The Universal Credit Cost of Living Payment is a vital financial support offered by the UK government to help low-income households manage rising living costs.

Issued automatically to eligible benefit recipients, the payments were designed to ease pressures caused by inflation, energy costs, and food prices.

This article outlines the payment schedule, eligibility criteria, and updates through 2025, offering a comprehensive overview of how and when support has been and may be distributed to claimants across the UK.

What Is The Universal Credit Cost Of Living Payment?

The Universal Credit Cost of Living Payment is a government-backed financial support initiative aimed at assisting individuals and households who are receiving certain means-tested benefits. It is a response to the sharp rise in household costs, particularly for energy, food, and general living expenses.

The payment is made automatically to eligible claimants. There is no need to apply, and eligibility is determined by the Department for Work and Pensions (DWP) or HM Revenue and Customs (HMRC), depending on the benefit type. It is issued in the same way regular benefits or tax credits are paid.

Each qualifying payment is a fixed amount. Claimants may have received one or more of these payments between 2022 and 2024 depending on their benefit status during specific eligibility periods.

Who Is Eligible For The Cost Of Living Payment?

Eligibility is based on whether a claimant was receiving a qualifying benefit during a specific eligibility window. The benefits that trigger eligibility include:

- Universal Credit

- Income-Based Jobseeker’s Allowance (JSA)

- Income-Related Employment and Support Allowance (ESA)

- Income Support

- Pension Credit

- Child Tax Credit

- Working Tax Credit

It is important to note that not all types of JSA or ESA qualify. Those receiving only New Style ESA or New Style JSA are excluded.

Tax credit claimants must have received a payment for a day within the specified eligibility period. If both HMRC and DWP benefits were being received, the payment is usually issued by DWP only. In joint claims, only one payment is made per household.

In cases where an individual was awarded a benefit at a later date, but it covered the relevant qualifying period, the Cost of Living Payment is still made automatically.

When were the Universal Credit Cost of Living Payments Made?

Recipients received five main Cost of Living Payments between 2022 and 2024. Below is a breakdown of the payment amounts, eligibility assessment periods, and disbursement windows.

Payment Dates from 2022 to 2024

| Amount | Eligibility Period | Payment Dates |

|---|---|---|

| £326 | 26 Apr 2022 – 25 May 2022 | 14 – 31 July 2022 |

| £324 | 26 Aug 2022 – 25 Sept 2022 | 8 – 23 Nov 2022 |

| £301 | 26 Jan 2023 – 25 Feb 2023 | 25 Apr – 17 May 2023 |

| £300 | 18 Aug 2023 – 17 Sept 2023 | 31 Oct – 19 Nov 2023 |

| £299 | 13 Nov 2023 – 12 Dec 2023 | 6 – 22 Feb 2024 |

These payments were made to those who had received Universal Credit during a qualifying assessment period. Payments may have arrived later for individuals who changed bank accounts or had a delayed benefit approval.

What if Your Payment Was Delayed?

If a qualifying benefit was approved after the payment window but covered the eligibility period, you were still eligible. In these cases, the payment was made after the approval, with no need for a separate application.

Is There A Cost Of Living Payment In 2025?

As of late 2025, the UK government has not confirmed any additional Cost of Living Payments like those issued between 2022 and 2024. There is speculation about future support measures due to the ongoing cost pressures on households, but nothing has been legislated or announced officially.

Overview Of Known Payments From 2022 To 2024

| Payment | Year | Included In Which Scheme |

|---|---|---|

| £326 | 2022 | Cost of Living (Universal Credit, low-income benefits) |

| £324 | 2022 | Second part of low-income support |

| £301 | 2023 | First of three for low-income claimants |

| £300 | 2023 | Second of three |

| £299 | 2024 | Final instalment of Cost of Living series |

Future announcements are expected to be made in fiscal statements or budget reviews. Any new support is likely to be focused on specific groups such as pensioners, disabled individuals, or those with children.

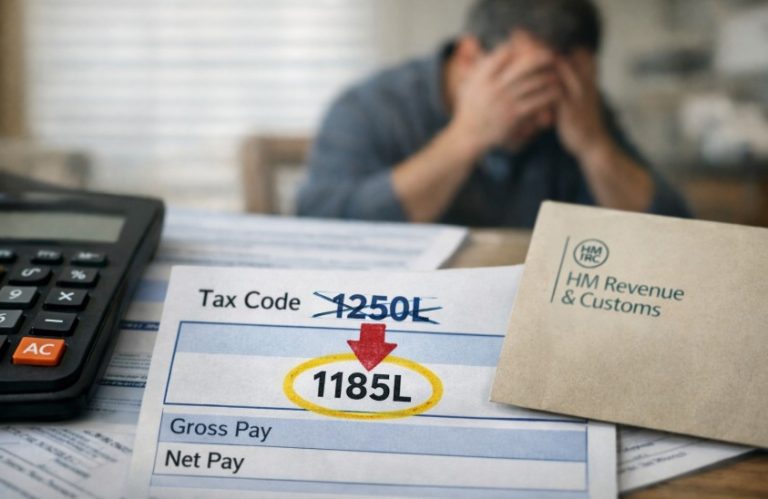

Why Might Someone Not Receive The Cost Of Living Payment?

