Have you been wondering what the UK National Living Wage will look like in 2026? With rising inflation, economic uncertainties, and shifting employment patterns, the Government’s latest wage announcement is significant for both employees and employers.

The Low Pay Commission has presented its advice, and the Government has accepted all the recommendations, introducing new minimum pay rates from April 2026.

The 2026 estimate is more than just a number, it reflects government policy, real earnings benchmarks, and economic resilience. The rate has been carefully calculated to meet at least two-thirds of the UK’s median earnings.

This blog takes a detailed look at the newly announced wage structure, the logic behind the figures, and how it will impact the workforce. Whether you are a worker on minimum pay or an employer navigating payroll responsibilities, this comprehensive breakdown will prepare you for what lies ahead.

What Is the UK National Living Wage?

The UK National Living Wage (NLW) is the legally mandated minimum hourly wage set by the Government for workers aged 21 and over. Introduced in April 2016, it replaced the previous National Minimum Wage rate for older workers and has since become a critical policy tool aimed at boosting the incomes of low-paid employees.

The NLW is distinct because it is not simply based on inflation or average earnings but is instead linked to a government target, specifically, it must not fall below two-thirds of UK median hourly earnings.

The National Living Wage is reviewed annually by the Low Pay Commission (LPC), which provides evidence-based recommendations to the Government.

These are based on a wide range of factors including economic conditions, employment trends, business feedback, and the cost of living. The goal is to ensure the rate supports wage growth while balancing job security and employer affordability.

The NLW plays a pivotal role in shaping employment policy, influencing wage structures, and promoting income equality in the UK economy.

How Does It Differ from Other Wage Rates?

The UK has several official and unofficial wage benchmarks that often cause confusion. While they might seem similar, each has its own criteria and purpose.

The National Minimum Wage (NMW) applies to workers under 21 and apprentices. These rates vary based on age and experience and are generally lower to reflect economic vulnerability and employment risks associated with younger workers.

The National Living Wage (NLW), in contrast, is for workers aged 21 and over and is legally enforceable. It’s based on maintaining a threshold above two-thirds of the UK’s median earnings, serving as a national baseline to support working adults.

The Real Living Wage is different altogether. It is calculated by the Living Wage Foundation, a non-governmental organisation. Unlike the NLW, this wage is voluntary and based on what people need to earn to afford basic necessities.

- NLW: Legal, for 21+

- NMW: Legal, for under 21s and apprentices

- Real Living Wage: Voluntary, based on cost of living

- London Living Wage: A higher rate specific to London due to higher living costs

These differences impact employer obligations and employee expectations across sectors.

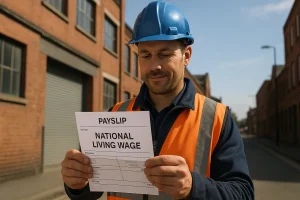

What Has the Government Announced for the 2026 Minimum Wage?

The UK Government has officially announced new minimum wage rates that will take effect from April 2026. These changes are based on the recommendations from the Low Pay Commission and are designed to ensure that wage levels reflect economic conditions, median earnings, and living costs.

For 2026, the National Living Wage for workers aged 21 and over will increase to £12.71, a rise of 50p or 4.1%. The 18–20-year-old rate will jump to £10.85, reflecting an 85p increase or 8.5%.

Meanwhile, 16–17-year-olds and apprentices will now receive £8.00, up by 45p or 6.0%. The Accommodation Offset, which allows employers to deduct a set amount for accommodation, will also rise to £11.10 per day.

Here is a quick overview of the 2026 rates:

| Category | New Rate (2026) | Increase (£) | Increase (%) |

|---|---|---|---|

| National Living Wage (21+) | £12.71 | £0.50 | 4.1% |

| 18–20 Year Old Rate | £10.85 | £0.85 | 8.5% |

| 16–17 Year Old Rate | £8.00 | £0.45 | 6.0% |

| Apprentice Rate | £8.00 | £0.45 | 6.0% |

| Accommodation Offset | £11.10/day | £0.44 | 4.1% |

These changes mark another step toward ensuring sustainable wage growth for all.

How Do the 2026 Wage Rates Compare to 2025?

As the new wage rates take effect in April 2026, it’s essential to examine how they compare to the 2025 structure. This comparison highlights the pace of wage progression and shows which worker categories are seeing the biggest gains.

