respond.

Importantly, the deduction process is ongoing. Even if you are not affected in December, you might still be flagged in January or later months, depending on your financial activities and reporting accuracy. Staying alert during this period and responding promptly to any communication from HMRC will reduce the risk of being caught off-guard.

Checklist for Pensioners to Avoid Future Deductions

To protect your pension income and avoid unexpected deductions, it’s crucial to stay organised and proactive. HMRC is using real-time data, so even small inconsistencies can result in reviews or adjustments. Here’s how you can safeguard yourself from future recoveries.

What to Check?

- Tax code accuracy

- Total pension income (State + private)

- Interest earned on all savings accounts

- Any recent pension withdrawals or lump sums

- HMRC letters and notices

Where to Find It?

- HMRC Personal Tax Account online

- Your private pension payslips or annual statements

- Your bank’s end-of-year interest summary

- Correspondence from DWP and HMRC

How Often?

- At least twice a year, ideally at the start and end of the tax year

- Whenever you change income sources

- After receiving any letters or emails from HMRC

- Before and after making large pension withdrawals

Other Smart Steps Include

- Report any change in income or circumstances to HMRC as soon as it happens

- Use free tools like the Tax Code Checker on HMRC’s website

- Speak to a tax advisor or call HMRC directly if anything seems unclear

- Keep records of your savings interest to ensure it stays within allowance limits

Taking these steps doesn’t guarantee you won’t face a review, but it puts you in a strong position to challenge any unexpected deductions. Awareness, routine checks, and honest communication with HMRC are your best defences.

Conclusion

The confirmed £500 bank deduction by HMRC has understandably alarmed many UK pensioners. However, it’s not a blanket fee or new charge, rather, it’s part of a wider initiative to reconcile tax and income discrepancies.

Only certain individuals, mainly those with multiple income sources or outdated tax codes, are likely to be affected. By understanding who is at risk, how deductions work, and what steps to take, you can protect your finances and avoid unpleasant surprises. December’s timing makes early action even more critical.

With simple checks and communication, most pensioners can reduce or delay any deductions and access support if needed. Staying informed is not just useful, it’s essential in today’s evolving tax environment.

The goal isn’t to penalise but to ensure fairness. Make sure your information is up to date, and if in doubt, reach out to HMRC or financial guidance services immediately.

FAQs

Is the £500 deduction applied to all pensioners?

No, it only applies to those who owe unpaid tax or received benefit overpayments. Most pensioners will not be affected.

Can HMRC take money from my bank account without permission?

Not without notice. HMRC must send a warning and give time to respond before any direct recovery occurs.

What is the protected balance HMRC must leave in my bank account?

HMRC must leave at least £1,000 in your account under Direct Recovery of Debts rules to cover basic needs.

Does this affect my Winter Fuel Payment or State Pension amount?

No, the deduction does not reduce your entitlement to Winter Fuel Payments or your State Pension amount.

Can I challenge or stop the deduction if I disagree with it?

Yes, you can contact HMRC to dispute the amount or reason, especially if you believe the data is incorrect.

Is this a one-time deduction, or can it happen again?

It can happen again if discrepancies are found in future tax years. Regular checks help prevent this.

What support is available if I can’t afford to pay?

HMRC offers Time-to-Pay plans, reduced repayments, and hardship protection. Charities like Age UK can also help.