Not all benefit recipients received the Cost of Living Payment, and this can be due to a range of factors. The Department for Work and Pensions (DWP) or HM Revenue and Customs (HMRC) determine eligibility based on strict criteria tied to specific dates and conditions.

Impact Of A Nil Award

The most common reason for missing out is receiving a “nil award” for Universal Credit. This means that the total amount due for an assessment period was reduced to £0. This can happen due to:

- A temporary increase in earnings

- Receiving more than one pay cheque within an assessment period

- A rise in savings above the allowed limit

- New income or overlapping benefits

- Failure to meet conditions in your claimant commitment, leading to a sanction

Although these situations can disqualify you, deductions for things like rent arrears or hardship payments do not count against you. If your benefit was reduced to zero because of these, you might still be eligible.

Changes In Benefit Entitlement

A change in your benefit type or status could also affect eligibility. For example, moving from Universal Credit to another benefit, or switching between types of ESA or JSA, may impact the automated checks used to determine payments.

Claimants who recently started receiving benefits may not have been in the system during the qualifying window, even if they became eligible shortly afterwards.

Low Annual Entitlement For Tax Credits

For those receiving only tax credits, another rule applies. If your annual tax credit entitlement was below £26, you were not considered eligible for the Cost of Living Payment. This threshold is based on total entitlement, not the monthly amount.

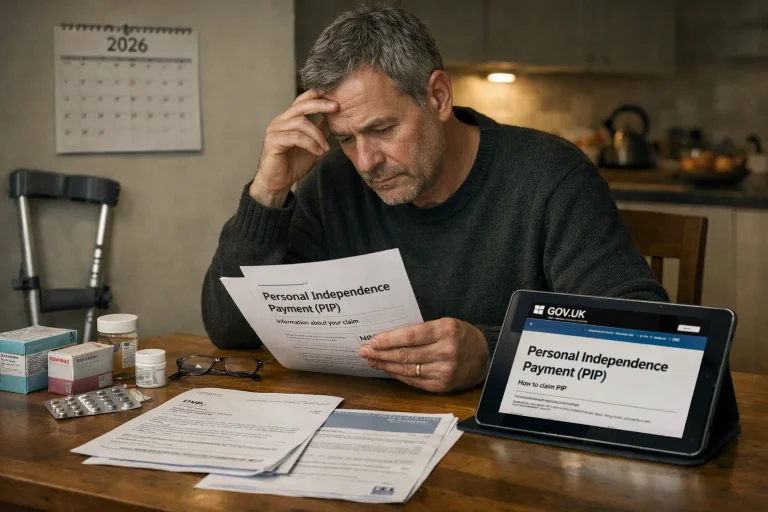

What Should You Do If You Haven’t Received Your Payment?

If you believe you were eligible for the Cost of Living Payment but haven’t received it, there are a number of steps you can take to investigate and potentially resolve the issue.

Review Your Benefit History

Start by checking whether you were receiving a qualifying benefit during the correct eligibility period. This means reviewing your Universal Credit or tax credit statements and assessment periods.

You should also confirm that your benefit was not reduced to a nil award. If you’re unsure, your most recent statements or benefit journal entries can provide this information.

Check Your Payment Method

Payments are made using the same method as your regular benefits or tax credits. Ensure that your bank or credit union details on file were correct at the time of the payment window. Delays can occur if you recently updated your account details.

It is also worth checking whether someone else in your household received the payment, especially if you have a joint claim.

Contact The Relevant Department

If you’ve checked your records and still believe you were eligible, you should contact the office responsible for your benefit:

- Universal Credit and most DWP-related payments: Contact DWP directly

- Tax credits and Child/Working Tax Credit cases: Contact HMRC

Explain your situation clearly and have relevant information ready, such as your National Insurance number, benefit details, and assessment periods.

Stay Alert For Scams

Be cautious of fraudulent messages asking you to claim or provide information for a payment. The government does not send texts, emails, or phone calls asking for personal or bank details to issue Cost of Living Payments.

All payments are automatic, and any message suggesting you need to apply should be treated with suspicion and reported to Action Fraud or your benefit office.

