How does HMRC discover when taxes or wages have been handled incorrectly? The answer lies in its payroll and tax verification systems, often referred to as wage raid payroll checks. These checks form part of HMRC’s long-standing mission to ensure employers and employees pay the correct amount of tax.

Although the term wage raid may sound dramatic, it rarely refers to officers physically arriving at a business. Instead, it usually describes HMRC’s growing use of automated technology and data-driven methods to identify underpaid tax or wage discrepancies. The approach allows HMRC to cross-check information from employers, banks, and other financial institutions in real time.

In essence, HMRC wage raid payroll checks are a combination of payroll audits, automated data analysis, and targeted investigations. They ensure that both PAYE (Pay As You Earn) contributions and National Minimum Wage requirements are correctly met.

For employers, this means that even small payroll errors or data mismatches can attract attention, while employees may find their tax codes adjusted automatically if discrepancies are found.

How Do HMRC Payroll Checks Operate in Practice?

HMRC’s payroll monitoring process is largely data-driven. Every time an employer submits Real Time Information (RTI) through their payroll software, HMRC receives details of employees’ income, deductions, and National Insurance contributions. The system then automatically compares these figures with employee tax records.

When the data aligns, no further action is taken. However, if the system detects inconsistencies, such as income reported by an employer that does not match what appears in a taxpayer’s account, HMRC flags the case for further review. This approach allows millions of payroll records to be reviewed without manual intervention.

Data Sharing and Expanded Information Sources

To strengthen its oversight, HMRC increasingly collaborates with other data sources. Banks, building societies, and pension providers now supply detailed information on savings interest and contributions. From 2027, HMRC will be able to access real-time bank data to calculate and collect tax owed on savings interest automatically.

This expansion of data sharing marks a significant step in how tax enforcement operates. It enables HMRC to act swiftly when discrepancies arise, reducing reliance on voluntary disclosure and minimising tax evasion opportunities.

Direct Collection and Tax Code Adjustments

When an underpayment or reporting error is confirmed, HMRC may take direct action. In some cases, it sends an official notice demanding repayment; in others, it simply adjusts the individual’s tax code to recover the outstanding amount gradually from future earnings or pensions.

This system of automated correction means that employees may see changes in their payslips before receiving a formal explanation, reflecting HMRC’s emphasis on rapid collection.

Why Is HMRC Expanding Its Wage Raid Payroll Checks?

One of HMRC’s central goals is to close the UK’s tax gap, the difference between the total tax owed and the amount actually collected. Automation plays a key role in achieving this objective. By cross-checking data electronically, HMRC can identify errors that might previously have gone unnoticed and recover funds more efficiently.

Promoting Fairness and Transparency

Automated wage raid payroll checks also aim to create a fairer tax environment. They discourage non-compliance by ensuring that those who pay correctly are not disadvantaged compared to those who attempt to avoid or underpay taxes.

Additionally, by introducing digital systems, HMRC seeks to make tax collection more transparent, consistent, and less reliant on physical inspections.

Reducing Administrative Costs

Automation reduces manual paperwork for both the government and businesses. Employers benefit from simpler reporting systems, while HMRC reduces operational costs and reallocates resources towards complex investigations that require human expertise.

What Triggers an HMRC Wage Raid or Payroll Investigation?

An HMRC payroll investigation does not always mean wrongdoing has occurred. Often, it is triggered automatically by irregular data or incomplete submissions. However, several common circumstances can lead to scrutiny:

- Discrepancies in PAYE submissions where employee income or deductions appear inconsistent.

- Late or missing RTI submissions which suggest reporting issues.

- Unusual salary sacrifice arrangements, especially those involving pensions or company benefits.

- Potential breaches of minimum wage law, particularly in industries relying on deductions for uniforms, tools, or staff benefits.

- Employer’s history of compliance issues, including previous penalties or investigations.

Certain industries, hospitality, retail, construction, and care, tend to attract more frequent checks due to their high staff turnover and varied pay structures.

What Are Some Examples of HMRC Wage Raids or Payroll Compliance Checks?

When individuals earn interest from savings accounts that exceeds the personal savings allowance, HMRC now receives that information directly from banks. If this income is not declared, the system automatically recalculates tax due and updates the taxpayer’s code.

