Are you wondering how to change your Child Benefit bank details online in the UK? You’re not alone. Many parents find themselves needing to update their bank account information due to switching banks, opening joint accounts, or simply changing account types.

With Child Benefit being a crucial source of income support for millions of families across the UK, ensuring that your payments go to the correct account is vital. Failing to update your bank details on time could lead to missed or delayed payments, and in some cases, overpayments that need to be repaid.

Thankfully, updating your bank details with HMRC has become easier than ever with online tools. This guide will take you through the fastest and most secure ways to change your bank details for Child Benefit, step by step. Whether you prefer using the HMRC app, phoning the helpline, or writing by post, we’ll walk you through all your options.

Why Is It Important to Update Your Child Benefit Bank Details?

Making sure your bank details are up to date with HMRC is not just a matter of convenience, it’s essential for receiving your Child Benefit without interruption. Your payments depend on the accuracy of the information HMRC holds, and even minor changes can affect your entitlement or cause delays.

Incorrect or outdated bank account details can lead to:

- Missed or delayed Child Benefit payments

- Funds being sent to closed or incorrect accounts

- Time-consuming correction processes

- Financial strain on families who rely on regular payments

But the implications go beyond just financial inconvenience. Not reporting changes to HMRC can result in overpayments. These must be repaid and, in some cases, penalties may apply if HMRC deems the delay unreasonable.

You are legally responsible for updating your details, and this includes informing HMRC when:

- You move house

- You open a new bank account

- Your income rises above £60,000

- Your immigration or relationship status changes

By keeping your details current, you ensure your payments are safe, timely, and in compliance with HMRC requirements. It also protects your family’s benefit entitlement.

What Is the Fastest Way to Change Your Bank Details for Child Benefit?

If speed and convenience are your priorities, the HMRC online services offer the quickest way to change your Child Benefit bank details.

You can use either the HMRC app or log in to your Government Gateway account on their official website. Both platforms are available 24/7 and allow you to make changes without needing to wait in a phone queue or send physical documents.

The HMRC app is available for Android and iOS, and it’s designed for ease of use. Once logged in, you can navigate to the Child Benefit section, start the change process, and update your banking details securely. The same process is available on the desktop version via the Government Gateway portal.

This digital route is considered the fastest because:

- Your information updates in real time

- You get confirmation instantly

- You avoid postal delays or call wait times

It’s also the most secure, using identity verification methods like passport or driving licence checks. Most users report completing the update in under 10 minutes.

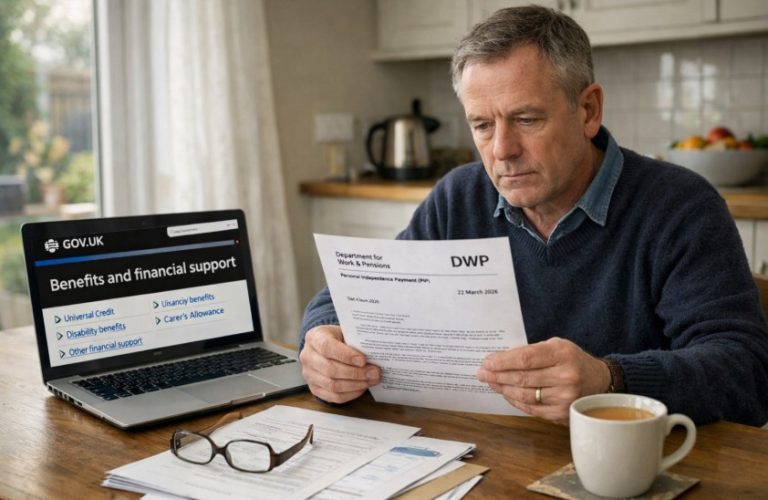

How Do You Change Your Child Benefit Bank Details Online?

To update your bank details online for Child Benefit, you’ll need your Government Gateway credentials and your current account information. This is the most efficient and accurate method available.

Here is the step-by-step process:

- Sign in: Use your Government Gateway user ID and password to log into your account or open the HMRC app.

- Locate: Go to the “Child Benefit” section within your account dashboard.

- Start the process: Click on “Change your bank details” and then select “Start now”.

- Confirm existing info: You’ll be asked to confirm the bank account currently used for payments.

- Enter new details: Input your new sort code and account number. Make sure all information is correct.

- Submit and confirm: Review your inputs and confirm the changes.

Once the update is confirmed, your future payments will be sent to the new account. If you don’t already have a Government Gateway account, you’ll be able to create one as part of the login process. Identity verification may be required for first-time users.

Can You Change Child Benefit Bank Details by Phone or Post?

Yes, if you prefer not to use the online system, you can change your Child Benefit bank details either by calling HMRC or writing to them. These methods are available for people who don’t have internet access or prefer speaking to someone directly.

Here’s how you can do it:

- By Phone: Call the Child Benefit helpline on 0300 200 3100, open Monday to Friday from 8am to 6pm. Have your National Insurance number and current bank details ready.

- By Post: Send a written request to Child Benefit Office, PO Box 1, Newcastle-upon-Tyne, NE88 1AA. Include your full name, National Insurance number, child’s details, old and new bank account numbers, and your signature.

While these methods are still effective, they are typically slower. Phone lines can be busy during peak hours, and postal requests may take several days to process. However, if you’re unable to use digital services, these options ensure you can still manage your benefit details effectively.

Who Is Allowed to Change Child Benefit Bank Details?