What Other Cost Of Living Support Is Available In The UK?

While the direct Cost of Living Payments may not continue into 2025, other support mechanisms remain in place across the UK. These include national and regional schemes aimed at providing additional help to vulnerable groups.

Summary Of Additional Support Schemes

| Type Of Support | Region | Managed By |

|---|---|---|

| Household Support Fund | England | Local Authorities |

| Crisis Grants | Scotland | Scottish Welfare Fund |

| Discretionary Assistance Fund | Wales | Welsh Government |

| Short-Term Benefit Advances | Northern Ireland | Social Security Agency |

| Pensioner Cost of Living Add-On | UK-Wide | DWP |

| Disability Cost of Living Payment | UK-Wide | DWP |

Additional help may be available through:

- Winter Fuel Payments with Pensioner top-ups

- Local council tax reduction schemes

- Free school meal programs

- Housing cost support under Universal Credit

- Energy support grants and home heating schemes

Support varies depending on location and eligibility. Local council websites and official government portals provide tools to check what assistance is available.

How Are Cost Of Living Payments Made And Verified?

All Cost of Living Payments are made automatically without the need for claimants to apply. The DWP uses a fully automated process to assess eligibility based on existing benefit records. For tax credit recipients, HMRC follows a similar procedure.

Payment verification is carried out as follows:

- Eligibility is confirmed by assessing entitlement on specific dates

- The same account where benefits or credits are received is used for payment

- Joint claims receive only one payment per household

- If entitlement is later revised or overpayment is found, repayment may be required

Claimants can contact the relevant department to request clarification or to raise concerns. An appeal or mandatory reconsideration can be initiated if someone disagrees with the payment decision.

Conclusion

Understanding when and how the Universal Credit Cost of Living Payment is made can help claimants manage their finances more effectively.

While the main series of payments concluded in early 2024, additional support may still be available through regional and national schemes.

Staying informed through official channels ensures eligible individuals do not miss out on essential assistance.

As the economic situation evolves, further government announcements may bring continued relief for those most affected by the cost of living crisis.

FAQs about Cost of Living Payments

How do I know if I qualified for the Cost of Living Payment?

If you were receiving one of the qualifying benefits during the eligibility period and didn’t have a nil award, you would have qualified. Check the DWP or HMRC website for specific dates.

Can I appeal a decision if I didn’t receive the payment?

Yes. Contact your benefit office to request a reconsideration or explanation if you believe you were wrongly excluded.

Do I need to repay the Cost of Living Payment?

Generally no, but if you were later found ineligible (e.g., due to benefit backdating issues), you may be asked to repay it.

Will the Cost of Living Payment affect my other benefits?

No. The payments are not taxable and do not affect existing benefits or tax credits.

Are joint claims eligible for double payments?

No. Couples or joint claimants receive a single payment per household for each eligibility period.

Is there help available while waiting for a benefit decision?

Yes. Short-term Benefit Advances or Discretionary Support may be available in some regions while you’re waiting for benefits to start.

What do I do if I suspect a scam regarding the Cost of Living Payment?

Report suspicious messages to Action Fraud and never share your personal details unless through official DWP or HMRC channels.

{

“@context”: “http://schema.org/”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How do I know if I qualified for the Cost of Living Payment?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “If you were receiving one of the qualifying benefits during the eligibility period and didn’t have a nil award, you would have qualified. Check the DWP or HMRC website for specific dates.”

}

},

{

“@type”: “Question”,

“name”: “Can I appeal a decision if I didn’t receive the payment?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes. Contact your benefit office to request a reconsideration or explanation if you believe you were wrongly excluded.”

}

},

{

“@type”: “Question”,

“name”: “Do I need to repay the Cost of Living Payment?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Generally no, but if you were later found ineligible (e.g., due to benefit backdating issues), you may be asked to repay it.”

}

},

{

“@type”: “Question”,

“name”: “Will the Cost of Living Payment affect my other benefits?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “No. The payments are not taxable and do not affect existing benefits or tax credits.”

}

},

{

“@type”: “Question”,

“name”: “Are joint claims eligible for double payments?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “No. Couples or joint claimants receive a single payment per household for each eligibility period.”

}

},

{

“@type”: “Question”,

“name”: “Is there help available while waiting for a benefit decision?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes. Short-term Benefit Advances or Discretionary Support may be available in some regions while you’re waiting for benefits to start.”

}

},

{

“@type”: “Question”,

“name”: “What do I do if I suspect a scam regarding the Cost of Living Payment?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Report suspicious messages to Action Fraud and never share your personal details unless through official DWP or HMRC channels.”

}

}

]

}