For example, a professional who receives £1,500 in savings interest but only £1,000 is tax-free under their allowance may see HMRC automatically adjust their code to recover tax on the extra £500.

Salary Sacrifice Schemes

Salary sacrifice schemes remain a legitimate way to manage pension contributions or benefits such as childcare vouchers and cycle-to-work initiatives. However, HMRC reviews these schemes carefully to ensure employees do not misuse them to reduce taxable income improperly. Employers that fail to calculate deductions correctly may face reassessments or penalties.

National Minimum Wage Enforcement

One of HMRC’s most visible areas of enforcement involves minimum wage compliance. Even minor payroll miscalculations, such as deducting uniform costs or unpaid breaks, can result in employees being paid below the legal threshold.

In 2024, for instance, HMRC investigated a group of hospitality employers whose pay deductions unintentionally reduced wages below the minimum level. Although the businesses claimed it was an administrative oversight, they were required to repay staff and pay fines, underscoring HMRC’s strict approach.

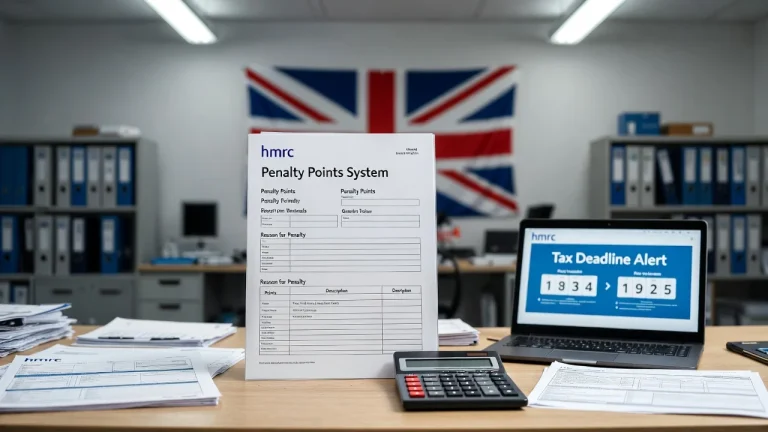

What Happens When HMRC Identifies Payroll Errors?

Once a payroll error is detected, HMRC follows a clear procedural framework. Initially, it contacts the employer or employee to request clarification or supporting records. If discrepancies remain unresolved, a formal review is initiated.

During this process, HMRC examines payroll records, contracts, payslips, and RTI submissions. Employers may be asked to provide additional evidence, such as proof of pension contributions or salary adjustments. If underpayment or non-compliance is confirmed, HMRC issues a demand outlining the tax owed, plus any applicable interest or penalties.

In certain cases, the agency can collect unpaid tax directly through adjustments in future pay or pension payments, bypassing lengthy administrative steps.

Typical Payroll Issues and HMRC Actions

| Issue Identified | Primary Concern | HMRC Response | Possible Outcome |

|---|---|---|---|

| Incorrect PAYE data | Misreported earnings | Reassessment of payroll files | Backdated payment notice |

| Salary sacrifice misuse | Reduced taxable income | Adjustment to NI and tax liabilities | Revised tax code |

| Minimum wage shortfall | Underpayment to staff | Enforcement and penalties | Repayment + public naming |

| Late RTI submissions | Compliance failure | Warning or fine | Fixed penalty charge |

| Undeclared savings income | Hidden taxable income | Automated code change | Recovery via payroll |

What Can Employers and Employees Do to Ensure Compliance?

For Employers

Employers carry the main responsibility for payroll accuracy. Regular internal audits and use of HMRC-approved payroll software can minimise the risk of error. Every deduction from pensions to staff benefits must be recorded accurately and never reduce net pay below the minimum wage.

Employers should also retain payroll documentation for at least three years, ensuring that any HMRC request for verification can be met promptly.

Periodic reviews of salary sacrifice schemes are equally important. Misinterpretations of pension contribution limits or benefit valuations often lead to avoidable penalties.

For Employees

Employees also play a vital role in maintaining tax accuracy. They should regularly review payslips, verify that the correct tax code appears, and use online tools such as the National Minimum Wage calculator to confirm legal pay rates.