Table Format Showing 2025 vs 2026 Rates

| Category | 2025 Rate | 2026 Rate | Increase (£) | Increase (%) |

|---|---|---|---|---|

| National Living Wage (21+) | £12.21 | £12.71 | £0.50 | 4.1% |

| 18–20 Year Old Rate | £10.00 | £10.85 | £0.85 | 8.5% |

| 16–17 Year Old Rate | £7.55 | £8.00 | £0.45 | 6.0% |

| Apprentice Rate | £7.55 | £8.00 | £0.45 | 6.0% |

| Accommodation Offset | £10.66/day | £11.10/day | £0.44 | 4.1% |

% Increase Year-Over-Year

- The highest percentage increase is seen in the 18–20 age group at 8.5%, highlighting the Government’s push to bring younger workers closer to NLW levels.

- The 16–17 and apprentice rates saw a 6% rise, while the NLW rate increased by 4.1%.

- The Accommodation Offset also increased in line with the NLW percentage.

Commentary on Significant Changes

The significant uplift for 18–20-year-olds is a key shift in wage policy. This age group, previously subject to much lower pay, is now gradually being aligned with the adult minimum wage. Although the increase is slightly lower than past double-digit rises for this group, it’s a strong move towards equalisation.

Also, for the first time, the 16–17-year-old and apprentice rates are matched, reflecting a simplified approach. For NLW workers on a 37.5-hour week, this update means an additional £81.47 per month or nearly £977 per year, offering more financial stability amid rising living costs.

These differences show a clear Government focus on closing the pay gap across age groups, with gradual alignment in progress.

What’s Behind the £12.71 National Living Wage Estimate?

The estimate of £12.71 for the 2026 National Living Wage wasn’t randomly selected. It represents a central figure calculated by the Low Pay Commission to ensure the wage remains at least two-thirds of the UK’s median hourly earnings.

This benchmark supports the Government’s commitment to uplifting working standards while ensuring balance with economic realities.

To calculate this estimate, several key data sources were analysed:

- ONS Annual Survey of Hours and Earnings (ASHE)

- Average Weekly Earnings (AWE) reports

- Bank of England wage forecasts

- HMRC Real Time Information (RTI)

- Independent economic forecasts from HM Treasury

The LPC published a projected range of £12.55 to £12.86, with £12.71 being the central figure. The increase accounts for a year-on-year wage growth of 5.1% in May 2025, and is expected slower growth of 3.9% and 3.0% in late 2025 and 2026.

These projections are not formulaic. They reflect a blend of economic data, labour market trends, and Government remit to maintain fair wages without risking job losses.

How Will These Changes Affect You as a Worker or Employer?

Whether you’re earning minimum wage or managing payroll, the changes to the National Living Wage will impact your financial planning.

For workers, the increase offers a welcomed boost to income, particularly at a time when the cost of essentials remains high.

Workers can expect:

- An annual gross pay rise of nearly £977 if working full-time (37.5 hours/week)

- A monthly increase of approximately £81.47

- Enhanced income security due to real-terms wage growth

For employers, particularly small businesses, the update brings both challenges and obligations:

- Increased staffing costs across all age groups

- Need to update payroll systems before April 2026

- Strategic planning for staffing and pricing to accommodate wage growth

Businesses that provide accommodation will also need to adjust to the new £11.10 daily offset rate. Compliance is legally required, and failure to apply these new rates could result in penalties. The changes aim to balance fair pay for workers with realistic expectations for businesses facing economic pressures.

Is This Enough to Tackle the Cost of Living Crisis?

While the 2026 wage increase represents progress, the question remains whether it truly offsets the cost of living crisis. According to the Low Pay Commission, the aim is to ensure a real-terms pay rise, even as inflation and essential costs remain high. Their analysis suggests that this wage will protect low-paid workers’ living standards through to April 2027.

Baroness Philippa Stroud, Chair of the LPC, has acknowledged that although there have been sustained increases in the NLW, many low-paid workers are still struggling. Rising food, housing, and utility costs continue to stretch household budgets.

At the same time, employers, particularly smaller ones, face growing financial strain. National Insurance changes and economic instability further complicate their ability to absorb wage hikes without passing costs to consumers.

Despite these concerns, the Commission has concluded that recent increases have not significantly harmed job numbers or the broader labour market. In short, the wage hike is helpful, but may not fully close the gap created by inflation.

Will Young Workers Be Included in the National Living Wage Soon?