Only the person who originally claimed Child Benefit is permitted to change the associated bank details. HMRC maintains this rule to ensure personal information is protected and fraud is prevented. This means that even if both parents contribute to the household finances, only the named claimant can make updates.

To complete the change, you’ll need:

- Government Gateway login credentials

- Your National Insurance number

- Your current and new bank details

- Access to the HMRC app or website

It’s important to know that identification checks may be required, especially if you’ve never used HMRC’s online services before. This may involve confirming your identity with a passport, driving licence, or other official documentation.

Even if you and your partner both claim for different children, you can’t switch payment details without permission. HMRC will reject changes made by unauthorised individuals. Always make sure you’re the listed claimant before initiating updates.

What Other Changes Should You Report to HMRC?

In addition to updating your bank account, there are several other changes that you must report to HMRC to keep your Child Benefit claim accurate and up to date. Failing to report these changes can result in overpayments or disruptions in your benefits.

Here are common life changes you need to report:

- You move to a new home or address

- You or your partner start earning over £60,000

- You change your name or gender

- You begin caring for another child

- Your relationship changes (e.g. divorce or new partner)

- You or your partner move abroad

- A parent passes away

- Your immigration status changes

You can report these updates via the HMRC app, online account, or by calling the Child Benefit helpline. In some cases, written documentation may be required.

Keeping HMRC informed helps ensure that you continue receiving the correct payment amount. It also protects you from penalties for non-disclosure or incorrect claims.

What Happens If You Don’t Update Your Bank or Personal Details?

Neglecting to update your bank or personal details with HMRC can lead to serious problems. The most immediate risk is missed payments, which could affect your ability to manage monthly finances. If your bank account is closed or no longer accessible, the funds may be returned to HMRC.

Here are potential consequences:

- Delay in receiving Child Benefit payments

- Suspension of your benefit until accurate details are provided

- Overpayments that must be repaid

- Penalties or investigations for failing to report changes

HMRC expects all claimants to keep their personal and financial details up to date. If they are unable to contact you due to an old address or incorrect contact details, your payments may be stopped. Always double-check your details after any major life event. It’s far easier to prevent problems than to fix them after the fact.

What Are the Current Child Benefit Payment Rates in the UK?

Child Benefit is paid to help parents and guardians with the costs of raising children. Payments are typically made every four weeks, although weekly payments are possible in certain cases. Staying informed about current and future rates ensures you know exactly what you’re entitled to.

Current Rates (April 2025 – March 2026)

| Category | April 2025 – March 2026 | From April 2026 |

|---|---|---|

| First or only child | £26.05 per week | £27.05 per week |

| Additional children | £17.25 per week (each) | £17.90 per week (each) |

Key Things to Know

- Payment Frequency: Child Benefit is usually paid every four weeks, but you may request weekly payments if you’re a single parent or on certain benefits.

- High Income Charge: If you or your partner earn over £60,000, you will need to repay some or all of your Child Benefit through the High Income Child Benefit Charge. If you earn over £80,000, you’ll need to repay the entire amount.

- Taxation: Child Benefit itself is not taxed, but the High Income Charge acts as a recovery mechanism based on earnings.

Staying updated on the rates and repayment rules helps you plan your family finances more effectively.

How to Keep Your Child Benefit Details Safe and Secure?

Your HMRC and Child Benefit information is sensitive, and keeping it secure should be a top priority. With the rise of phishing scams and identity theft, it’s important to take steps to protect your personal data.

Follow these safety tips:

- Always use the official HMRC app or website to make changes

- Never share your Government Gateway ID or password with anyone

- Enable two-factor authentication on your HMRC account

- Avoid clicking on suspicious emails or text messages claiming to be from HMRC

- Regularly review your Child Benefit account activity to detect unauthorised access

If you suspect any fraudulent activity, report it immediately via HMRC’s fraud reporting service. You can also call the helpline for guidance. Keeping your details secure not only protects your payments but also shields your identity and financial well-being.

Conclusion

Changing your Child Benefit bank details in the UK is a straightforward process when done online through HMRC’s digital platforms. It’s fast, secure, and accessible around the clock.

Whether you’re switching to a new bank, moving house, or updating personal circumstances, keeping your details current helps ensure uninterrupted payments.

While phone and postal methods are still available, using the HMRC app or Government Gateway offers the best experience. More importantly, remember that you’re responsible for keeping your account and circumstances up to date.

Doing so protects your entitlement, prevents overpayments, and avoids the risk of penalties. Stay informed, stay secure, and stay in control of your Child Benefit.

FAQs

What documents do I need to update my Child Benefit bank details?

You’ll need your National Insurance number, Government Gateway login, and your current and new bank details.

How long does it take for the new bank details to be updated?

Updates made online are usually processed immediately, but it may take one payment cycle to reflect.

Can I update Child Benefit details without a Government Gateway ID?

No, you need a Government Gateway ID to update your bank details online, but you can create one during the process.

Will I miss a payment if I change my bank account late?

Yes, if HMRC receives incorrect or outdated bank details, your payment may be delayed or returned.

Can both parents access or change Child Benefit bank details?

No, only the person who claimed the Child Benefit can update the bank account details.

How do I reset my Government Gateway password if I forget it?

You can reset your password online by answering your security questions or confirming your identity.

What should I do if I suspect a scam related to Child Benefit?

Immediately report it to HMRC’s fraud department and avoid clicking on suspicious links or sharing personal data.