If an underpayment is suspected, employees can report it through GOV.UK channels or seek advice from their trade union or advisory service.

Those with multiple income streams from savings, pensions, or part-time jobs should monitor how these affect their overall tax position. A simple error in recording supplementary income can result in unexpected deductions later.

How Can Employers Protect Themselves Against Future HMRC Wage Raids?

A proactive approach offers the best defence against compliance problems. Employers should develop structured payroll control frameworks that clearly define responsibilities and timelines.

Regular training ensures that payroll and HR teams understand the latest HMRC guidance, while external consultants can conduct independent audits to identify weak points before official checks occur.

Transparency remains critical promptly responding to HMRC correspondence or providing requested documents often prevents escalation.

Creating a culture of compliance is equally important. When payroll accuracy becomes part of a company’s values, errors diminish, and HMRC scrutiny tends to lessen.

What Are the Broader Implications of HMRC Wage Raid Payroll Checks?

The rise of automated payroll checks represents more than a shift in technology; it reflects a fundamental change in how compliance is monitored in the UK. Employers can no longer assume that small discrepancies will go unnoticed. With direct access to financial data, HMRC can detect inconsistencies almost instantly.

For employees, these systems offer protection from exploitation and reassurance that tax contributions are being managed fairly. Yet, they also mean individuals must remain vigilant, keeping personal records accurate and up to date to avoid unintended corrections.

Conclusion

HMRC wage raid payroll checks symbolise the future of tax compliance in the UK: digital, data-driven, and increasingly automated. While the concept may sound daunting, these measures aim to promote fairness and ensure that everyone contributes their fair share.

Employers who prioritise transparent payroll management, and employees who take an active interest in understanding their payslips and tax codes, are far less likely to encounter problems.

By embedding accuracy and compliance into everyday business operations, organisations can meet HMRC’s expectations confidently and maintain trust with both regulators and staff.

FAQs on HMRC Wage Raid Payroll Checks

What triggers a payroll investigation by HMRC?

Investigations are typically triggered by data discrepancies, incomplete submissions, or unusual payroll activity identified through automated systems.

Are wage raids physical visits to business premises?

Most checks are digital. Physical visits occur only when there is serious suspicion of fraud or consistent non-compliance.

Can HMRC change a tax code without prior notice?

Yes. If underpayments are detected, HMRC may adjust tax codes automatically to recover the difference from future earnings.

How long must payroll records be kept?

Employers should retain payroll data, payslips, and related records for a minimum of three years, although five years is recommended for best practice.

What are the penalties for failing a payroll audit?

Penalties vary but may include fines, interest on unpaid tax, or public disclosure for minimum wage breaches.

How often are payroll checks carried out?

There is no fixed schedule. Checks occur randomly or when data analytics flag potential inconsistencies.

Can employees report suspected tax avoidance?

Yes. HMRC provides confidential online channels where individuals can report tax fraud or avoidance anonymously.

{

“@context”: “http://schema.org/”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What triggers a payroll investigation by HMRC?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Investigations are typically triggered by data discrepancies incomplete submissions or unusual payroll activity identified through automated systems.”

}

},

{

“@type”: “Question”,

“name”: “Are wage raids physical visits to business premises?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Most checks are digital. Physical visits occur only when there is serious suspicion of fraud or consistent non-compliance.”

}

},

{

“@type”: “Question”,

“name”: “Can HMRC change a tax code without prior notice?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes. If underpayments are detected HMRC may adjust tax codes automatically to recover the difference from future earnings.”

}

},

{

“@type”: “Question”,

“name”: “How long must payroll records be kept?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Employers should retain payroll data payslips and related records for a minimum of three years, although five years is recommended for best practice.”

}

},

{

“@type”: “Question”,

“name”: “What are the penalties for failing a payroll audit?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Penalties vary but may include fines interest on unpaid tax or public disclosure for minimum wage breaches.”

}

},

{

“@type”: “Question”,

“name”: “How often are payroll checks carried out?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “There is no fixed schedule. Checks occur randomly or when data analytics flag potential inconsistencies.”

}

},

{

“@type”: “Question”,

“name”: “Can employees report suspected tax avoidance?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes. HMRC provides confidential online channels where individuals can report tax fraud or avoidance anonymously.”

}

}

]

}