The Government has a long-term ambition to extend the National Living Wage to younger workers. Currently, the NLW applies to those aged 21 and over, but plans are in motion to lower the threshold gradually to age 18 by 2029, aligning with the LPC’s own recommendation.

Steps already taken include:

- Increasing the 18–20 rate by 8.5%, progressing toward alignment with the adult rate

- Matching the 16–17 and apprentice rates at £8.00, simplifying youth pay scales

- Evaluating economic risks for younger workers, particularly job availability and stability

Despite these goals, the Low Pay Commission remains cautious. Extending the NLW too quickly could negatively affect youth employment, especially if entry-level roles are reduced due to higher wage costs.

The Commission has therefore recommended a phased approach:

- Include 20-year-olds by 2027

- Extend to 18–19-year-olds between 2028 and 2029

This roadmap is dependent on favourable economic conditions and ongoing analysis of youth employment metrics. It signals a future where wage equality starts even earlier in one’s career.

What Can You Expect in the Coming Years?

Looking ahead, the National Living Wage is likely to continue its upward trend. The Government’s Growth Mission includes raising living standards and reducing income inequality, with the NLW serving as a cornerstone of this initiative.

Future projections will continue to be guided by:

- The commitment to maintain the NLW at two-thirds of median earnings

- Careful consideration of economic data such as inflation and wage growth

- Labour market trends and business feedback

The Low Pay Commission is expected to provide ongoing recommendations each year, reflecting both short-term and long-term challenges in the economy. The remit requires them to strike a balance between supporting workers and sustaining employment.

While no one can predict the exact figure beyond 2026, there is consensus that wage rates will not decline. If the economy performs well, we could see another robust increase in 2027.

Ultimately, the Government will continue publishing estimates, with the next major update anticipated in October 2026 following consultation and economic reviews.

How Should You Prepare for the 2026 Wage Changes?

With the 2026 wage changes confirmed, preparation is key for both employees and employers. Understanding how the new rates affect your income or business operations can help you plan more effectively.

For workers:

- Review your current pay and check eligibility for the NLW or NMW

- Budget ahead using the new estimated income

- Consider how increased earnings may affect benefits or tax thresholds

For employers:

- Update payroll systems ahead of April 2026

- Communicate rate changes clearly with staff

- Review business budgets to account for higher wage costs

- Consider operational adjustments to absorb or offset increased payroll

Employers who provide staff accommodation should also update deductions in line with the new £11.10/day offset rate.

Whether you’re receiving or paying the NLW, this is a significant shift. Proactive planning will ensure compliance and help both sides of the employment relationship benefit from the upcoming changes.

Conclusion

The UK National Living Wage 2026 estimate marks a decisive moment in the country’s wage policy. With a central rate of £12.71, the Government is working towards a fairer wage system that supports both employees and economic growth.

The phased approach to integrating younger workers, while maintaining a careful eye on inflation and employment, shows a commitment to long-term balance.

This change brings real financial benefits for low-paid workers and places responsibility on employers to adjust accordingly. The Government’s goal of tying the NLW to two-thirds of median earnings remains a cornerstone of this initiative.

As 2026 approaches, both workers and businesses will need to stay informed and ready. These changes offer opportunities for growth and improvement, provided they are handled with the preparation and awareness they deserve.

FAQs

What is the difference between the UK National Living Wage and the Real Living Wage?

The National Living Wage is a legal minimum set by the Government, while the Real Living Wage is voluntary and calculated by the Living Wage Foundation.

Will the National Living Wage continue to increase every year?

Yes, the NLW is reviewed annually and is expected to rise gradually to stay aligned with two-thirds of median earnings.

How does the Low Pay Commission calculate the wage recommendations?

They use economic data from the ONS, HMRC, and other sources to assess affordability, inflation, and the impact on employment.

Do employers have to legally pay the new National Living Wage rates in 2026?

Yes, all employers must comply with the updated wage laws starting April 2026 to avoid penalties or legal action.

What impact will the 2026 wage changes have on small businesses in the UK?

Small businesses may face increased payroll costs and will need to plan carefully to manage their budgets effectively.

Is there a different living wage rate for London?

Yes, the London Living Wage is a higher voluntary rate set by the Living Wage Foundation to reflect the city’s higher living costs.

What happens if an employer does not comply with the new wage rates?

Non-compliance can lead to penalties, fines, and being publicly named by HMRC for breaking wage laws.